“We all get addicted to something that takes away the pain.” – Bella Aurora

Addiction is a complex condition that we see across all facets of life; many people have struggled with addiction or have seen it affect their friends, family, and coworkers. If you know someone who needs some professional help, Virginia Center for Addiction Medicine is ready to offer long-term engagement, integrated care that is focused on healing and recovery.

Addictions often begin as a subsidy / outlet for an individual’s pain, and can occur in many different forms.

Mainstream addictions include drug and alcohol abuse that make people start thinking of carefully treating addiction in Sacramento centres or somewhere else (Click on the following to find the closest drug addiction counseling center). But addiction comes in all shapes and sizes, including the avoidance of short-term financial pain. Coastline Behavioral Health in Los Angeles is ready to help you regain joy and chase life without addiction holding you back.

The US Federal Reserve (The Fed) As Our Financial Drug Dealer

The US Fed dramatically adopted the policies of famous economist John Keynes during the 1960’s-70’s, attempting to treat the “pain” of bear markets with market interventions (e.g. interest rate policy).

Prior to such attempts, most bear markets declined 20-30% on average, with a larger decline during the Great Depression as a low probability outlier event.

With monetary policy aimed at tightening in bull markets, and easing in bear markets, the well-intention-ed Fed began an attempt to create greater stability in financial markets.

So what was the outcome?

Interestingly, we have now had not just one statistically low probability 50% selloff, but instead two in the last two decades.

The 2000-2002 and 2007-2009 bear markets were both far in excess of the 20-30% range that was supposed to be healed with Fed policy.

Instead of healing, the meddling Fed created larger bubbles with its low interest rate policies, and larger subsequent bear markets when they burst.

Having one low probability event might be happenstance.

Having two in a row is not a simple coincidence, but rather an indictment of these so-called volatility-reducing policies.

The Fed appears to have produced the opposite of their intended effect, having inciting larger swings than statistical probabilities would predict.

Introducing Quantitative Easing

Financial markets and the economy were in the doldrums in 2007-2009, when the bear market corrected previous excesses from the Fed-induced bubble.

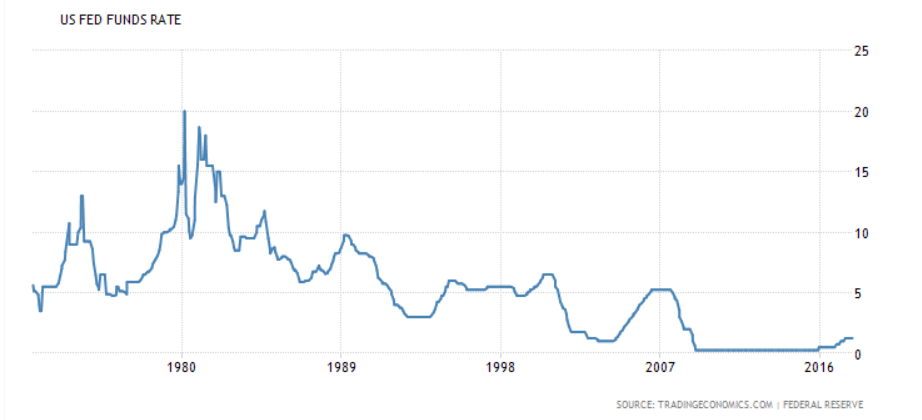

In response, the Fed tried again to lower interest rates, this time taking them all the way down to 0% in the short term.

When this failed to resuscitate the patient, there was finally an opportunity to “come clean,” and to let the system clean itself out.

Rather than self-reflecting on past failures and changing course, the Fed doubled down with a new policy, a new and more potent financial drug to perhaps ease the short-term pain once again.

If the interest rate drug wouldn’t work, why not try another one, instead of getting sober.

And so the policy of Quantitative Easing (QE) was born.

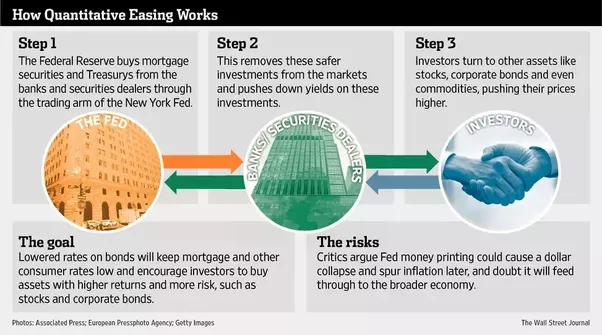

- Q: What is QE?

