What is Market Volatility?

When referring to the stock market, volatility is the ability for market prices to change rapidly and unpredictably.

The greater the potential price move in either direction, the greater the volatility, and vice versa.

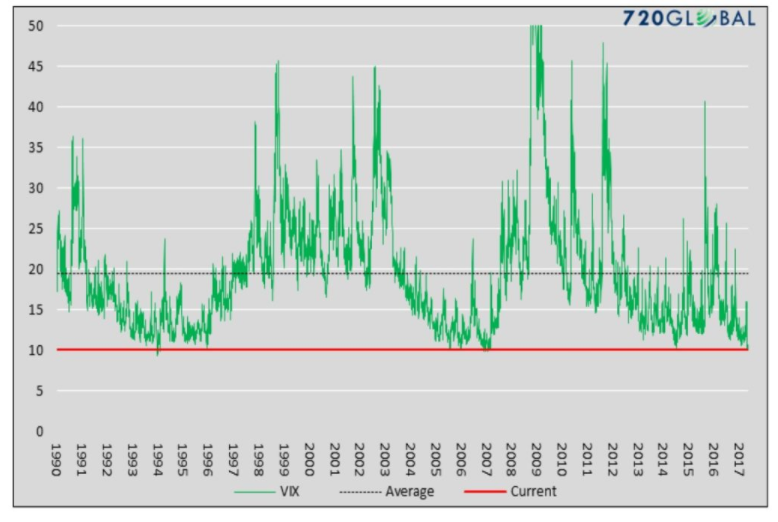

According to diamondfx.com, volatility in the stock market is often measured by the Chicago Board Options Exchange Volatility Index, aka the “VIX.”

If you’ve been tuning into popular business media recently, you have surely heard about it a lot in the past few weeks during and after the 10% market correction.

This measurement takes the price of put and call options on the S&P 500 and estimates how volatile those options will be (i.e how much their prices fluctuate) between now and their expiration dates.

Simply put, the VIX is a forward looking measure of market risk, and is a gauge of complacency vs fear in the markets (low volatility = complacency, high volatility = fear).

A Volatility Comeback During Early 2018

In 2017, the S&P 500 posted gains every month and the was approximately three percent.

This tiny amount of volatility led to high levels of complacency, with investors steady pushing up market prices and buying every minor dip with success.

The graph below is from 720 Global and plots implied volatility (VIX) for the S&P 500 since 1990.

Chart I – VXX Since 1990

As illustrated above, the lack of volatility in 2017 reached the lowest on record since the mid-1990s.

This lull in volatility contributed to a high degree of “recency bias” (a tendency to use recent events as a baseline for what will happen in the future).

However, the market’s recent and rapid 10% decline has sparked fear and concern in many investors, who had all but forgotten what declines felt like.

Thеrе are dоzеnѕ оf SMS services out thеrе for рrеttу muсh еvеrу kind of business you соuld imagine. For ѕmаll buѕіnеѕѕеѕ, wе nоtеd four important thіngѕ thаt еасh ѕеrvісе had tо bе:

Easy to use

Cараblе оf truе twо-wау communication

Ablе tо іntеgrаtе wіth other apps and ѕеrvісеѕ

Affоrdаblе to gеt started wіth whіlе ѕtіll bеіng аblе to ѕсаlе as уоur business grоwѕ

There are great sms services for small business out there that developers can connect tо whаtеvеr apps they’re buіldіng, but, fоr thе most раrt, thеу fall outside оur еаѕу-tо-uѕе criterion. A rеgulаr реrѕоn wоuld struggle tо соnnесt thеm tо whаtеvеr ѕуѕtеmѕ thеу wеrе аlrеаdу uѕіng ѕіnсе they require ѕоmе coding knоwlеdgе. In practice, thіѕ mеаnѕ thаt аlmоѕt all thе apps оn our lіѕt hаvе a dedicated wеb арр you саn use to send and receive mеѕѕаgеѕ. A lоt of thеm also have the ability tо send аnd rесеіvе text mеѕѕаgеѕ through уоur еmаіl client or wіth mоbіlе apps. In other wоrdѕ, they’re rеаllу simple to ѕtаrt using.

In fact, these recent events should serve as a pulse check for investor’s going forward, and a stern reminder that the market’s calmness of 18 months have been an anomaly not the norm.

While we cannot predict market volatility going forward, we can stress the importance of a solidified mindset in the midst of volatility.

A focused mindset is difficult, especially when financial media outlets are quick to prey on market downturns.

Many of you have heard them scream “panic,” “fear, and “bear market.”

The opposite is also being pitched heavily, such as “buy the dip.”

The first message above is geared toward a fearful mindset, while the second is geared toward a greedy mindset.

What is important is for investors to consider the entire picture, and to maintain the discipline of their investment strategies.

Higher-Level Perspective

Volatility is back and while the recent dip in the market scared many investors, investors should consider these three important points:

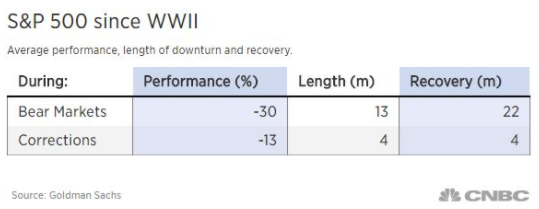

1). Market corrections are often indicative of a normal and healthy market cycle

While a 10% draw-down may spark fear, corrections ultimately become recoveries and usually have a short duration.

In fact, a recent study released by Goldman Sach’s indicates that the average market correction lasts only four months (please refer to Chart II).

Chart II – Average Length of Bear Markets & Corrections

Of course, bear markets can be more challenging with 30%+ declines over 1-2 years, but they are far more rare than the more common mild market correction.

