Greetings from Switzerland

I am writing this quarterly investment blog post from my family vacation in Switzerland.

Every few years we take a trip back to my late-mother’s homeland to reconnect with family and friends.

Not to mention, the forced rest and relaxation is good for me and my crew.

One huge benefit of travel is the perspective it offers into life outside the US.

Upon first arriving in Zurich, we were confronted with oodles of private bank advertisements adorning the airport walls.

A few of these banks were established in the early 1800s (over 200 years ago!), surviving multiple generations, world wars, and market booms and busts.

One sign reminded me of my own heritage, the advertisement for the bank UBS, where my grandfather worked nearly six decades ago!

It was a reminder of how long-term and multi-generational investing can be.

In the US, we often focus more heavily on the near-term.

We embrace creative destruction in capitalism, which has a strong track record of invention and innovation.

However, a short-term view can also lead to manic behavior, anxiety, and performance chasing with investments.

Short-term thinking also encourages our centralized institutions to ease any pain with market and budget manipulations, rather than embarking on healthier long-term solutions.

While short-term comfort is achieved, it often comes at the expense of long-term results.

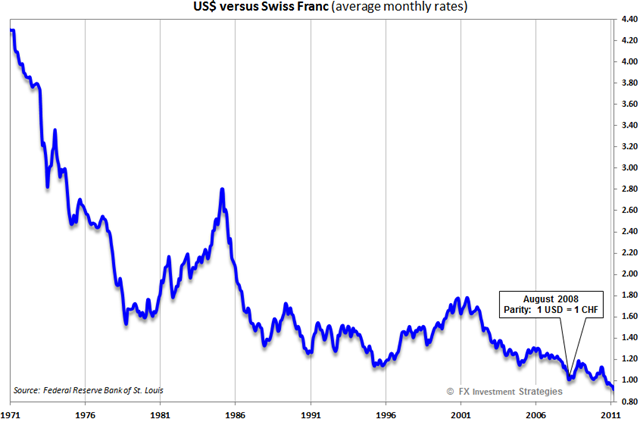

For example, as a child, I would travel to Switzerland with family and receive between 3 to 4 Swiss francs for every US dollar exchanged.

Today, 30-40 years later, a US traveler only receives 0.9 Swiss francs per US dollar (an astounding 75%+ decline in the US dollar’s purchasing power)!

Perhaps we are missing the forest for the trees with our short-term policy thinking, and should endure a bit more real-world pain in the near-term, for improved health and long-term outcomes?

Other observations from our travels include how little care the everyday person in Switzerland has for manic global events.

There is little talk of the Federal Reserve or the European Central Bank.

There is little talk of Donald Trump.

There is little talk of scandals, social media, or the latest Facebook or Google endeavor.

The cows don’t care.

The farmers don’t care.

The local restaurateur, lift operator, bus driver, fisherman, or watch maker don’t care either.

For the Swiss, life goes on with a focus on their families, their communities, and their connection to those they are spending time with in the moment.

I truly admire the Swiss formula of long-term investing, along with a day-to-day focus on achievement and connectivity.

At LGA, we also help our clients to focus on long-term investing while striving for day-to-day personal achievement.

My guess is that we are together onto something that is as durable and enjoyable as the Swiss.