- A: QE is a country’s central bank purchasing or selling market securities in order to influence interest rates and the money supply.

So the Fed moved beyond short-term interest rate manipulation, and turned to QE to also lower the long-term interest rate.

This reduction in long-term interest rates made it less expensive to borrow money (e.g. lower home loans, lower debt costs for corporations, etc).

It also became quite unattractive to invest in safe and secure areas because the rates were so low (e.g. savings accounts, CDs, and bonds yielded close to 0%).

So money moved out of safe and secure assets, and more debt was taken on, with all these dollars invested in riskier assets (stocks, housing, etc).

The below chart, illustrates the QE cycle:

Chart I – How Does Quantitative Easing Work?

Cause and Effect Outcomes

Fast forward to today.

As the Fed has attempted to “treat the pain,” there have been effects both on the financial markets and to investors.

Nine years of QE has made it extremely difficult to find yield.

Short-term interest rates remain near historic lows, so there is very little return from cash in bank accounts and CDs (Please see below: Chart II)

Chart II – Federal Funds Rate: 1970 – Present

Additionally, extremely low long-term interest rates have left conservative clients with very low yield options in fixed income investments.

As such, money has been moved into stocks, real estate, and higher yielding junk bonds (even among more traditionally conservative investors).

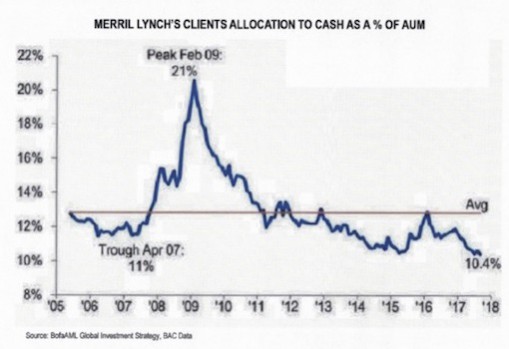

This flight out of cash is illustrated in Chart III below from Merrill Lynch:

Chart III – Merrill Lynch Client Cash Allocation

While Chart III shows the low levels of current cash with clients, it is also interesting to see how clients have done the exact opposite of what they should be doing as investors.

Notice how they significantly increased cash positions right after the 2007-2009 selloff, peaking only 1 month before the very attractive low valuation market bottom in March 2009.

Conversely, they have recently been moving out of cash and buying into risky investments, as markets appear to be once again in a bubble scenario.

The good old fashion sell low and buy high, the opposite of good investment principles.

This same pattern can be seen with businesses today not only draining cash reserves, but also raising additional cheap debt to buy back their stock at extremely high valuation levels.

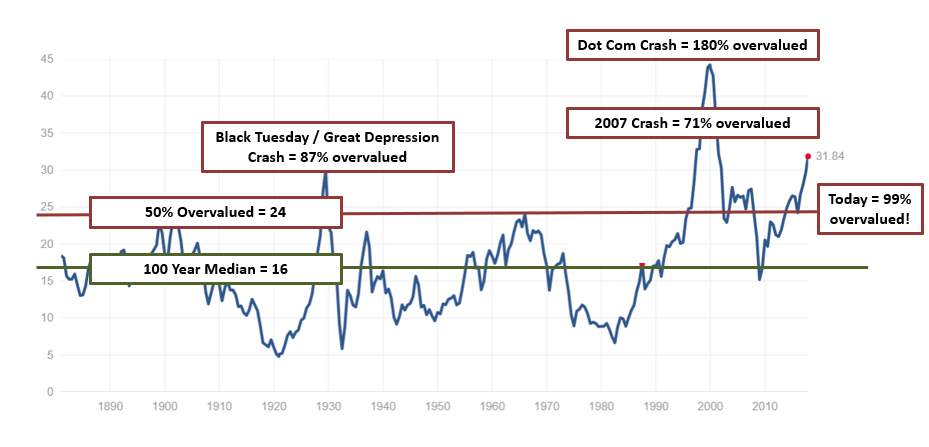

All told, The Fed has once again succeeded in creating a bubble of massive proportions (see our updated Shiller PE Chart IV below)

Chart IV – The Highly Accurate Shiller PE for the S&P 500 in the US ( Now 99% Overvalued)

Investors are once again struggling with the Fear of Missing Out syndrome (“FOMO”) on the current bull market.

The current buy-side argument is “stocks are cheaper than bonds,” so one should be buying stocks.

This relative argument, while possibly correct, doesn’t indicate that stocks are a good absolute purchase.

For example, Warren Buffet’s favorite metric (market-cap-to-GDP) forecasts that US stocks should deliver -1.4% per year of return over the next decade.

