FOMO Defined

FOMO, or the “Fear Of Missing Out”, can lead to a fun, spontaneous life, but it can also lead to financial ruin.

We’ve all heard the age-old saying, “The best things in life are free”, but in reality, living a fun-filled life of travel and adventure requires a constant flow of cash. Unlike their predecessors, Gen-Xers and Gen-Yers are much more interested in living in the now, a lifestyle more focused on instant gratification.

Of less importance is suspending life’s luxuries in favor of delayed satisfaction and saving for the future. The implication of this behavior is that money, and a lot of it, is being spent now and isn’t going into savings that will lead to financial freedom and stability in the long run.

The Allure

You’re sitting at home on a sleepy Friday evening, content with your glass of wine or a beer and a movie when it happens. You get a text from a friend spontaneously requesting your presence for a fun night out. Your initial reaction is a quick, “nah”, but with just a tiny push from your friend you start thinking about what you could be missing out on, who they might see, what memories they might create without you.

FOMO isn’t always nights out, it comes in a variety of disguises. Sometimes it reveals itself in trips, concerts and other experiences. It can also be shopping that induces FOMO. You fear missing out on fitting in, having the latest fashion, enjoying the best TV watching experience, not being able to play Madden on the newest gaming console, and so on.

Financial Implications

This gut reaction, undisciplined spending style is the exact behavior that forces people to live paycheck to paycheck seemingly never able to catch up, let alone get a step ahead.

FOMO quite literally denies people the most basic level of financial freedom, an ample emergency fund and a growing retirement portfolio.

To be clear, financial freedom does not entail an inactive or a meticulously planned lifestyle, but it does require a strategy that includes saving a set amount every month. You can still live an exciting, adventurous life; you just need to temper that with a bit of discipline.

Counter with a Lifestyle Plan

Budgets don’t work for the same reason diets don’t work, people simply aren’t disciplined enough and don’t want to live a confined life. The ones that do work don’t overindulge, but they still allow some of the good stuff.

To conquer FOMO you need a lifestyle plan that negotiates the right balance between saving and spontaneous luxuries.

So how do you do that?

Implementing FOMO Protection

Creating a lifestyle plan and sticking to it takes a lot of expertise and work that normally require a professional to help build it correctly who can also hold you accountable, but that doesn’t mean you can’t get started on your own.

1. Get a handle on your fixed monthly expenses, such as rent/mortgage, car costs, utilities, cell phone, TV, memberships, insurance, etc. Are there areas you can cut some monthly cost? Are there things you spend money on each month in a fixed manner that aren’t really that important to you

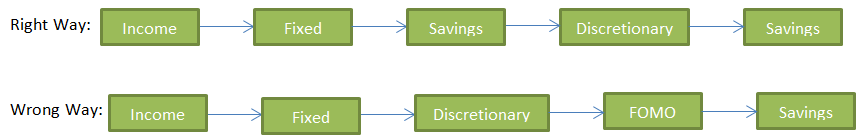

2. Determine how much you should be saving each month for your long term lifestyle and financial stability. This could be retirement savings or emergency account savings, but it is the ongoing maintenance and support of your lifestyle. It’s imperative that you have a plan to save the amount necessary to ensure you get to where you want to be down the road in the short and long term.

3. Whats left over after your fixed expenses are paid and your savings are taken care of is your monthly discretionary spending (groceries, dining, clothing, etc.) and your FOMO spending.

The key here is automation. You must automate your savings every pay period or every month to ensure it happens and that you are paying yourself first.

Where people get it wrong is putting their discretionary and FOMO spending before their savings, making savings the ‘whatever is left over’ pile at the end of the month, which is often nothing.

With a properly crafted lifestyle plan, when you spend the last of your FOMO money for the month, there is no mo’ FOMO for you!

If you’d like guidance on crafting your lifestyle plan, or help figuring out how much you should be saving to hit your short and long term goals, send me a note and we can discuss.