Well into our second year of the program now, we continue to find reasons why our clients love passive income.

Most recently, our clients have told us it helps with the following:

- The ability to explore different career options because the stability of consistent income was there

- A greater focus on growth initiatives in their businesses, because their income needs for family are being provided for

- More freedom in retirement to figure out what’s next, as the fear of where the money is coming from diminishes

We continue to work hard at developing new sourcing channels for deal flow, conducting due diligence, bringing on new clients, and getting existing ones more involved.

Quick Program Update (Stats)

Below are selected stats associated with our Private Investment Program for Q2/2016:

- $2.4 million of new client savings were invested ($13.5 million since program inception)

- 23 new individual investments were made (161 placements since program inception)

- 4 new households began participating (40 total households are now invested)

- $34K of average annual cash flow per client ($1.35 million annual cash flow for all clients)

- $8.6 million of more potential investments available with existing clients, representing the possibility of an additional $860K of near term cash flow

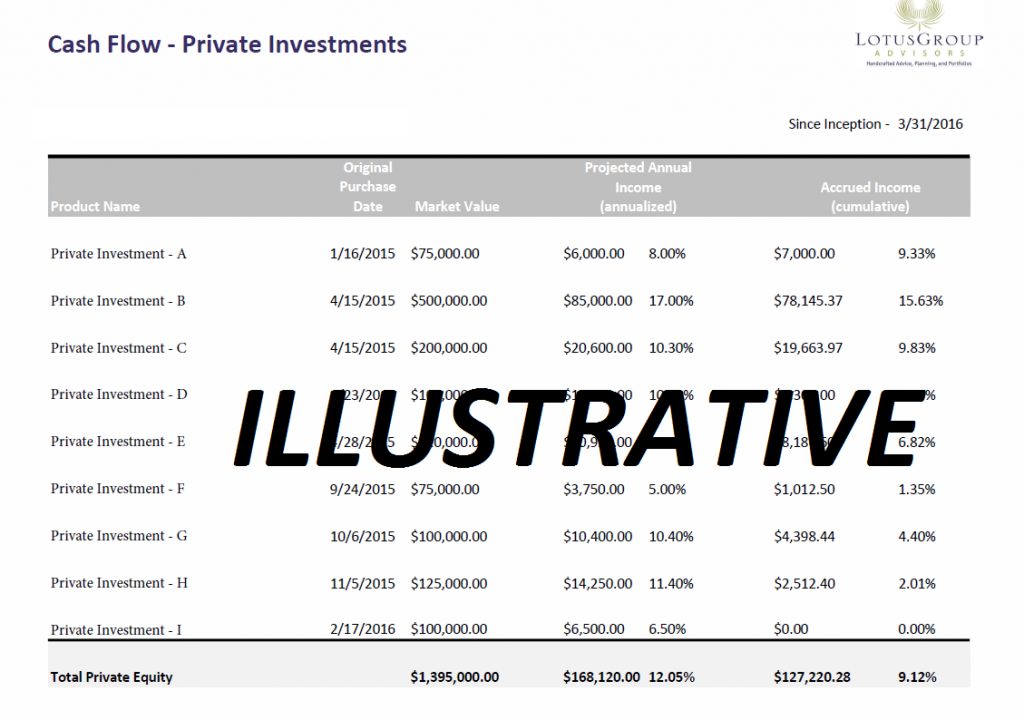

New Enhancements (Cash Flow Report)

This report was very well received as it helps clients to see what their current investments are cash flowing, and helps them to better plan their freedom dates.

Freedom to take new jobs. Freedom to personally focus on growth initiatives instead of income-producing activities. Freedom to feel security in retirement.

For each of our clients, we are excited to be able to provide this client-crafted report.

New Client Welcome (4 New Clients in Q2/16)

In Q2, we welcomed 4 new clients to the private program…one an existing client and three new clients altogether.

We continue to see great energy behind the program, as public markets offer a very poor outlook with little potential rewards and high potential risks.

New clients have been excited to access our professionally-sourced opportunities, typically reserved for only the ultra-rich, by leveraging our aggregated purchases.

As always, all investments are free of commissions from us, given our fiduciary status with clients.

Additionally, our program continues to stay away from startups and venture funds, instead focusing on opportunities with extremely high success rates, and meaningful assets or protections.

Learn How Private Investments Can Supplement Your Current Public Strategy

At LGA, clients work closely with a dedicated LGA Private Client Advisor to determine appropriateness, size of investment, and which accounts are best suited for each specific opportunity.

For example, a heavy income-producing investment may be better suited in a tax-free IRA account.

LGA clients receive an exclusive Quarterly Private Program Report which provides details of their various holdings and how they are performing (not available to the public on this site).

And as a fiduciary, our Private Client Advisors are unbelievably unique to this space, as there are zero commissions paid to the Advisor or to our firm.

That means our advice is conflict-free.

We are strong practitioners in the public investment space as well, but if you happen to like what you are doing there already, there is no need to change it.

You can access our private program while keeping your public exactly where it is, if that’s what you wish.

Learn more about how our program works by completing / submitting our simple form here (takes literally 15 seconds):

You owe it to yourself to learn a bit more, and we promise to not waste your time nor bother you with any hard sales pitches.

If it is a good fit for both you and for us, then great….if not, no hard feelings.

We look forward to speaking with you to see if you qualify.