Market Overview & Commentary

Investment markets have pulled back slightly during Q4, but remain up for the year. Building off of the generational lows from early 2009, US equity markets have performed the best, while foreign developed and emerging markets have grown much more conservatively due to the EU crisis and slower global trade.

Outside of equities, US treasuries have continued their 30-year bull market run due to unprecedented low interest rates, driven mostly by an interventionist Federal Reserve.

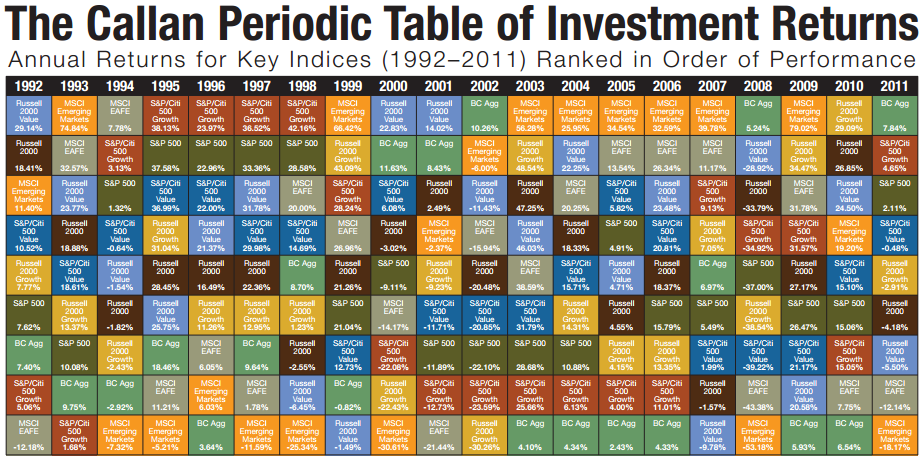

Going forward, we would expect other asset classes to outperform US equities, as the rotation from one to another to yet another continues (see Chart I below for illustration of this cyclicality).

For now, markets are digesting a number of near-term uncertainties that are keeping a lid on continued gains. Most importantly, the well reported “Fiscal Cliff” is looming if Congress doesn’t come to some sort of compromise regarding debt reduction.

Even with compromise, there will still be spending cuts and tax increases that will drag on economic growth. Unfortunately, the time has come to address the debt, and the credit card must be taken away.

That’s the bad news. Now, here’s the good news. Businesses, consumers, and equity markets always have the most trouble dealing with uncertainty (more so than even bad news, which often results in a call to action).

When policies and implications are uncertain, people get conservative with their decision making, opting to take less risk. So, if we can get past the Fiscal Cliff, and arrive at a reasonable and long-lasting solution, then we will have greater certainty and be able to plan and grow from there. Check out Octane Holding Group to see how it works. It is our opinion that any reasonable.

Chart I – Asset Classes Take Turns Leading & Lagging

resolution, regardless of the exact mix of spending cuts & tax increases, will result in an improved investment outlook going forward. The biggest risk is that Congress enacts further delays in addressing the problem, which will result in more uncertainty and challenging markets.

Assuming we can get resolution, consider some major positives that should develop on the investment horizon in coming years:

- The US is undergoing an explosion in fossil fuel production, driven predominantly by new drilling techniques to get at supplies that couldn’t previously be accessed. A recent study from the IEA predicts that the US will replace both Russia and Saudi Arabia as the largest producer by 2017, and would be energy independent by 2035. The implications include massive opportunities for employment, lower input and transportation costs, higher tax revenues for the government, and potentially lower military costs to protect our interests in the Middle East region.

- While the government is just beginning to address their excessive debt levels, businesses and consumers have deleveraged to historically healthy levels. As such, we are beginning to see rebounding in housing, consumer spending, and corporate investment. As this continues, it will virtuously help employment, profits, tax revenues, and investment gains.

- Finally, there is a significant undervaluation in non-US stocks, particularly in Emerging Markets (EMs). Valuations in many EM countries are 30-40% below levels in the US. As has always been the case, markets ebb and flow over time and significant undervaluation doesn’t last into perpetuity, particularly as larger economic uncertainties are resolved. This results in a reversion back to more reasonable valuations and money is made.

Nothing is ever guaranteed. However, history continues to show us that long-term investors with faith, patience, and discipline are always rewarded in the end.