Market Overview & Commentary

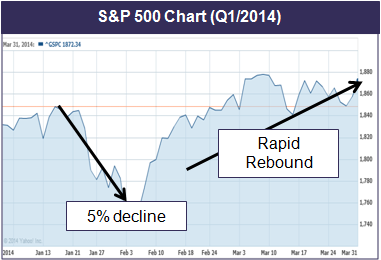

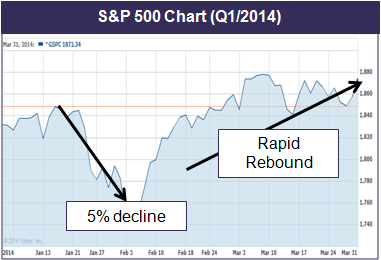

Despite a rocky early start to 2014, most investments rallied back during the back half of Q1 to end flat or slightly up (see Chart I below).

Chart I: Q1/2014 Daily Price Chart for the S&P 500

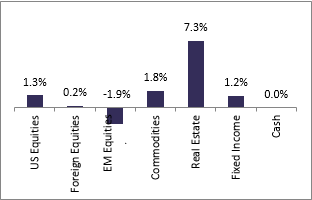

Across various investment asset classes, only real estate really stood out with a meaningful gain (see Chart II below).

Chart II: 2014 YTD Asset Class Returns

(US Equities = S&P 500, Dow was -0.72%, Nasdaq was +0.54%)

With valuations and sentiment levels highly stretched, the January declines may have been precursors to larger declines expected during the Q2-Q3 time period. At this point, consider the following:

– The S&P 500 is overvalued by 29-57% as compared to the current and 10yr trailing P/E averages

– The current bull market is 61 months old and counting…

– …as compared to the historical average of 42 months

– Bullish sentiment has been at or near peak levels for a record duration of time period as compared to the past 20 years. We are in unchartered territory from this perspective.

– Corporate profits are at peak levels and have few levers left to pull for further growth

– Government stimulus is starting to wane, with the tapering of quantitative easing

There are no guarantees with investing, but the odds strongly favor a larger market correction occurring in the 2014-2015 timeframe. As such, we are preparing tactical client portfolios for this scenario (see below).

Remaining Cautious

Portfolio Review (Q1/2014)

Heading into Q1, we were cautious on equities while becoming slightly more neutral to optimistic on fixed income. Equity markets entered the quarter at excessively high bullish crowd sentiment levels, having hit a key level without a major correction for over 190 trading days, the longest measured time period at these levels in the last 20 years. Fixed income took some hits in 2013, and while still somewhat overpriced, were looking slightly more attractive for at least a small pause in their decline or to inch higher.

Consequently, we underweighted equities in our tactical client portfolios, holding excess cash in expectation of a cooling off period. We also remained underweight with our real estate holdings, while we began to nibble back on our commodity holdings, especially in gold. Finally, in fixed income we slightly increased our allocations, but generally continued to hold alternative assets like merger arbitrage funds for our fixed income allocations.

In our trading models, we maintained a small hedge with our Volatility Timing Model. Otherwise, we stayed cautious, awaiting a more attractive entry point.

Q: What worked?

Early in the quarter, equity markets declined rather sharply, with US equities falling 5-7% during January. During this time period, our risk-off positioning helped tactical client portfolios to stay relatively flat, with only minor losses.

In addition, a couple of strong outperformers in New Zealand (ENZL) and gold miners (GDX) helped to offset any market declines, bucking the downdraft and generating positive returns for that time period.

Finally, our fixed income positions kicked in a modest return for the quarter.

Q: What didn’t work?

Following the steep January decline, markets rebounded sharply in late February and March. During the rebound, our excess cash resulted in more muted returns.

Additionally, a number of our positions hit trailing stops during the January drop, were sold, and subsequently did not participate in the rebound. These positions included Japan (EWJ), Hong Kong (EWH), Mexico (EWW), Oil Companies (XLE), and a short Yen position (YCS).

Net Results for Q1/2014

Despite intra-quarter turbulence, most investment markets ended the period with a flat to slightly positive return (see chart on Page 1). Client portfolios had similar results, albeit with a lot less volatility during the selloff and subsequent rebound.

We are in the late innings of a bull market, and are positioned conservatively with our tactical client portfolios. While remaining underinvested, we continue to deploy capital to investments that have good reward-to-risk characteristics. However, we are making these choices sparingly, while focusing on preservation of capital.

We know that these periods can be trying as we wait for a more significant decline. However, if January was a precursor of what will eventually come in a much larger dose, then we should be well positioned to weather the storm and then reinvest your cash at more attractive levels

What’s Left When Momentum Wanes?

Looking Ahead to the Rest of 2014

Investment markets are comprised of many types of different players. However, when it comes to the more sophisticated institutional investors, there are three main types to be aware of:

– Value Investors: Seeking low valuations to buy, high valuations to sell

– Momentum Investors: Chasing trends, either on the long or short side

– High-Frequency Traders: High volume arbitrage of small inefficiencies

High Frequency Trading (HFT) has been in the news lately given the new book released by influential writer Michael Lewis. HFT has gone from a very small fraction of the market to by some estimates over 60% of market volume. As a result, these players are getting extra scrutiny. However, they tend to not move markets, acting more like parasites that clean out all the minor little inefficiencies. There is more to HFT, but let’s focus more on value and momentum investors.

In the current market, value investors began selling as recently as late 2012 to early 2013, with the main reason being excessively high valuations. As an example, there have been a number of media stories about how Warren Buffet, one of the most famous value investors of all time, has been said to have lost his touch because he has underperformed the market in 4 of the last 5 years. His underperformance stems from excess cash that remains un-deployed. He and other value investors are simply finding the markets too expensively priced.

So that leaves us with the last leg to hold up an aging bull market, the momentum players. Momentum players usually pile into high-flying growth names, riding a trend, regardless of price levels (think dot com days). These players have been in force since mid 2013, and have been the highest returning strategy. However, growth favorites began to break down in Q1/2014, with double digit declines materializing in Wall Street darlings like Google, Amazon, Netflix, and Tesla.

Bottom line: When value investors think markets are too expensive, and momentum strategies start breaking down, there aren’t many institutional investors left to buy into an aging bull market. Now is the time for caution, and our client portfolios reflect this point of view and positioning.

As always, we encourage you to pursue life’s dreams with vigor. Make life count!