Public Market Update

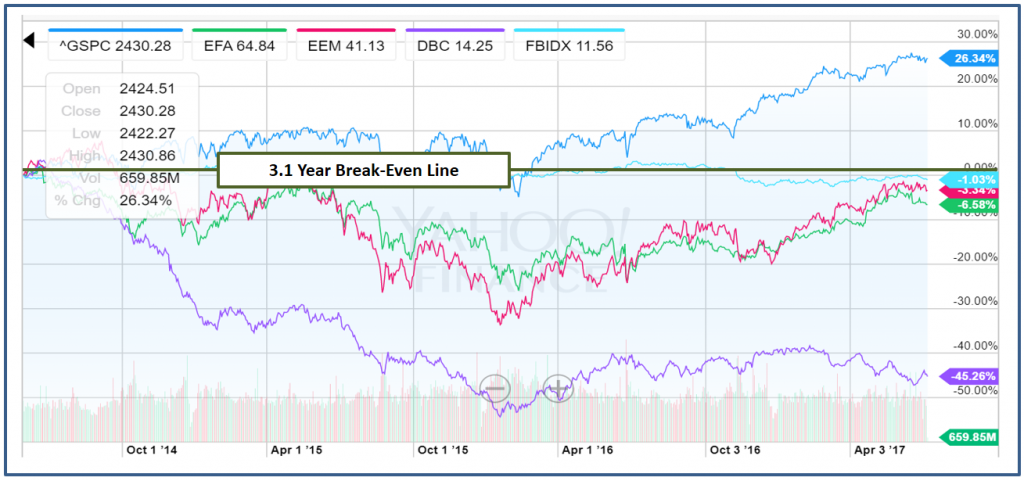

We have been warning of public market overvaluations for over three years now (since May 2014), and the net global indexes have been less than inspiring since:

- US equities are up 26% (blue line)

- US fixed income is down 1% (light blue line)

- Emerging markets are still down 3% (pink line)

- Foreign developed markets are still down 7% (green line)

- Commodities are down an astounding 45% (purple line)

Chart I – Global Returns Since LGA Bearish Call in May 2014

We continue to hear from new clients that investor returns across the industry are flat to slightly negative, with the exception of those individuals who are overly-concentrated in US equities.

However, US equity investing without diversification is a risky game.

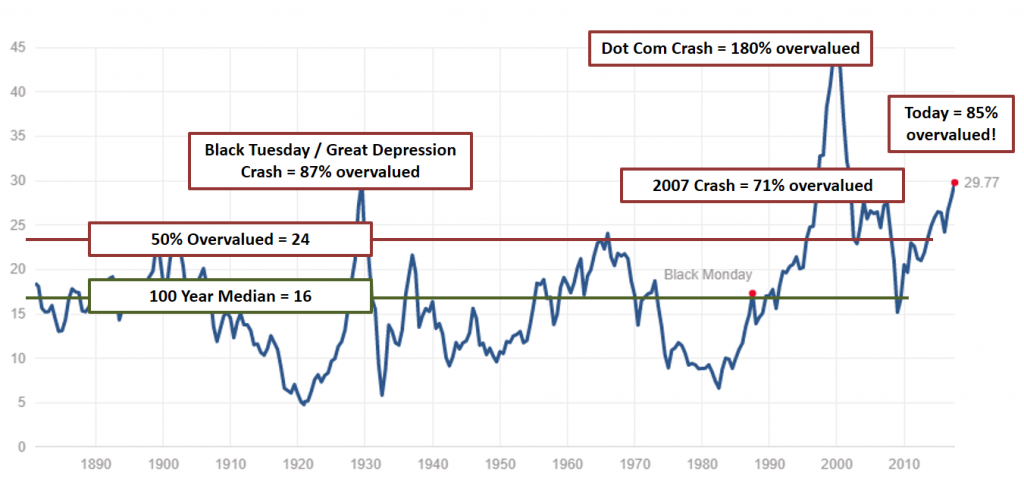

As illustrated in Chart II below, US equities continue to climb to obscene valuation levels, and are ripe for a major decline (now at an astounding 85% overvaluation)!

Chart II – The Highly Accurate Shiller PE for the S&P 500 in the US (Now 85% Overvalued – 14% Higher Than Even 2007 Bubble Peaks!)

While valuations cannot predict the exact timing of market declines, they do inform investors of expected returns, which are today negligible (expected at negative 1.1% per year over the next 10 years).

US markets now require a greater than 55% decline in order to simply get back to what has historically been “fair value.”

