Public Market Update

Global markets delivered positive returns during Q3 2017, with most asset classes rising in value.

These results were positive for public market investors who saw balances in their accounts rising.

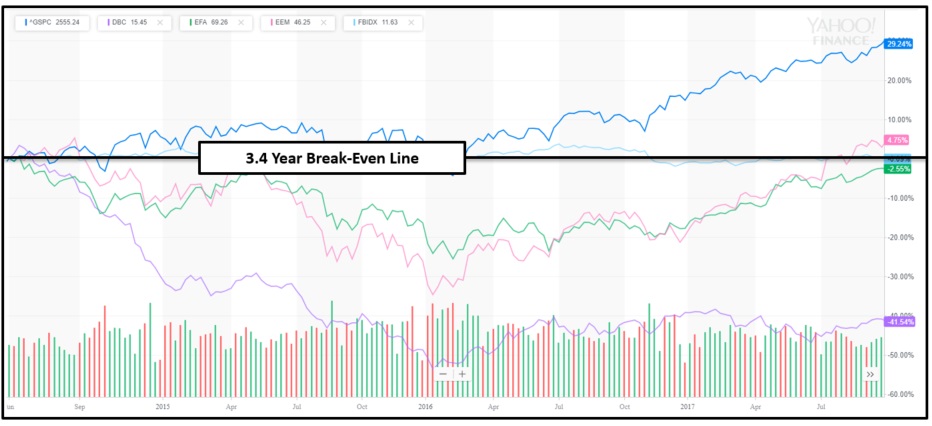

Over the medium term, however, global market have still been rather lackluster since we warned of overvaluations in May 2014.

With the exception of US markets, most asset classes have been flat to negative in the past three and a half years (see updated stats and Chart I below):

- US equities are up 29% (blue line)

- Emerging markets are up 4.8% (pink line)

- US fixed income is down 0.1% (light blue line)

- Foreign developed markets are still down 3% (green line)

- Commodities are still down an astounding 41% (purple line)

Chart I – Global Returns Since LGA Bearish Call in May 2014

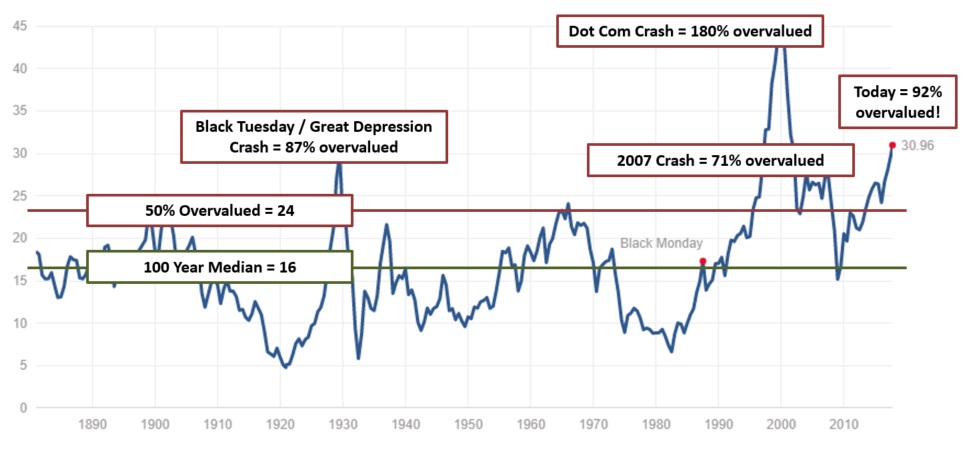

In the most positive performing sector (US equities), prices have significantly outpaced the rate of earnings growth, in a sign of increasing overvaluation.

The US has reached a new extreme, with current indicators suggesting a now 92% overvaluation (see chart II below).

Chart II – The Highly Accurate Shiller PE for the S&P 500 in the US (Now 92% Overvalued)

Expected returns going forward are flat to negative, with a likely major bear market in the forecast at some point in the near-term years ahead.

To illustrate, one of Warren Buffet’s favorite market indicators is now suggesting a negative 1.5% per year return over the next ten years.

Furthermore, US markets would require a 50%+ decline in order to simply get back to what has historically been “fair value.”

Outside of the US, valuations are a bit more reasonable, and we are starting to see higher performance in emerging markets, foreign equities, and commodities.

Of course, valuations cannot predict the exact timing of market declines, but they do inform investors of expected returns, which are unattractive today in the US.

