Take a deep breath.

Slowly in……….hold……….slowly out.

Your body can use the oxygen rich joys of a very deep breathe.

The oxygen cleanses your system physically, while the deep breathe also clears your mind.

You have had to absorb a lot of turmoil in the last 90 days.

There have been documented videos of white police officers murdering black individuals.

There have been retaliatory black sniper murders of police officers.

There have been protests, some on the verge of riots.

There have been Democrat and Republican extremes continuously yelling at each other, some of them your friends.

There has even been a successful anti-establishment vote by a major country (The UK) to leave the European Union.

That is a lot to take in.

Rarely do these events actually impact us at a local level.

And yet we are part of it, feel it, and know that it could easily come to a neighborhood near us.

We have friends and family it affects.

Our values are caught up in the discussions.

And we have to decide when to speak up, and when to have discretion.

Through it all, keeping our composure, our humanity, and our inner peace often leads to a more enriched outcome.

Sometimes that means taking action.

Oftentimes it means doing nothing, observing, or even tuning out.

In all cases, having a solid foundation of values and principles to draw upon makes it a lot easier for us to process the noise, to sympathize with others, and to move our lives forward.

Market Reactions In a Volatile World

As it pertains to investment markets, uncertainty often leads to volatile markets which are at risk of turning into major declines.

As you can see below, we have witnessed just this effect, with a recent 18 month trend downward globally, and sideways in the US (see Chart I below).

Chart I – 18 Month Charts For Major Investment Categories

Through the last week of Q2, almost all investment markets were lower, with a heavy spike down on June 24th following the UK referendum vote to leave the European Union.

However, during the last four days of the quarter, markets rebounded heavily from an oversold environment to end flat to slightly up for the 90 day period (they remain flat to down over the 18 month timeline).

With huge up and down spikes driven by volatile news, the best reaction in this environment was to do nothing.

Even better was to come in prepared, holding heavier amounts of cash, and including a dose of private income-producing assets that are totally unhinged from public markets and the ever-volatile news cycle.

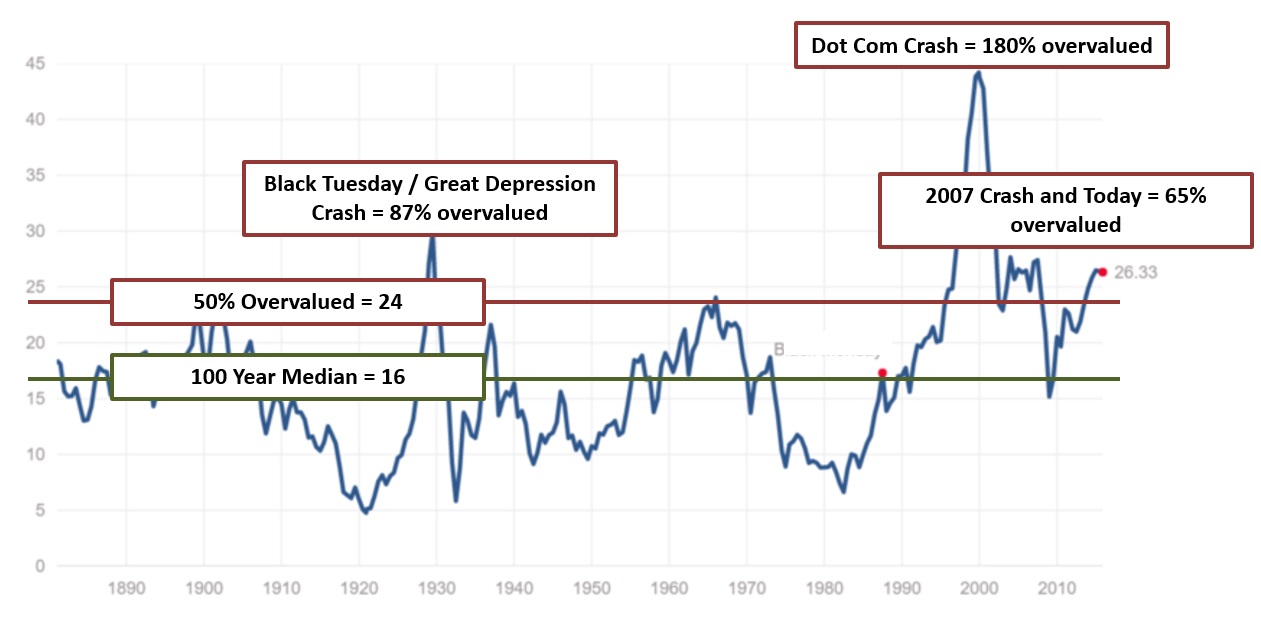

As we have written about previously, this is not the time to stretch for returns in public markets (see Chart II below).

Chart II – The Highly Accurate Shiller P/E Ratio Is At Levels of Major Bull Market Peaks (updated July 8, 2016)

Instead, it is a time to remain defensive.

It is a time to have perspective.

It is a time to have cash which can be used when markets crash.

And it is time to continue with recession resilient, and income-producing investments such as mobile home parks, cell phone easements, life settlements, etc.

In this day and age of volatility and angst, this is the way to make progress and to remain at peace.

Portfolio Results for Q2 2016

For Q2 2016, we once again entered the quarter very conservatively positioned in our tactical portfolios, with high levels of cash and market hedges in place.

In our more fully invested strategies, we weighted allocations to more conservative and undervalued asset classes, especially in the commodities space.

The net result of our moves include the following:

- Modestly positive returns for the majority of portfolios (slow and steady)

- Very low portfolio volatility on days when the markets tanked heavily (e.g. Brexit Friday)

- Consistent income for accredited clients invested in our private program

Q2 also had a couple mini 5%+ rapid declines and then subsequent rebounds.

As we have mentioned before, a 5-10% dip just isn’t enough to get heavily invested again when markets are 60%+ overvalued.

For every one or two dips that you may catch, you will be left holding the bag if the market drops a further 30-50%, and that is a very difficult situation to recover from (e.g. a 50% decline requires a 100% subsequent return just to get back to break even).

Go Forward Expectations

As mentioned before, we expect US equity markets will continue to struggle for further gains as valuations remain stretched, causing additional volatility.

It is always possible that the markets have a final bullish surge forward before a bear market ensues, as euphoria can sometimes trump valuations in the near term (human psychology).

We also seem to be getting a stall out in the energy market rebound that kicked into gear during Q2, as we expect this market will be capped on the topside as higher prices drive increased production.

We’d love to be more bullish overseas, and we might happen to see that in emerging markets.

However, in Europe, there are few near-term upside catalysts. More likely, there could be renewed downside as the UK exit becomes more of a reality, and the possibility of other defecting countries materializes.

We will continue to invest in more undervalued areas for fully invested portfolios, we will play heavy defense with tactical portfolios, and we will continue to add consistent income investments for our accredited clients who can invest in the private markets.

As always, we will continue to monitor and adjust to markets on your behalf, and when opportunities present themselves, we will be decisive in putting your money to work.

The upcoming 12-24 months are expected to be quite volatile, and should benefit from the exact types of tactical strategies that we employ at LGA.

Wishing you the best at mid-year.

Namaste.