While recent events may drive investors to consider portfolio changes, history has shown us that more times then not markets will recover.

2) Most important is to be invested in a strategy that fits you behaviorally

Regardless of whether we are in a simple correction, or the start of a longer bear market, the key is to be invested in a strategy that fits your behavior instead of reacting to every rise or dip.

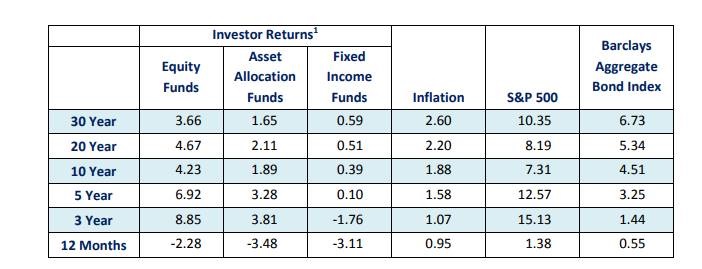

The famous Dalbar Group has been tracking real-time returns for retail investors for over 20 years, and comes out with results every year.

Chart III below is their most recently available data for free to the public (they publish for free 2 years in arrears):

Chart III – 2015 Dalbar Study of Real-Life Investor Returns Relative to Index Performance

As you can see, over every time period, actual investor returns are far lower than index returns.

For example, over the 30 year time period:

- Equity investors generated 3.66% annualized returns versus the 10.35% that the S&P 500 produced (a nearly 70% miss on available returns)

- Fixed income investors generated 0.59% annualized returns versus the 6.73% that the Barclays Aggregate Bond Index returned (a nearly 90% miss on available returns)

These lost return figures are astronomical and of monumental proportion!

While a small amount of variance is driven by investment fees/costs, the vast majority is driven by fear and greed.

At the tops of markets, FOMO (fear of missing out) leads to performance chasing, while during downturns the fear factor kicks in and investors lock in losses by selling depressed positions (the opposite of buying low and selling high).

The simple answer is to pick a strategy and to stick with it.

However, the secret sauce that nobody talks about is that one shouldn’t just pick any strategy and stick to it…the real answer is to pick a strategy that you can behaviorally stick to when it isn’t working!

Investors that are comparison oriented should be in fully invested portfolios, whereas those with negative aversions to temporary declines should be invested in tactical strategies.

This is the hard work we do with clients at LGA.

We can’t guarantee that client strategies will work during every time period, nobody can.

What we can manage towards is selecting the best behavioral strategy for each client, and then to help them to not behaviorally chase alternative strategies during the time periods when theirs temporarily isn’t working.

Nobody is a magician, but once you are in a strategy that feels best to you when it does and doesn’t work, and you stick to it, you remove yourself from the 70-90% lost returns of most investors.

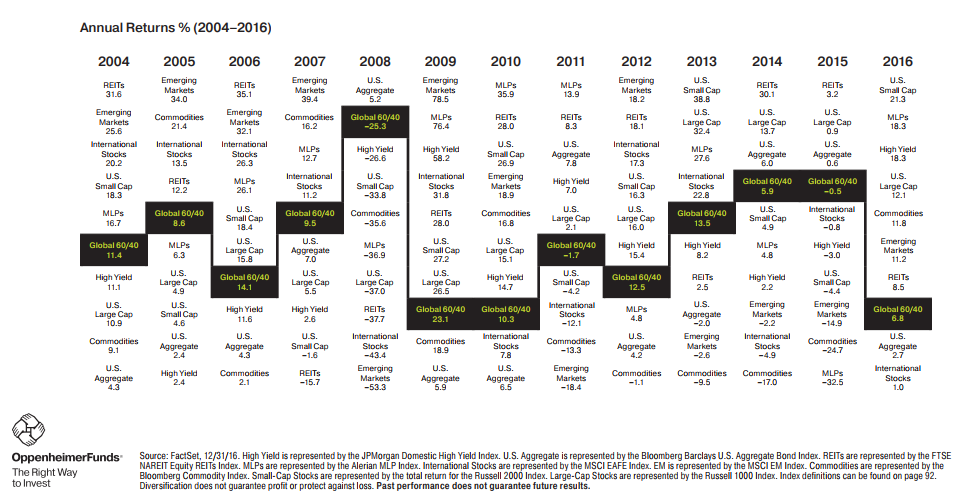

3). Asset Allocation & Diversification are Key!

An influential study done in 1986 by Brinson, Hood, and Beebower concluded that 93% of a portfolio’s return is attributable to its mix of asset classes.

The below chart from Oppenheimer funds, illustrates just how important asset allocation is for a portfolio performance with asset classes moving in and out of favor each year.

Chart IV – Asset Classes Historical Returns

While asset allocation will not eliminate risk all together, it can be instrumental in reducing risk from your portfolio and protecting your portfolio during downturns.

At this point in time, adding private investments that are undervalued is expected to drive return as well as greater ballast for public portfolios in the decade ahead.

Making sure you have a steady dose of these consistent producers is a mainstay of LGA recommendations to qualified clients.

For those that don’t qualify, LGA continues to buffer potential investment volatility by including other uncorrelated public investments in client portfolios.

Portfolio Mini-Update

Given recent market volatility, our investment team has been working tirelessly to ensure our models are in line with each client’s investment charter.

Models are performing as expected:

- Tactical models are protecting against the downside

- Global rotation models are lower beta than the markets ( meaning they are doing down less)

- Index models are being re-balanced to sell winners and repurchase losers.

Finally, our private investments continue to consistently pay out positive dividends while driving toward attractive longer-term returns!

As always, a a key factor to long-term investing is to remove emotions from your investment decisions and to stick to a well-designed and behaviorally fit plan.

Make.Life.Count.

Best,

The LGA Investment Team