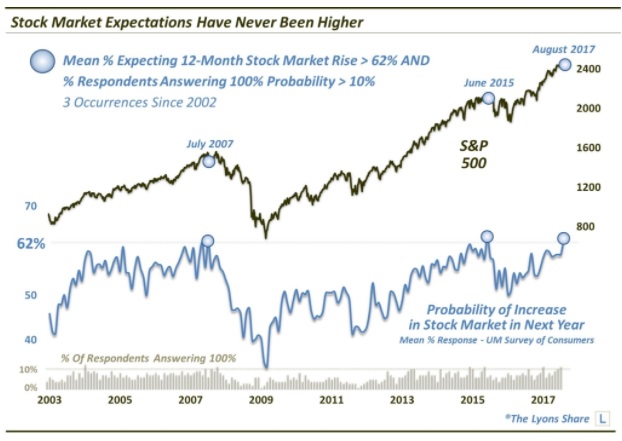

In terms of timing, investor sentiment typically provides the best (and yet still imperfect) insight into when the markets may begin to decline.

As such, we are sharing with you Chart III below which indicates we are currently at the same level as the last two major market pullbacks.

Chart III – Investor Sentiment At Levels of Two Most Recent Major Market Declines

Of course, markets can always push further to new highs, but investors should be cautious when combining highly exuberant and overvalued markets.

Full market cycles are always completed and the current US equity bull market is not a permanent “new normal” that will only keep rising.

Additionally, magazine covers espousing bull markets have many times marked previous bull market tops (e.g. see cover image to this blog from recent “The Economist” magazine).

Public Portfolio Updates

For tactical and global rotation portfolios, we have continued to overweight more reasonably-valued emerging markets such as China, Taiwan, and Singapore.

We have also been holding overweight positions in some select commodities.

Rounding out our equity holdings, we have been nibbling on foreign developed markets such as New Zealand, Australia, and select Europe.

All of these positions have delivered positive returns to portfolios, and have a greater margin of safety than US equities given the lower starting valuations.

We have also continued to hold income-producing REITs (real estate), and have recently parked some excess cash in very safe and short duration US treasury bonds.

We continue to produce a modestly positive return for the majority of portfolios, while remaining prepared for meaningful public market declines in the years ahead.

With respect to just how conservative we are positioned, the below discussion on beta quantifies that discussion:

Nerd Alert – Please read the next section at your own risk of glazed eyes and drowsiness ensuing

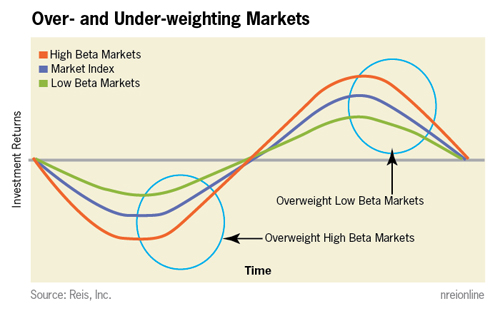

Last quarter, we briefly introduced investors to the concept of “Beta” in the “LGA Enhancements” section of our Q2 blog post.

As a reminder, beta modeling compares the relative performance of an investment to an index, and gauges how much it will go up or down relative to a corresponding move in that underlying index.

In US markets, an investment with a 1.5 beta means that for every 1% the US equity market rises, this particular investment would rise by 1.5%.

For a 0.75 beta, for every 1% rise in US equity markets, the investment would rise only 0.75%.

1.5 beta would be more volatile than the market, and 0.75 would be more damped relative to the market.

Regardless of how a portfolio is constructed (equities, fixed income, commodities, cash, etc), beta is used to gauge how exposed we are to markets for the aggregate set of holdings.

With that said, here is how LGA public portfolios are conservatively positioned today (range is for ultra-conservative through aggressive risk profiles):

- Index = 0.40 – 0.85 beta

- Global Rotation = 0.24 – 0.63 beta

- Tactical Active = 0.13 – 0.40 beta

- Emerging portfolios = 0.10 – 0.39 beta

- Tactical Absolute = 0 beta (fully market neutral)

From the above data, one can quantify the risk-off positioning for public portfolios, while awaiting a market adjustment downward.

In the interim, we will continue to invest client assets in the undervalued private markets (see below).

Private Market Update

We typically do a more detailed private market update mid-quarter, once all our GP partners have had a chance to close out their previous quarter’s numbers.

In the interim, we can emphatically state that all dividends continue to pay out as expected, and underlying strategies remain on track.

We continued to monitor our 14 GP relationships and now 483 individual client investment placements.

We also rolled out a newly-sourced opportunity in real estate preferred equity and mezzanine debt, which will begin funding in Q4.

Finally, we are looking forward to our first two exits in early 2018:

- GPB Cold Storage has signed terms to sell the cold storage business and is working on the final land sale

- Mainstreet Fund A is targeted to complete its first facility in November, have the pre-leased operator occupy immediately, and sell in Q1/2018

The private investment market continues to be a highly undervalued area for clients to allocate their savings, with valuations often 50% below similar public market assets.

