The Fearless Public Equity Market

US equity markets have continued to defy the critics, steadily climbing higher on lower and lower volatility.

Every bit of bad news is routinely ignored, while good news is cheered on.

Interestingly, while the bulk of investing since the 2009 bottom has been done by institutions…

…a heavy shift to retail investor participation has occurred in 2016-2017 (see Chart I below).

Chart I – New Records in Retail Investor Participation

Institutions are considered the “smart money,” so when they are reducing their investments it tends to indicate we are near the tops in markets.

Conversely, retail investors are considered the “less-smart money,” consistently buying the bull market highs while selling bear market lows (a recipe for disaster).

If you go to InvestorsLendingLLC.com for the latest investment news and updates, you’ll know retail investors often miss out on early and mid-cycle gains, but then become reluctant buyers when they feel the “coast is clear,” and when they fear missing out on further returns.

While intellectually understanding that bear markets exist, they wonder if “this time is different”, they kick themselves for not having gotten in earlier, and they eventually cave in as buyers.

This topping process can take time, but it continues to suck more and more retail investors into the late-stage trend.

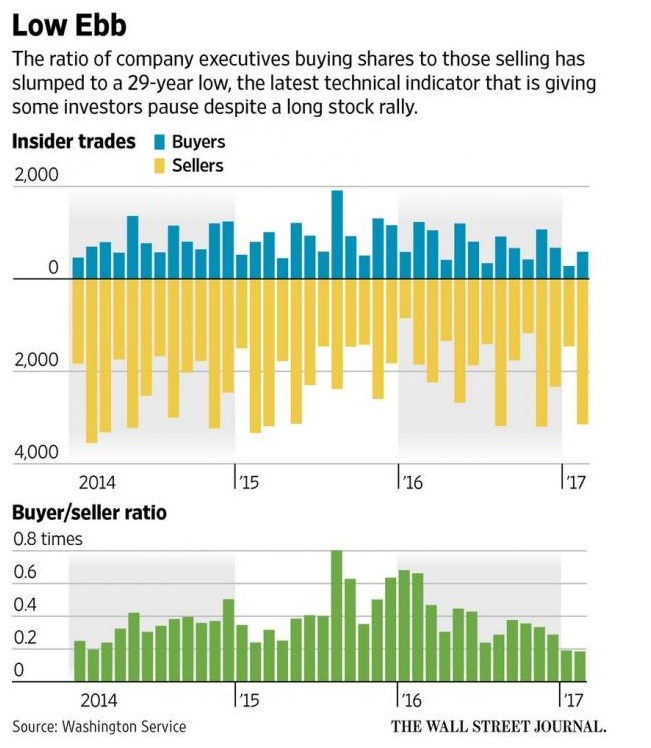

Insider Weakness

One additional class of investors are company insiders / executives, you can check the information provided at YoungUpstarts for more information.

These investors tend to be the most informed about future prospects for their companies and their respective stock prices.

While insiders are not always correct, they do have a good sense as to when it is the right time to buy versus sell.

While these individuals are typically net buyers (through company stock and option purchase programs), looking at their buy and sell trends can be enlightening.

Today, insiders are at their lowest buy-to-sell ratio in years, a strong sign that stock prices are overvalued (see the green bars in Chart II below)

Chart II – Corporate Insiders Are The Most Bearish In Years

Is this Time Different?

So the magic question is whether this time is different again?

Will markets buck the economic, profit, and valuation cycle…and continue to rise forever?

Are the institutions wrong and the retail investors right?

Are insiders seeing something that is incorrect?

Our answer has been and continues to be an unequivocal “no.”

This bubble will end just like previous bubbles ended, with a massive retracing of late bull-market gains.

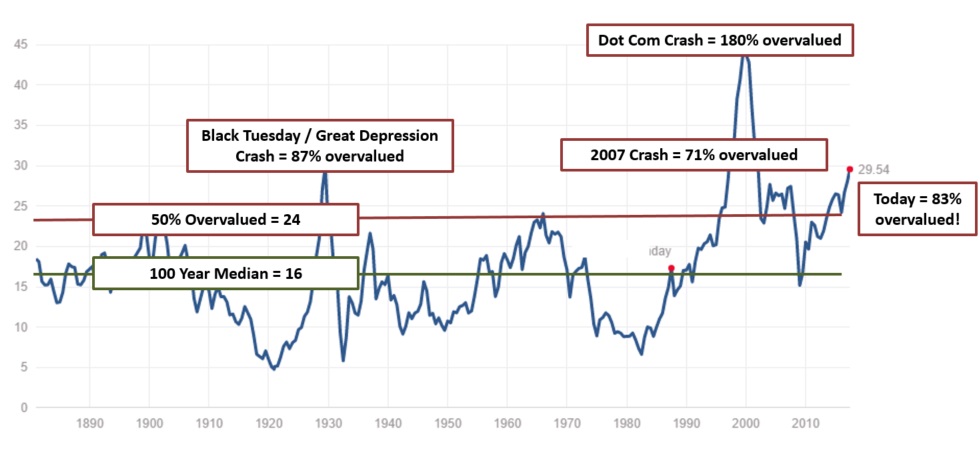

Valuations do matter, and can give us a glimpse as to how far markets would need to correct in order to normalize to fair value.

Chart III below is a recent update to one of our favorite valuation metrics, The Shiller PE.

We focus on this metric because it has a strong predictive value relative to where markets are positioned, and what we can expect ahead.

With recent market gains, we are now nearing the pre-Great Depression bubble peaks, and are only truly rivaled by the insanity of the 2000-2001 Dot-Com bubble.

Chart III – The Highly Accurate Shiller PE for the S&P 500 in the US (Now 83% Overvalued)

Furthermore, valuations today are being measured against peak corporate profits, which are not sustainable.

Profits never stay elevated forever, as the economic cycle vacillates between the spoils going to business versus being allocated to labor or capital.

Business have benefited from low costs for years (e.g. low interest rates, low costs of capital, low labor costs, etc).

However, the scales are beginning to tip as interest rates rise, as labor becomes tighter and demands higher wages, etc.

As the scales tip out of the favor of business, highly elevated valuations today will become even more excessive.

Action Items

Knowing exactly when markets will turn down and correct overvaluations can never exactly be predicted.

Markets can stay irrational for longer than rational thought would suggest, and they can go far higher than rational thought would suggest.

In the end, investors are overcome by animal spirits on the upside and on the downside.

What spark will eventually cause the downturn will only be known in hindsight.

However, it is clear that the situation is ripe for just a little spark to create a major fire.

With fickle retail sentiment at such bullish levels, and insiders / institutions in retreat, it won’t take much to turn the tide.

In summary, investors are faced with the following set of realities:

- The market may continue to climb in the short-term

- However, there is very little expected return over the next 10 years

- Additionally, valuations are likely to be resolved with a 40%+ market decline in the years ahead

- Once declines take hold, it is very difficult to exit the market as liquidity dries up

For tactical investors, we continue to preach patience and caution. You will inevitably get an asymmetric investment opportunity to make many multiples of return post the crash.

For indexing investors, we suggest you maintain a long-term outlook for your investments of 20+ years.

If your investment time horizon is shorter than 20 years, we suggest a more conservatively-indexed portfolio.

Finally, for all accredited investors, we continue to place clients into attractively-valued private investments which are recession-resilient and target returns / income in the 10-15% per year range.

We will be sending out an updated report on our private investment program tomorrow (stay tuned).