Global markets posted declines across the board, with the MSCI All-Country Index declining for a second quarter in a row.

We monitor a diversified and global benchmark which includes the following asset classes:

- US Equities

- Foreign Developed Equities

- Emerging Market Equities

- Fixed Income

- Commodities

- Real Estate

This benchmark declined 1.96% for Q4, after declining 3.52% in Q3 already.

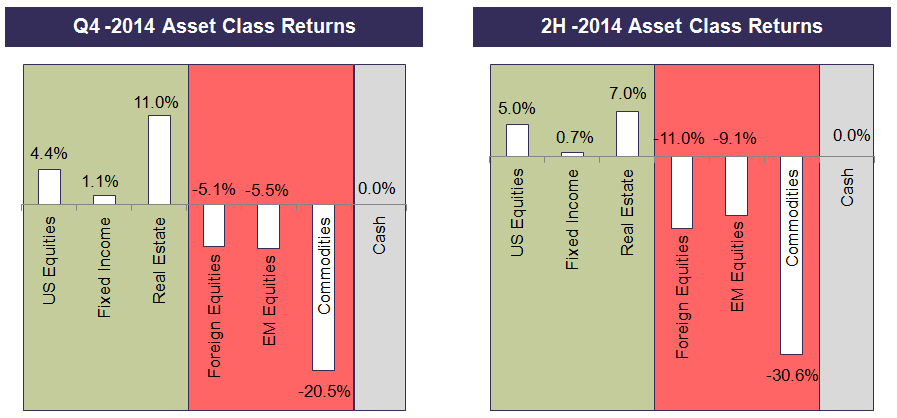

For more specific returns by each asset class:

Chart I – Returns by Asset Class for Q4/2014 and for Second Half 2014

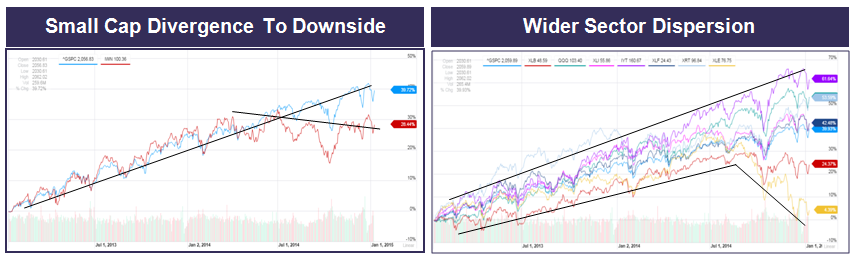

Even in the US, where large-cap US stocks ended up posting a small positive return for Q3-Q4, US small caps actually declined, and many US sectors experienced double digit losses.

Below are 2yr charts showing recent losses in small caps (left), and wider sector dispersion in last 6 months, including some with outright losses (right):

Chart II – Small Cap Losses & Dispersions

However, the biggest news for the quarter was the massive 60% price drop in crude oil from $110 per barrel to a recent $45.

While many consumers of oil and gasoline will benefit from such a steep price drop (think sub $2 per gallon gasoline), there are many negative implications as well.

For example, energy was the leading grower of high-paying jobs in the US over the last couple of years, and this will not only vanish, but most likely move to negative.

Additionally, many banks and private individuals loaned money to energy projects, much of which will now be under-water.

This can create an unknown systemic risk in the banking system that can result in panic and illiquidity, as other banks don’t know who has a solid balance sheet and who is in trouble.

Typically, when an investor is presented with an environment that is overvalued, overbought, and now with declines beginning and credit spreads widening (see below for more info on this), it is time to be cautious!

Corrections can happen quickly, and it is always nice to have cash available when the declines occur.

Protecting Against Declines

Last quarter we highlighted a few metrics showing markets to be massively overvalued and overbought, urging caution in portfolios.

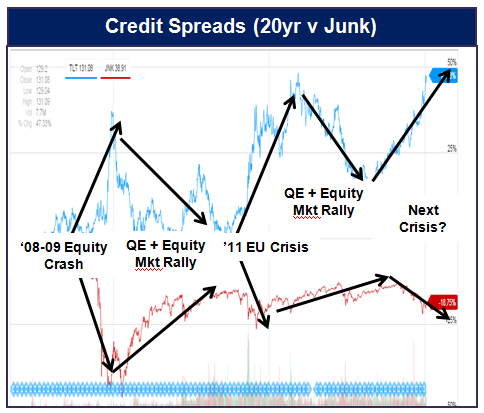

This quarter, we introduce another indicator that often predicts the timing of when corrective market declines occur.