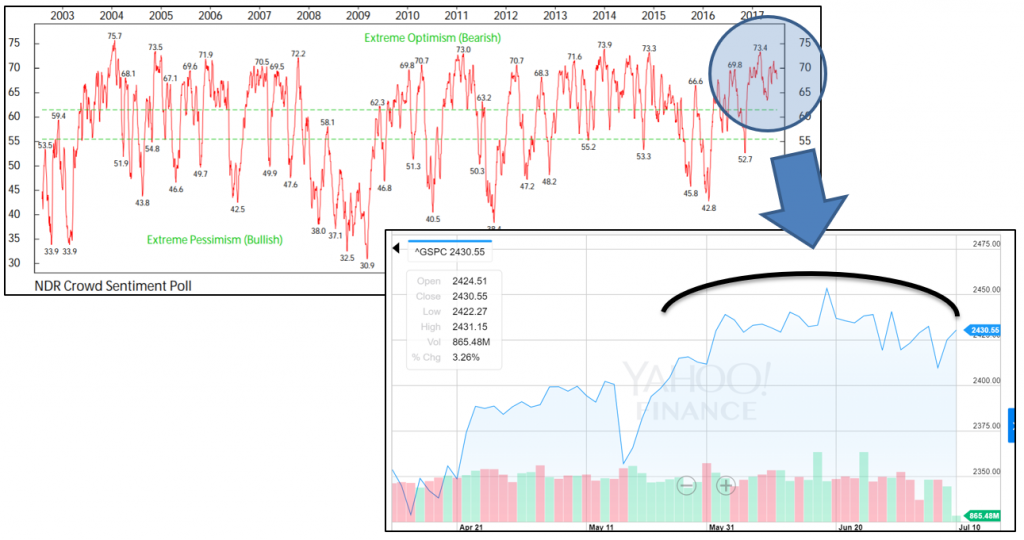

We are also starting to see some topping action in US markets, illustrated by highly positive market sentiment not being able to push markets to new highs (see Chart III below).

Chart III – Investor Sentiment Has Been Overly Bullish For An Extended Period While The S&P 500 Appears to Be Topping (A Negative Market Signal)

Of course, markets can always push further to new highs, but investors should be cautious when combining highly exuberant and overvalued markets with ones that are stalling out technically.

Full market cycles are always completed and the current US equity bull market is not a permanent “new normal.”

On a positive note, we are focused on sifting for that one gold flake among the rubble in the pan…and are finding a few gems with reasonable valuations.

We have taken modest positions in China, Taiwan, New Zealand, and Australia.

We are also finding opportunity in select real estate investment trusts, ones with discounted prices and yields in the 5-10% ranges.

Finally, traditional energy assets appear to be undervalued after two very negative recent years.

However, we are awaiting a bottoming out in energy prices before we jump back in…as it doesn’t pay to “catch a falling knife” when asset prices continue to decline.

Outside of these specific sectors, we remain in defensive positions for our fully invested portfolios, and are hedging with cash and insurance positions like VXX for more tactically invested portfolios.

We continue to produce a modestly positive return for the majority of portfolios, while remaining prepared for meaningful public market declines in the years ahead.

Private Market Update

LGA clients have continued to aggressively allocate money to private investments.

As discussed in previous posts, there is now a 50% discount for certain “nuts and bolts” private assets.

A major driver has been the severe lack of funding from the traditional bank sector.

After two decades of industry consolidation, today’s big three banks are focused on “vanilla” lending to home owners.

As such, private investors (us) have been filling the gap, but also demanding higher compensation in return.

During Q2, we introduced three new recession-resilient opportunities:

- Green infrastructure investing with guaranteed 14+ year contracts that can be aggregated and sold

- A roll-up of the waste management industry, purchasing at 4-5x multiples and exiting at 8-9 multiples

- Mid-market lending with 11%/yr targeted returns versus 5-6% returns in public markets

LGA clients have now invested $50 million in private assets, are collectively enjoying $5 million of annualized cash flow, and are looking forward to additional long-term returns as investments exit over time.

We look forward to continuing progress in this important area with our clients.

LGA Enhancements

As part of our standard business practice, we annually deliver enhancements that have been either internally identified by employees or recommended to us by multiple clients.

For 2017, our focus has been on three areas:

- Beta modeling for public market portfolios

- Improved reporting

- Improved distribution

Below are details on #1 and #2, which are currently being rolled out.

