Market Overview & Commentary

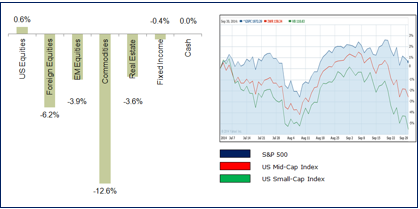

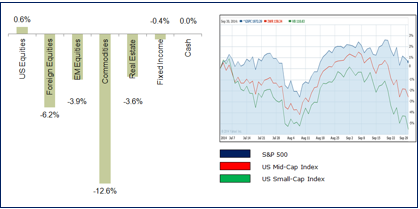

Global markets began selling off in earnest during Q3/2014, with almost every asset class declining (see Chart I – below left). Even in the US, small-caps and mid-caps began declining, with large caps barely holding on for a very modest 0.6% gain in the S&P 500 (see Chart II – below right), the last standing soldier in a weakening investment landscape.

Chart I: Q3-2014 Asset Class Returns Chart II: Q3-2014 Select US Index Returns

A number of headwinds have been dragging on markets, including continued global deflation from over-indebtedness, a reduction in Fed stimulus with the QE taper, global tensions in Russia/Ukraine and the Middle East, and now a new threat of global disease (Ebola). However, these issues are mere catalysts to the more over-riding issue of severe overvaluation and over-exuberance that we have been highlighting in our newsletters since mid-2013. All it takes is a slight change in sentiment to begin a market correction or larger bear decline.

Of course, there are positives as well. The resurgence of US oil production is causing large declines in the price of oil and gas, which essentially provides a tax cut to US consumers and manufacturers who spend less on fuel. This extra money translates to greater discretionary funds, higher profit margins, and resurgent US manufacturing. The US also remains the undisputed leader in technology and innovation, which helps drive efficiencies and productivity for our populace, as well as higher profits for our corporations.

So, the million dollar question is whether there is more to go in this aging bull market, or whether this is the beginning of the end? While it is always possible that the bull has further to run upwards, the probabilities…

Protecting Against Declines

Portfolio Review (Q3/2014)

Heading into Q3, we remained highly cautious on equities, as our indicators measured both extremely overvalued and over-loved markets. One of Warren Buffet’s favorite valuation metrics (Market Cap-to-GDP) pointed to a potential negative 8 year return, and only a 1% per year 10yr return (see Chart II below). Furthermore, our historically reliable 10yr PE ratio was pointing to a 64% overvaluation level in US equity markets!

Chart II: Market-Cap-to-GDP Predictor of Returns

Fixed income also remained overpriced from a long-term perspective, but was modestly attractive for its favorable characteristics during risk-off environments.

As a result, we once again underweighted equities in our tactical client portfolios, along with REITS and other equity-like holdings. Based on our expectation for volatility, we hedged the markets with our volatility trading model, held heavier fixed income positions, and had a full-sized position in gold and gold miners for stability.

On the whole, we were cautiously positioned, waiting for

potential market declines. Select investments like commodities and emerging markets had already declined heavily, and were becoming oversold. As such, we were prepared to redeploy cash as these areas stabilized and regained their footing from recent declines.

Q: What worked?

Our risk-off heavy cash positioning in non-US markets helped stem some of the global decline. Additionally, our volatility trading strategy added a small positive return. On the fixed income side, we also posted mostly gains, while the overall total bond index declined for the quarter.

Q: What didn’t work?

While our risk off positioning helped globally and in most US equity sectors, it reduced return relative to the slight gain in the S&P 500 (US large-caps). Additionally, our foreign equity exposures and commodity exposure with gold participated in the global decline.

Net Results for Q2/2014

As always, client portfolios had varying returns due to strategy and risk profile. However, for our non-index oriented tactical models, most client portfolios declined less than US and global benchmarks, with the exception of US large-cap benchmarks like the S&P 500.

We continue to believe that markets are overvalued and overheated, and are now starting to break down technically as well. We remain focused on capital preservation during the current period, instead of aggressive investment. However, we also remain vigilant for the opportunities that will present themselves on greater market declines.

Looking for Value While Hedging Declines

Looking Ahead to the Rest of 2014, and Start of 2015

We have been calling for a correction to overvalued and overbought conditions since mid-2013, and it is quite possible that we are beginning that today. While US large-cap equities (S&P 500) have been the holdout, we fully expect them to join the current declines in US small-caps, mid-caps, and most overseas markets. As conditions deteriorate, excess valuations will be corrected via a more broad-based market decline. Such a decline has most often been the result of a reduced level of confidence and willingness to pay high multiples, and often doesn’t require a weakening economy.

How much the market corrects before stabilizing remains to be seen. A garden variety correction would take markets down 5-10%, which has already occurred in many indexes outside of the S&P500. A more significant correction would take markets down 15-20%, improving the investment landscape from a sentiment perspective. However, it will take a 30-50% bear market for us to see the deep valuation discounts that we look for when deciding to get fully and aggressively invested.

Tactically, we remain heavily hedged and in cash…sometimes even seeing gains in client portfolios on days when equity markets decline heavily. We will maintain this protective positioning until investor sentiment eases (should start after a 5-20% S&P 500 decline). Thereafter, we will keep a close eye on whether we should tip toe back in for potential market rebounds, or whether the market conditions are deteriorating so rapidly that it warrants us waiting longer until valuations are also much more reasonable. There is no exact science to this process, but our “Market Phase” methodology helps to protect client portfolios during the most treacherous potential investment scenarios, while getting more aggressive during environments more conducive to taking investment risk.

Strap on your seatbelts, it could be an interesting period directly ahead…and we are excited to meet that challenge head on for our clients.

As always, we encourage you to pursue life’s dreams with vigor, while we help take care of your growing nest egg.

Make. Life. Count.