In Chart III we highlight the current environment of increasing credit spreads (the difference between high quality 20yr treasuries in blue and low quality junk bonds in red).

Chart III: Widening Credit Spreads

As credit spreads widen, markets tend to experience stress and declines…whereas the opposite is true as well.

This relationship has held true throughout history, and was no different during the recent ’08-’09 crash, the EU crisis in ’11, and the subsequent rebounds.

However, as credit spreads began widening again in 2013-2014, markets have not yet fully responded, most likely due to continued Fed easing in the US.

This easing has now ended, markets have begun declining, spreads have continued to widen, and we continue to urge caution while positioning our tactically-managed client portfolios conservatively.

As a result, we once again underweighted most risk assets as well as fixed income in our tactical client portfolios, temporarily choosing alternatives and cash instead.

Based on our expectation for increased volatility, we also hedged the markets with our VIX trading model, and had a full-sized position in gold and gold miners for stability.

Q: What worked?

Our risk-off heavy cash positioning in non-US markets helped stem the global decline. Additionally, our individual sector selections in the US, Emerging Markets, and Commodities all outperformed their relative index benchmarks. Finally, our VIX trading strategy added a small positive return for the second quarter in a row.

Q: What didn’t work?

While our risk-off positioning helped globally and in most US equity sectors, it reduced return relative to gains in US large-caps (the S&P 500). Additionally, our underweight in traditional fixed income and real estate resulted in some lost gains as these surged into bubble territory.

Net Results for Q4/2014

Nearly all tactical portfolios outperformed global benchmarks for the second quarter in a row. Only in some of our more conservative portfolios did our underweight to traditional fixed income and real estate drag results slightly.

We continue to believe that caution is warranted and we remain focused on capital preservation. As declines occur, more opportunities will present themselves.

One Eye on the Bear, One Eye on Value

Heading into 2015, our Tactical and Global Rotation portfolios are maintaining an underweight on almost every asset class available.

Additionally, we are hedging Tactical Absolute and Active portfolios with our VIX trading system, looking to benefit from the rise in volatility expected with continued market declines.

These underweight positions have resulted in an increased allocation to alternative diversifier funds such as merger-arbitrage, multi-strategy / market-neutral, and long/short strategies for both equities and fixed income.

For Tactical portfolios we also continue to hold a healthy level of cash, awaiting declines in nearly every asset class to more attractive entry price levels.

For Global Rotation portfolios our charter is to remain fully invested, so we focus on relative value opportunities.

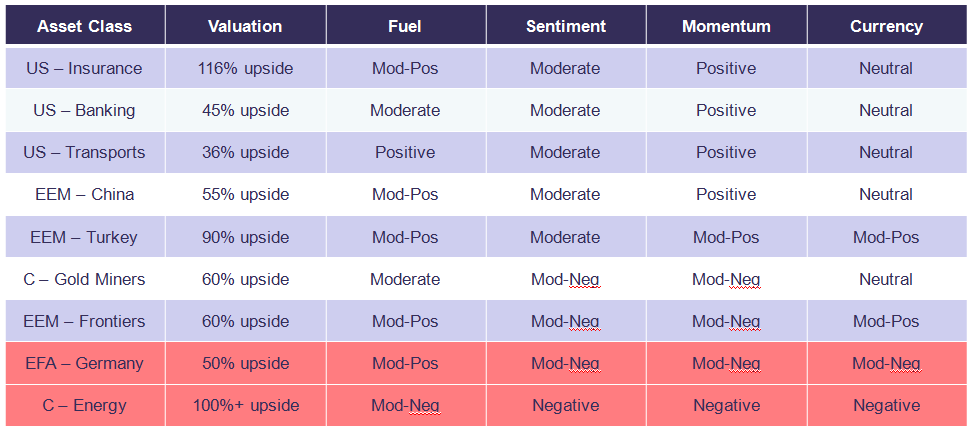

While we are playing solid defense, a few asset classes are finally coming down in price enough to start looking attractive.

In Chart IV, we illustrate asset classes that we are currently investing in, as well as areas that have become inexpensive but require technical support before we jump back in (red highlights):

Chart IV – Attractive Asset Classes from LGA 5-Forces Analysis

As we have mentioned in our most recent newsletters, it should be a very interesting and volatile period directly ahead…and we are excited to meet that challenge head on for our clients.