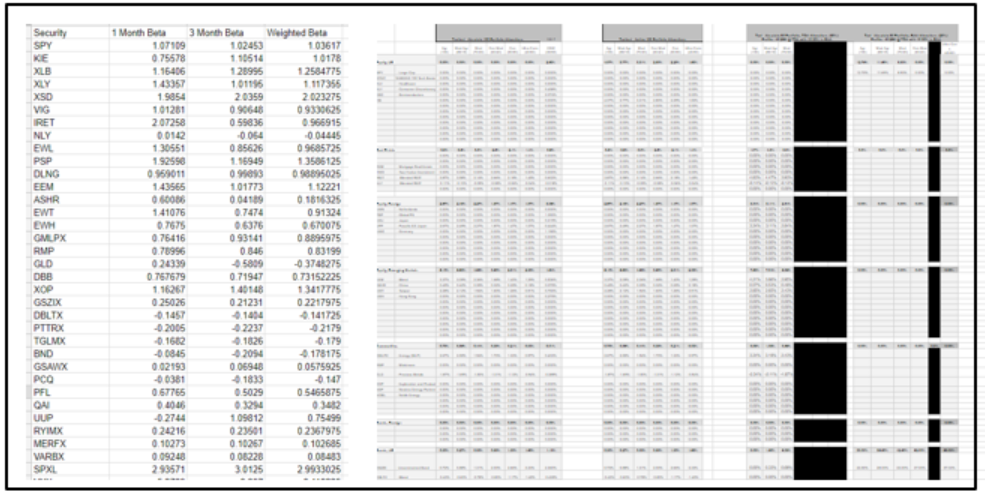

#1 – Beta Modeling

High-Level Screenshot of LGA’s New Beta Modeling Tool

For public portfolios, we have traditionally categorized asset classes as either risk assets (equities, commodities, real estate, etc) or conservative assets (fixed income, market-neutral alternatives, cash).

This is standard industry practice.

However, just because assets are grouped together does not mean that they act alike over short time periods.

For example, while US equities rose 26% in the past 3 years, commodities declined by over 40% (as illustrated in Chart I of this blog).

The industry would say that these two risk assets are simply providing diversification by moving in opposite directions.

Of course, it is far more comfortable to be diversified when US markets are under-performing, because one sees the benefit to including other assets in the portfolio (this was the case in the 1990s and early 2000s).

Conversely, it is far more difficult to be diversified when US markets outperform and diversification appears to be hurting returns in the near term (the more recent case was during the 2010s).

When this happens, our main goal is to keep clients from changing their strategy or performance chasing…and one of the main tools is to minimize psychological pain.

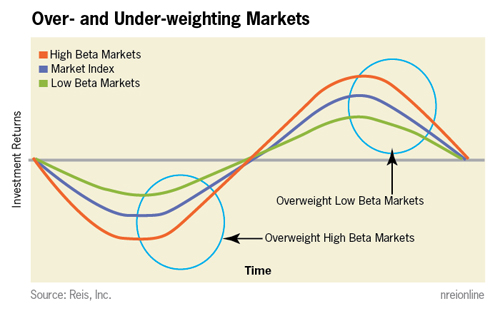

As such, we have borrowed a concept from sophisticated hedge funds called beta modeling.

Beta modeling compares the relative performance of an investment to some base level index, and gauges how much it will go up or down relative to a corresponding move in that underlying index.

In English, a beta of 1.5 means that for every 1% the US equity market rises, this other risk asset would rise 1.5%.

For a 0.75 beta, for every 1% rise in US equity markets, the corresponding risk asset would rise 0.75%.

Make sense?

In the case of US equities and commodities over the past three years, the beta was actually negative, meaning commodities went down when the US markets went up.

So how do we use this new tool to counter negative investor psychology?

While we are focused on diversified portfolios, our beta modeling can now ensure that portfolios don’t get too psychologically far away from their underlying US benchmark.

Investments will not only need to be attractive, but they will also need to combine as a portfolio to be within a tolerable distance to the US benchmark.

The net result will be better management to our US-centric client expectations when diversification outside of the US is under-performing.

