Market Overview & Commentary

Global equity markets have been mixed for the first half of 2013, with most US stock indexes hitting new highs while overseas markets have risen less exuberantly, and in some cases have even declined on the year.

Despite numerous economic challenges in the US, an unprecedented level of government stimulus and intervention continues to push investors into riskier assets, driving US markets higher than indicators suggest is reasonable.

At LGA, our analysis and models have indicated that global equity markets have become overheated in recent months.

Back in March, we began discussing the possibility of an upcoming correction to an overheated market in our newsletters. As such, we took more conservative positions in our client portfolios. So far, this positioning has proved partially correct and partially incorrect.

While overseas markets have indeed cooled off, the US has continued a strong upward trend over the past couple months despite numerous headwinds.

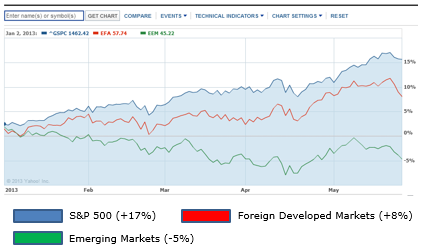

As a matter of comparison, the US Market (S&P 500) is up 17% year-to-date, whereas Foreign Developed Markets are up only 8%, and Emerging Markets are actually down -5%, a 22% relative underperformance when compared to the US (see Chart I below).

Chart I – Relative Performance of Various Markets YTD 2013

Whether one concludes that the continued US equity market run-up is a function of unprecedented Quantitative Easing from the Federal Reserve, or a function of irrational exuberance that is typical at the outer ends of a market cycle, indicators continue to suggest that the US market is overheated and ripe for a pullback.

It’s natural to be frustrated when the US market outperforms a globally diversified portfolio in the short-term, as our home bias would cause the natural question to be, “Why go outside of the US if we have the best market here at home?”

While mulling over this question, it is important to remember that over the past 10 years, being a global investor has yielded much higher returns than investing in the US alone.

Furthermore, while global and active strategies have temporarily underperformed the US equity markets, client portfolios continue to rise in absolute terms, and are being managed within a more reasonable level of risk tolerance to diversify risk and protect from major downturns.

Fear is always a powerful force in the markets. Near market peaks, investors fear “missing out” on excess returns, clamoring to be fully invested or even leveraged with margin. We appear to be in this situation today.

However, just a few short years ago, investors feared they would lose all their precious capital as markets dropped by more than 50%.

During 2008-2009, their fearful conclusion was to “protect capital” by liquidating investments, as the world was seemingly on the verge of collapse.

In hindsight, we all know that buying high and selling low is a recipe for disaster, yet it is often practiced, as illustrated by the past 4-5 years.

We endeavor to do things a bit differently, choosing to participate in the majority of bull market trends when they happen, but to be aggressive near bottoms and cautious near tops. We can be a little early at times, but tend to catch the majority of moves by sticking to our models and remaining disciplined.

Just as we counseled clients to confront their fears and be fully invested during the depths of the 2008-2009 down turn, we are now counseling clients to be cautious as the market moves to new highs. Through patience, discipline, and logic, we can counteract our natural fears…while protecting and growing our savings.