We have much more in store for Q4 and beyond, as discussed below.

LGA Enhancements For Clients

As always, we work hard to not just deliver on solutions that our clients have come to enjoy, but also on ongoing enhancements.

Below are three areas we are working on:

Enhancement #1 (Complete) – Putting idle cash to work without increasing market risk

We most recently researched CDs, money markets, and short-duration bond ladders as a way to put a portion of idle cash to use in tactical portfolios.

After 2 months of study, we decided on a very short duration, no-cost fixed income ETF (ticker: SHY).

SHY is currently yielding 0.84% and has an incredibly low beta to the market (meaning extremely low risk).

As such, tactical clients who previously would see high cash positions in their portfolios will now see lower positions, along with a larger SHY holding to generate some yield.

This position is both conservative and highly liquid, meaning it will act very much like cash in an equity market downturn, and we would be able to access it quickly if needed to buy market lows.

We trust this will be an enhancement to client portfolios, generating an approximate $43K/year of cumulative additional return while tactical portfolios are conservatively positioned.

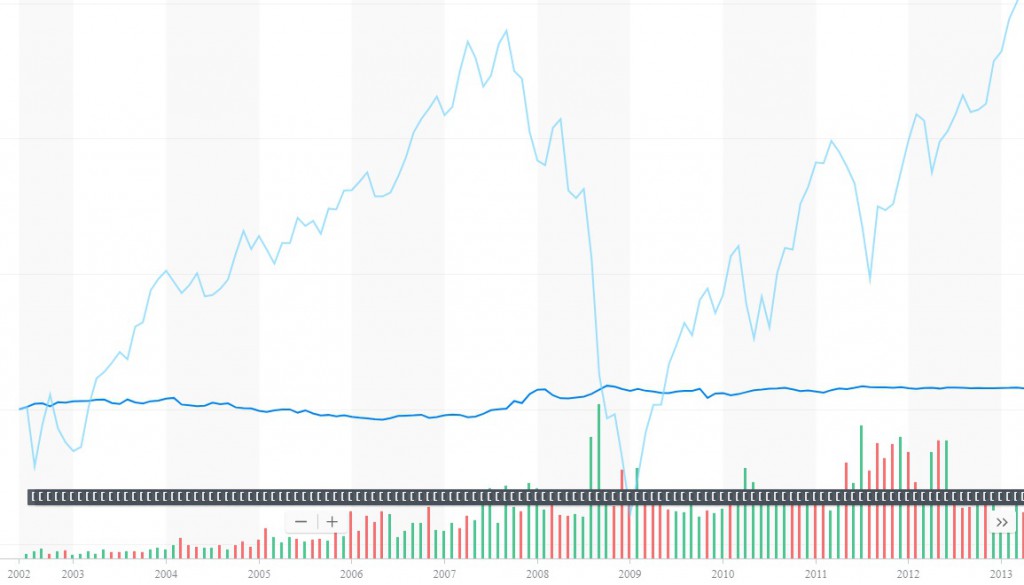

Chart IV – SHY share price (dark blue) was flat to positive during 2007-2009 major bear market decline (while delivering a modest yield)

Enhancement #2 (Q4) – Researching alternative assets for non-accredited clients

While our accredited clients have enjoyed the benefits of private investing, our non-accredited investors have not been able to.

Interestingly, a handful of private strategies have very recently been brought to public platforms for non-accredited clients to access.

We are researching some of these options to ensure they are secure, not overly costly, and can offer a strong upside without the downside when the bear market arrives.

A couple areas we are reviewing include Business Development Companies (BDCs) and Insurance-Linked Notes.

BDCs are private equity firms that have listed publicly, and can participate in the lower private market valuations.

Insurance-linked notes have low double-digit returns that are uncorrelated to stock markets (e.g. declines occur when there are more global catastrophes than premiums have planned for – which is not tied to the stock market or the economy, and is often a quite rare occurance).

We will keep you posted on the progress of our research, and hope to begin adding some of these assets in the coming quarters to help drive returns for non-accredited tactical clients.

Enhancement #3 (Q1/18) – Launch of our first Fund-of-Funds

We have been working very hard to lay the groundwork for the launch of LGA’s first ever private-label fund.

This fund will be directly run by LGA, rather than client assets being placed with a separate 3rd party fund manager.

Some of the expected benefits will include the following:

- Easier processing with Docusign vs paper

- Improved expected returns with greater scale and speed

- Reduced costs with fewer layers of fees

We will continue to focus on generating income for clients, choosing recession resilient investments, and keeping exit lengths reasonable.

This will not displace direct placements which we will continue, but it will be a new option for clients to enjoy.

Stay tuned !

The LGA Team