Does it make sense to invest money in a -1.4% per year expected return, only because you think that return will be higher than what will happen in bonds, where the return could be even more negative?

This relative pricing argument is absurd.

Perhaps the best course of action is to not play ball at all, or to look elsewhere for better possibilities.

The Great QE Unwind – What Happens When The Pain Shows Back Up Again?

The first step on the road to recovery is recognition of the problem.

In September, the Fed announced their QE unwinding schedule, beginning with $10B per month and ramping to $50B per month in a year’s time.

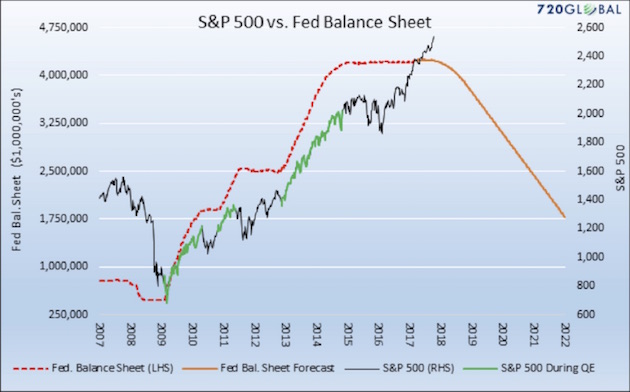

Chart V comes from Michael Lebowitz of 720 Global.

This chart overlays the S&P 500 with the Fed’s balance sheet, and then includes the forecast of where the Fed intends to go.

Chart V- S&P 500 vs. Changes in the Fed’s Balance Sheet

The Fed’s balance sheet grew with three rounds of QE, and the S&P followed higher each time.

As discussed previously, the Fed essentially pushed investors into risk assets.

Conversely, the S&P dipped downwards each time QE was paused (horizontal red line).

We are now at a place where the Fed is hoping that the patient is healthy, and they will attempt to begin reducing the medication.

Any sort of unwinding will lead to higher long-term interest rates, meaning headwinds for consumers and for businesses.

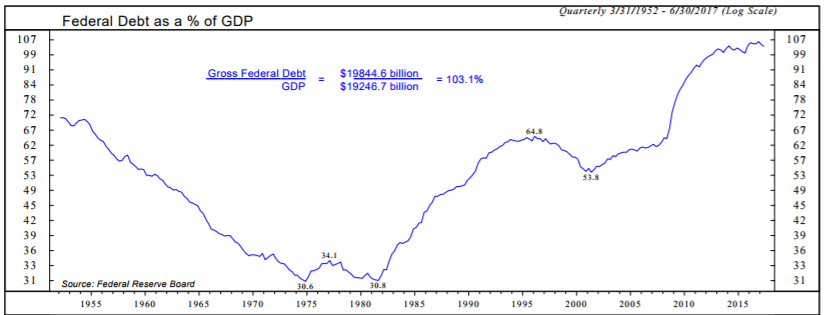

Furthermore, US government debt is currently at a dangerous 103.1% public debt-to-GDP ratio (see Chart VI below).

Chart VI – US Debt as a % of GDP

With so much public debt on the books, any rise in interest rates would be very restrictive to the government in terms of higher interest payments.

If you think our politicians are struggling with budgets today, wait till the drugs are removed and interest rates are higher.

The outcome will be like a patient relapsing.

Either the market will come clean with a 50% price reduction, or

The Fed will blink and start hitting the QE button again.

One has to believe that it is an absolute remote possibility that the Fed will grow a backbone and admit to their mistakes.

Scarier still, it’s quite possible that the QE button may not work the next time it is pressed.

Whatever the outcome, we are not dealing with a healthy patient, nor a responsible doctor.

So What’s Next?

As we move into the new year, we hope to see the Fed take steps to overcome their “addiction.”

However, the U.S economy is on extremely thin ice, and it will be difficult for them to let it clean out as needed.

With US public markets at severe overvaluation levels, it is not out of the question to expect a 50%+ decline over the upcoming years..

It also is possible to have a last blow-off topping process in stock markets, sucking the last few into the bull market peak (corporate tax cuts could be the catalyst).

For tactical investors, we continue to preach and implement a conservative position.

For more fully invested portfolios, one should expect volatility and have the ability to dollar-cost average / re-balance through a bear market.

Finally, we will continue to allocate into recession-resilient private investments to generate consistent returns for our accredited clients.

Strap on your seat belts ladies and gentlemen – it should be interesting!

Happy Holidays,

The LGA Investment Team