Market Overview & Commentary

Income inequality is a popular and heated topic these days, with the growing wealth gap pitting the “rich” versus the “poor.” However, there is a different gap that we would like to address in this Update, the income inequality of interest rates and dividend yields that investors receive today versus in the past.

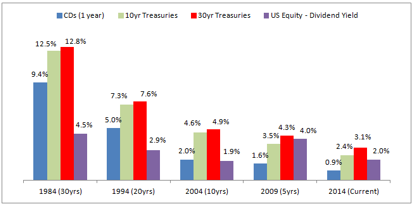

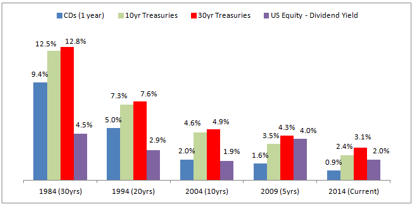

Chart I – 30yr Historical Rate Comparisons for Yield Producing Assets

You may remember the good ‘ole 80s; big hair, crazy rock bands, and CDs that paid out 9%! Well, maybe you don’t remember that last part, but 9% was real, and if you stretched your risk profile a bit further, you could get 12 – 13% from longer -dated US treasuries. Even dividends from stocks paid out 4.5% in 1984 (see Chart I above). Fast forward to today, and that same 1-yr CD will get you less than 1%, while treasuries pay 2.4 – 3.1%.

Talk about income inequality, today’s CD rates are nearly half what they were 5-10 years ago, one fifth what they were 20 years ago, and only one ninth of what they were 30 years ago. $100,000 invested today will earn you $900 in a 1yr CD, whereas it would have earned you $9400 in 1984!

The $9400 question is: why are rates so low today versus yesteryear?

The answer is QE, otherwise known as the Federal Reserve’s unprecedented Quantitative Easing program…the massive-scale centralized purchase of fixed income securities to artificially suppress interest rates. The prevailing “wisdom” is that this program produces low interest rates and a stock market “wealth effect,” which in turn entices people to spend more money and stimulate the economy. Lower interest rates are also supposed to stimulate borrowing, because projects/investments are less costly to finance.

However, there is scant evidence that our economy has recovered more strongly with five years of QE versus if it had been left to recover on its own. The post-recession economic recovery is one of the weakest on record, with sub-par GDP and employment growth. Corporate profits and the stock market have indeed been stimulated to new highs, but they have not translated to a rapidly improving economy, and these results will not be sustainable once interest rates rise.

If that weren’t enough, guess who is footing the bill? Answer: The low-risk, responsible savers in this country…mainly pensioners and retirees. The low interest received is going to finance stock buyback programs to goose earnings.

Do you feel ripped off yet? You should!

Taking a look back at Chart I, the income gap between yesteryear and today is massive and has continued to decline with continued and increasing central bank suppression of interest rates. Today, fixed income yields are so artificially low that stocks have an equivalent to higher dividend rate. This is so rare, that it causes conservative investors to unsafely stretch into equities in search of yield. The more they stretch, the more equities become overvalued as well. The net result is a race to the bottom with ALL assets becoming overvalued and unattractive.

We won’t discuss the further issue of massive debt liabilities that the Fed has accumulated and must pay off in the future. Even ignoring those figures, QE policies are not working economically, and more importantly, are creating one of the most massive bubbles of our lifetimes…one that will not end happily.

Rather than buying into the canard of the “rich” versus “poor” debate, let’s look at it as the symptom to the underlying problem of massive central bank manipulation. A less manipulated market would naturally result in higher interest rates and less extreme boom-bust cycles.

As always, we encourage you to pursue your dreams while we take care of protecting and growing your hard-earned savings. Make. Life. Count.