Market Overview & Commentary

There are endless reasons to be pessimistic, from the EU crisis, to a Chinese slowdown, to the dreaded “fiscal cliff” in the US (the term for government spending cuts and tax increases that will automatically go into effect in January 2013 unless Congress acts – which is not likely).

These daily doses of negativity have weighed heavily, helping to drive markets lower during Q2/2012.

However, these current ills are very well known and defined, whereas equity markets tend to react more negatively when an unknown ill surfaces.

Consequently, while markets pulled back during Q2, they still remain positive for the year-to-date 6-month period of 2012.

Digging a little deeper into the volatility of the past 12 months, we can make a few interesting observations.

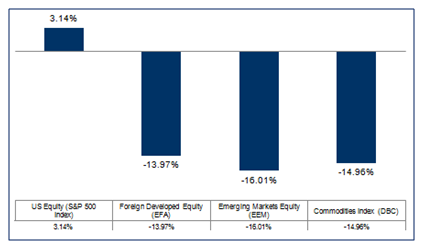

First off, as illustrated in Chart I below, US equities were the cleanest dirty shirt in the world, delivering the only positive return…and this despite numerous protestations by the media and politicians that the US economy has been doing horribly.

Chart I: Q2/2012 Equity Returns by Asset Class

Secondly, while the EU is dealing with a severe crisis, and now recession, investors have thrown the Emerging Markets baby out with the EU bathwater.

As detailed more on page 2 of this newsletter, Emerging Markets are growing in some countries at 4-5 times that of developing markets, and yet have been driven down to valuations far below that of developing markets.

These types of market anomalies do not present themselves often, but when they do, they should be acted upon (see page 3 of newsletter for our specific actions).

Q2 Market Pullback

Portfolio Review (Q2/2012)

Heading into Q2, our indicators suggested that US equity markets were a bit overbought and could be headed for a correction. Overseas, we remained bearish on European equities given their ongoing debt crisis.

However, we expected better performance from Emerging Markets (EMs). Our EM bullishness was driven by significant valuation discounts as well as continued room for monetary policy easing as inflation declined meaningfully.

While we were correct in our cautiousness for the US and EU, we were wrong in our expectation that EMs would rally.

Despite lower inflation and increased policy easing, EM equities were grouped together with other international equities, and in our opinion were oversold.

Outside of equities, we stayed overweight high-yield bonds, initiated a small position in Ginnie Maes, and remained short US treasuries (albeit we reduced our exposure on continued Fed bond buying with their “Twist” program).

Finally, we continued to hold alternative funds (e.g. merger-arb), instead of overvalued US Treasuries, as ballast against any potential stock market declines.

Q: What Worked in Client Portfolios?

Despite an across-the-board global equity market decline during Q2, a number of areas delivered positive returns:

- Select US equities turned in positive returns: Utilities, Google stock, BBT bank stock

- All our long fixed income holdings turned in positive returns between 0.75 – 4.73%

- Reports by our property valuation Brisbane experts state our real estate holdings were up 3-10%

- Our Active Trading Models once again delivered impressive results, with a 23% gain in for the volatility trading model.

Q: What Didn’t Work in Client Portfolios?

The following areas underperformed:

- Select US equities underperformed: Retailers, Banks, deep value stocks like AIZ & DRYS

- EM and Asia-Pacific stocks, most commodity positions, and our short US treasury position also declined in an all “risk-off” environment.

- Disappointingly, our alternative funds turned in mixed results, with some providing a buffer to the decline while others did not (we discuss actions taken with these on page 3 of this newsletter).

Net Results for Q2 and 2012 Year to Date

During Q2, client portfolios declined between 1 and 8%, depending on their risk profile. Aggressive portfolios declined more due to heavier positions in emerging markets and commodities, whereas conservative portfolios declined less due to heavier positions in fixed income.

All portfolios remain positive for the full year 2012, and continue to build off of March 2009 major market lows.

Additionally, we believe there are many home-run investments in client portfolios that will be realized in the years to come (e.g. EM’s).

Major market disruptions have caused investors to flee these areas in the near-term, but rewards will be provided to those that invest patiently and with fortitude over the long-term.

Investing Like a Bonsai Gardener

Looking Ahead

Japanese bonsai gardens are very impressive labors of love. These highly-curated collections of little trees exhibit the pride and professionalism that comes from years of love, care, and constant attention.

The bonsai practitioner uses multiple cultivation techniques depending on what he/she is trying to achieve, and what they are trying to overcome (pot size, new climate acclimation, etc).

Investing has some similar characteristics. Despite the changing market environment, it is an investor’s job to provide years of love, care, and constant attention to a portfolio…making careful adjustments along the road to success.

At times, a portfolio requires an adjustment to preserve capital and ensure the best odds of survival.

Other times, it requires adjustments to realize opportunities at hand. For all time periods, investing requires care and patience, as rewards come to those with the steadiest hand and the fortitude not to panic.

In our current work, we have made a number of recent adjustments to client portfolios.

First off, we have continued to increase our allocations to Emerging Markets as they get more and more undervalued. While this positioning has dragged portfolios in recent time periods, it represents a blockbuster opportunity for gain over the next 5-10 year period.

Secondly, we have used the past 18-24 month period to assess our diversifier alternative funds. Those that have performed as expected during downturns (e.g. offering relief and ballast to our equity holdings), have been kept for future protection against declines, while those that have not met their stated objectives have been pruned.

Finally, we have continued to refine our Active Trading and Risk Management models to ensure that opportunities and risks are more rapidly met with the appropriate response. This is not an easy task given the abnormalities of markets in recent years, but we are comfortable with our improving capabilities.

We remain as excited as ever about the future, as we also await the catalyst for the cure of current global ills. When this occurs, as it always does, our deep value investments have a large runway for growth.