Public Market Update

2017 will go down as a remarkable year for high-risk investors.

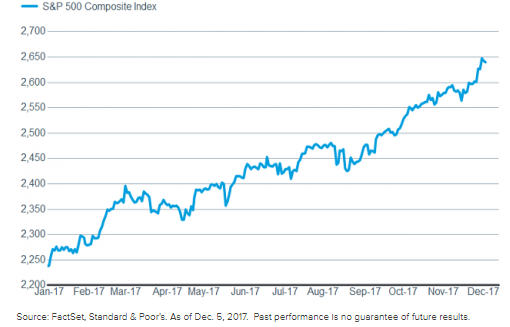

Few foresaw the S&P 500 posting gains of almost 20% (Chart I below)…

Chart I – 2017 S&P 500 Returns

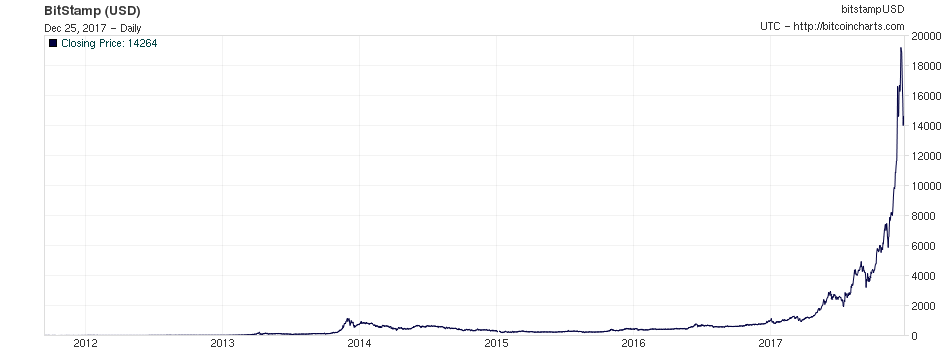

…and fewer still predicted the fantastic gains possible in bitcoin investing (see Chart II below):

Chart II – Bitcoin Futures through End 2017

We all have some relative or friend who claims to have smartly predicted and invested early in these areas, which can trigger personal “FOMO” (Fear of Missing Out).

While it is fun to talk about from an entertainment perspective, the reality is few have actually achieved such concentrated results and kept them.

Similar to previous bubbles (Dot Com, The Gold Rush, etc), there are many people who are jumping on the bandwagon while setting themselves up for disaster.

In Bitcoin, for example, CNBC recently reported that nearly one third of purchases were being made from credit card borrowings. Online Bitcoin trading has become a popular means of earning extra profit. Check out bitcoinrevival.net to read a review of an automated trading platform for cryptocurrencies.

For those that did so near the top (around $18,500), the current drop into the $13,000s will prove very painful given they not only have a loss, but they have a loss on money they have to pay back at a high credit card interest rate.

When layered on top of previous bubbles in history, bitcoin demonstrates an even larger bubble pricing characteristic than the biggest in history (the Dutch Tulip Bubble in 1636-1637).

The equity markets are a bit less frothy, but high valuation equity purchases, and using margin debt, are also at historical highs, a precursor to leveraged distress ahead when the bear eventually arrives.

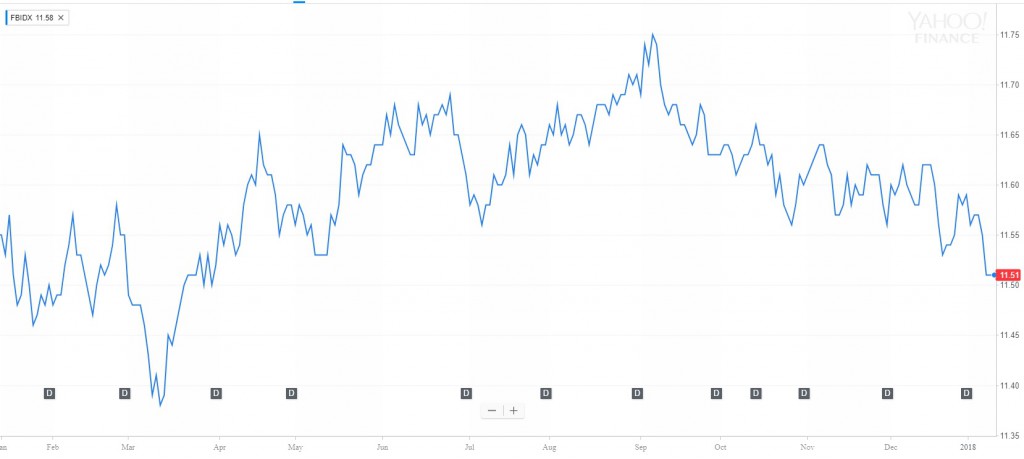

For a more conservative investor, US fixed income continued to disappoint.

