There has been quite the buzz over rapid stock market declines in 2015 and early 2016. Since the global bear market took hold:

- Commodities are down 50-60%

- Emerging Markets are down 50%+

- Europe is down 20-25%

- …and even the US is now down 10-20% in the first two weeks of 2016.

Here’s the good news though…LotusGroup clients have thrived during this downturn!

- Our public portfolios have been heavily in cash and hedging the markets

- Our recession-resilient private investments have been cash flowing at 8-12% annual rates consistently

- And our Advisor team has tirelessly been working with clients to deliver greater financial control and to generate increased savings habits

No matter what the markets are doing, our clients are constantly striving to improve, and we always here to encourage and support their potential! Paul Koger’s take on this is highly credible where he explains how one can understand the changing market and make it work to their advantage.

For 2015 we launched 3 major initiatives, with more to come in 2016:

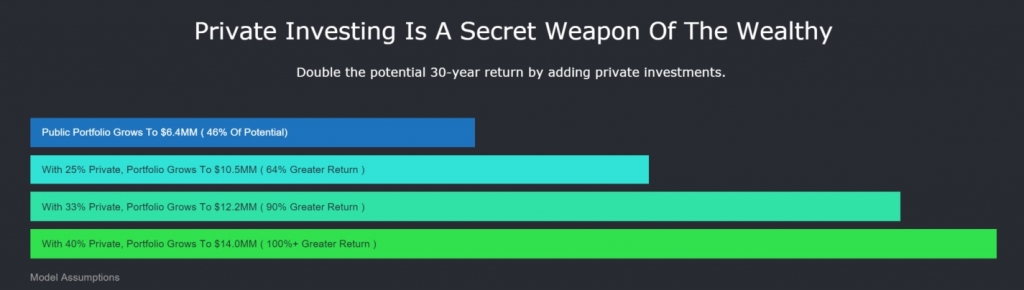

Improvement #1: Private Equity Investment Program (Rolled Out in early 2015, with more to come in 2016)

A major initiative for us in 2015 was the implementation of our Private Investment Program.

The program was initially aimed at generating higher long-term returns.

…and for many people, this remains the main attraction.

Cash Flow = Freedom!

- Cash flow is providing our working professional clients with the freedom to consider career changes.

- Cash flow is providing our entrepreneurs with the freedom and the ability to go take risks.

- Cash flow is providing our retirees with the freedom to pursue life vigorously and worry-free

In 2015, we placed a whopping 107 total private placements with clients: representing $9 million of investments, and over $1 million of passive income (CASH FLOW)!

Improvement #2: Behavioral Investment Assessments (Rolled Out in Late 2015, with more to come in 2016)

We also beefed up our behavioral investment assessments to go well beyond the industry’s sole focus on risk versus reward analysis for portfolio selection.

In addition to risk categorizations (aggressive/moderate/conservative), we also test for client biases around absolute vs relative results, and levels of liquidity.

These assessments have proven invaluable in helping clients be custom-fitted to tactical absolute strategies, fully-invested strategies like indexing, or something in between.

This fitting of strategy to behavior is critical to success, given the number one killer of long-term returns is performance chasing, driven by behavioral discomfort with a chosen strategy.

In other words, picking a strategy that one will stick to, rather than the one that academically looks the best on paper, is they key to a client’s long-term investing success.

For accredited investors, our liquidity assessments help us determine if adding income-producing private investments will be something they will be comfortable with.

Improvement #3: Online eMX Dashboard & Financial Planning Tool

Finally, we are excited to continue the roll-out of our award winning eMX dashboard and financial planning tool to all clients.

LGA clients have had nothing but accolades for our new tool, which aggregates all of your accounts in one easy place online (whether on your computer, phone, or tablet).

Investment accounts, businesses, insurance, real estate, confidential documents… it all can be monitored from a single and secure location with eMX.

eMX also has powerful financial planning software that we have already used with a number of LGA clients.

It can illustrate base assumptions, but more importantly, help them test the scenarios that they are considering (taking a business risk, remodeling a home, or helping to pay for a grandchild’s education).

Our professional staff is highly trained in both programming the tool, and in providing clients with quick and easy visuals that track the long-term impacts of their decisions.

We are very excited about this capability, and are excited to offer it at as an included service (no additional charges).

As always, we continue to believe that the best days are ahead of all of us, and remain committed to helping each and every client to reach their potential.

If you are interested in learning more, please give us a shout!

Make. Life. Count.