A big thank you to LGA’s public portfolio manager, Stephanie Schlemeyer, for all her hard work in researching, creating, and implementing this new model.

As our team’s workload continues to expand, Stephanie recently hired a new member to her team.

Welcome aboard Mr. Louis Frank!

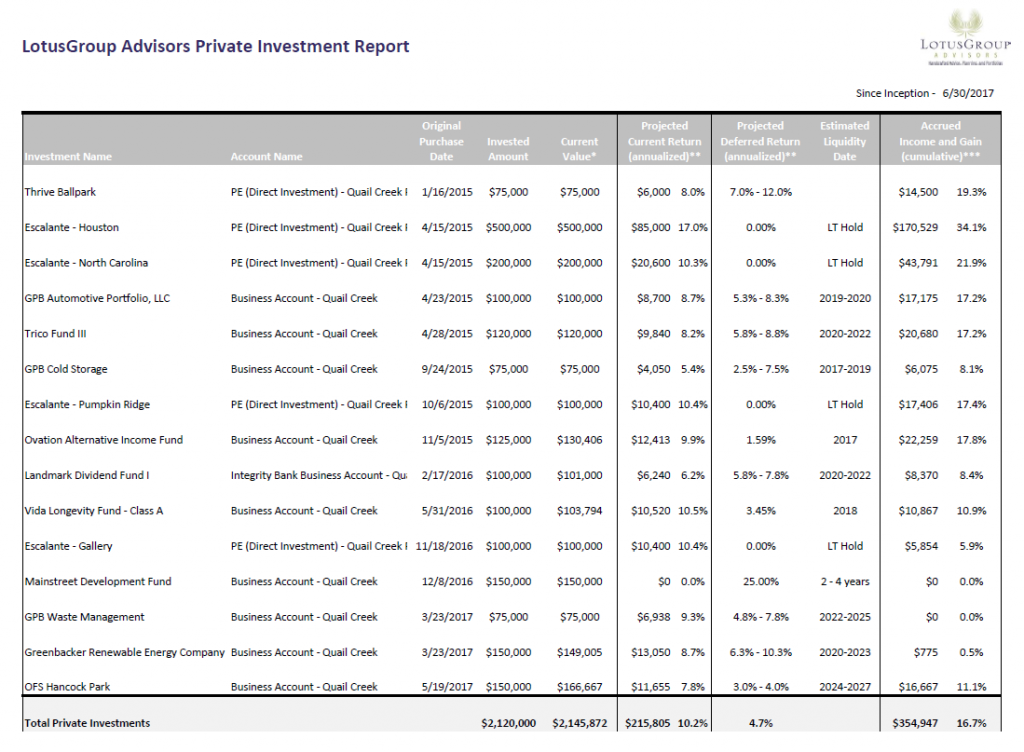

#2 – Private Investment Reporting

New and Improved LGA Private Investment Report

LGA clients have continued to express their happiness with our Private Investment Cash Flow Reports.

However, a number of families have indicated a desire to add projections for deferred returns, along with estimated exit dates.

With our new report, clients can now evaluate both the expected current year yield as well as their total return potential (metrics that are important to different types of clients).

In Chart V above, this example client can expect 10.2% of current year returns, along with an additional 4.7% estimated annualized return upon fund exit (totaling 14.9% per year of expected returns).

A big thank you goes out to all our clients for their feedback, our advising team for being their advocates, and our operations team for helping to develop and roll-out this enhancement.

Parting Shout-Out and “Thank You”

One final (and important) shout out.

Our beloved Operations Manager, Alissa McBain, will be moving from Denver to California to be near family as she raises her beautiful new boy Harrison alongside her husband Graham McBain.

Alissa has worked diligently to help document our entire operations processes.

She has also helped to recruit and train her replacement, Amanda Cohen, who we are excited to introduce to our clients.

Thank you very much Alissa for all your hard work, your diligence in product development, your accuracy and advocacy in taking care of our clients, and your playful quirkiness as a team member.

Your efforts have helped to tremendously advance our firm and clients in the past three years, and for that we will forever be in your debt.

Alissa – we wish you all the best in your new adventures!

Make. Life. Count.