We have repeatedly preached that the standard 4% expected fixed income return would not be achievable, and that financial planners and firms who have pitched this to investors would be severely missing the mark.

For five years now, fixed income returns have been flat to negative, with the most recent flat year illustrated in Chart III below:

Chart III – US Fixed Income Blend for Year 2017 (Flat to Slightly Negative Return)

For conservative and traditional investors, this has been frustrating.

In some cases, this has pushed more investors into equity markets, chasing returns.

We continue to disagree with this move, chasing after returns while significantly increasing risk profiles, and setting oneself up for potentially devastating declines ahead.

Our view is that it has been far more intelligent to move into private investment assets, where valuations can be nearly 50% cheaper than in public markets today (in both equities and fixed income).

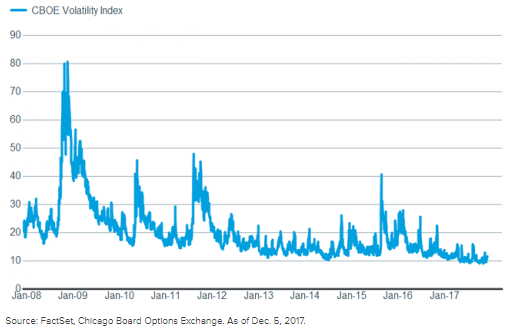

Regardless of which markets one tracks, it was clear that volatility was incredibly subdued in 2017, despite geopolitical tensions, waves of natural disasters, political turmoil in Washington, and a tighter monetary policy.

Market pullbacks were all small and very short-lived (Chart II below for how low volatility has become).

Chart IV – CBOE Volatility Index 2008-2017

In fact, we have experienced the longest period in S&P 500 history without a 3%+ correction, with no move of that size since November 4, 2016

While we cannot predict the timing of when this will change, low volatility is often the calm before the storm.

All bull markets expire, and they tend to do so when everything feels great, and when volatility is low (a lack of fear in the markets).

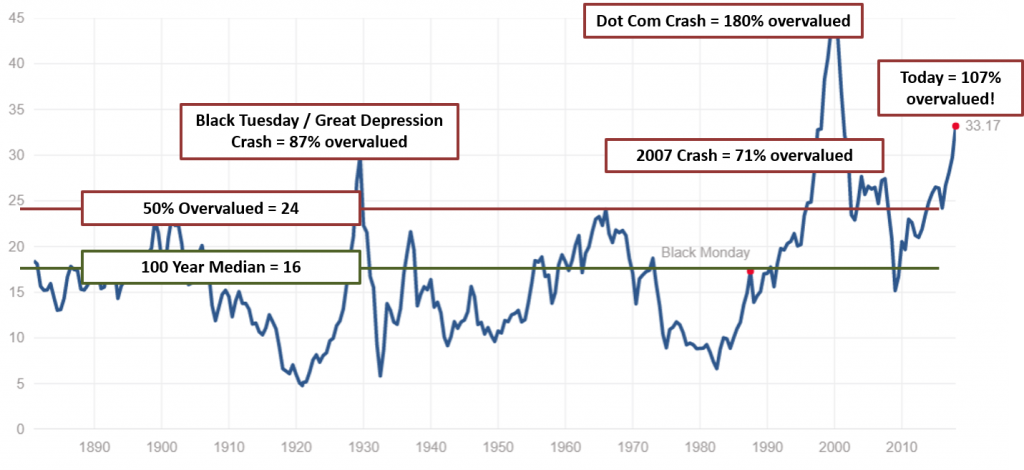

From a valuation perspective, this further euphoric surge in equity prices far outpaced gains in earnings, and has taken an already highly overvalued market to even more obscene levels.

In the US equity markets alone, current indicators are now suggesting a 107% overvaluation (see chart III below).

To further quantify, Warren Buffet’s favored Market Cap-to-GDP indicator suggests a -2.2% per year return over the coming decade!

Chart IV- The Shiller PE Ratio for S&P 500 – Highly Predictive Of Next 10 Year Returns

The above notwithstanding, there are a few important events upcoming as we head into 2018, including: tax reform, continued investment into our nation’s infrastructure, and Federal Reserve Bank policy.

While tax reform has now passed, its overall impact to the greater US economy is still within question.

In the near term, corporate earnings will be boosted, and it appears that some of these spoils will be shared with the working class (bonuses, increases in minimum wages, etc).

However, it is questionable as to whether the longer term impacts will be positive or whether they will create larger deficits that further stifle growth.

Investors are also optimistic about a potential infrastructure package, albeit this may fall through the cracks as midterm elections heat up during Q1/18 and as the reality sets in that US government debt is already insanely high.

Finally, we have the Fed unwinding its balance sheet which creates an increasing drag on financial markets (refer our recent blog post: The Great Stimulus Drug Unwind).

Newly incoming Fed Chairman Jerome Powell has continued to preach continuity and transparency; however, if inflation begins to rise, or economic growth slows, some lofty challenges may be presented to the new regime.

New headwinds will appear for equity markets, and rising rates will continue to harm bond market prices, given their inverse relationship.

Public Portfolio Updates

While we have been cautious in the US, we continue to see value in select areas outside of the US.

We have seen value in Emerging Markets and Commodities, which both became inexpensive in 2015-2016, and were subsequently added to all portfolios outside of index models which are static.

In the emerging market’s asset class, for our tactical and global rotation portfolios, we are overweight China, Taiwan, and Singapore.

During Q4, we also added exposure to Oil and Natural Gas.

Finally, we added some exposure to Foreign equity markets, allocating smaller positions to the EU, Germany, and Asia Pacific.

Our strategies have continued to produce consistently positive returns, while including market hedges and lower risk profiles.

We continue to participate, while preparing clients for a public bear market ahead.

* Specific note: We finalized a 6-month due diligence cycle and added exposure to a semi-liquid offering in Insurance-Linked Securities for all investors (accredited and non-accredited alike – read more below in Enhancements section).

Private Market Update

As mentioned above, we qualified accredited clients continue to generate their returns and income from select, recession-resilient private investments.

During Q4 2017, clients committed $9.1 million of new investments, including allocations to two exciting new offerings.

- JCR Capital Fund IV

- Pravati Litigation Fund III

JCR will begin to draw capital in January 2018, investing with 10-40% “capital stack protection” in 20+ real estate projects.

Pravati has already begun drawing capital, and is targeting one of the higher return profiles that we have sourced for clients.

Focused on financial litigation proceedings with law firms, the excess returns come from a limited supply of traditional capital to this space from the big banks.

Finally, investors Mainstreet sold their first completed facility, and clients received their first capital return + pref payout in December.

LGA Enhancements For Clients

As always, we work very hard to deliver current services while developing and launching continuous improvements.

Below are two areas we have been working on and have now launched:

Enhancement #1 (Complete) – Alternative Assets for Smaller Non-Accredited Clients

We spent the last six months of 2017 researching alternative assets for our non-accredited clients to enjoy.

The two that were most attractive included Business Development Companies (BDCs) and Insurance-Linked Notes.

- BDCs are private equity firms that have listed publicly, and can participate in the lower private market valuations while not being an accredited client.

- Insurance-linked notes from Frontlight Insurance Services have attractive returns that are uncorrelated to stock markets (e.g. declines occur when global catastrophes outweigh premiums paid which is a rare occurrence, and not tied to the stock market or the economy).

Ultimately, we decided made an investment in the Insurance-Linked Notes (ILS) space based on a couple of factors (specifically, Pioneer’s ILS Interval Fund – XILSX).

First, the ILS space coincides with our overall investment theory of adding uncorrelated asset-backed securities to our portfolios.

Second, 2017 was a rare occurrence when catastrophes outweighed premiums, offering us an opportunity to buy XILSX at a significant discount.

When this has happened in the past, there has typically been a rapid rebound thereafter given insurers ability to increase premiums charged.

Enhancement #2 – LGA Fund-of-Funds

After months of hard work and preparation, we are excited to officially announce that we will be launching our fund-of-funds program.

We will run these funds directly, rather than client assets being placed with a separate 3rd party fund manager.

Some of the expected benefits will include the following:

- Easier processing with Docusign vs paper

- A single purchase to create wide-spread diversification

- Negotiated discounts with underlying investment managers

We will be offering funds to existing LGA clients and may consider wider distribution to other RIA and family office investors.

We wish you an innovative, fruitful, and successful 2018!

The LGA Team