Public Market Update

After nothing but bullish outlooks in 2017, 2018 has gotten off to a far choppier start, with global equity markets correcting 10%+ off of recent highs.

Big U.S. tax cuts, synchronized global growth, and strong earnings look to face increasingly strong headwinds from the Fed’s rate hikes, rising inflation, and protectionist threats to global trade.

While the cycle tailwinds remain stronger than the headwinds, we continue to preach caution as volatility begins to pick up.

Volatile Start to 2018

The S&P 500 got off to a fast start this year with a 5.6% rise in January, which was the largest first month gain since 1997.

However, this was quickly followed by a rapid decline, coupled with the largest ever one-day spike (116%) in the CBOE Volatility Index (VIX).

This volatility spike sent shock-waves through a broader part of the investment community that had been short the VIX (one of the more popular complacency trades of the previous 2-3 years).

In fact, many ETFs that had successfully shorted the VIX for years blew up overnight and were shut down completely (Chart I below).

Chart I – Performance of Inverse VIX ETF (XIV)

While strong Q4 corporate earnings and large Trump fiscal stimulus provided the initial runway in 2018, this was undone in February when January’s payroll data triggered an inflation scare.

Thereafter, investors experienced their first 10% market correction since 2016 (See Chart II).

Chart II – S&P 500’s 2018 Performance (6.5% Gain, 10% Decline, Then Small Normalization)

Additionally, the U.S. 10-year Treasury yield rose 50 basis points to 2.90% – the highest since late 2013!

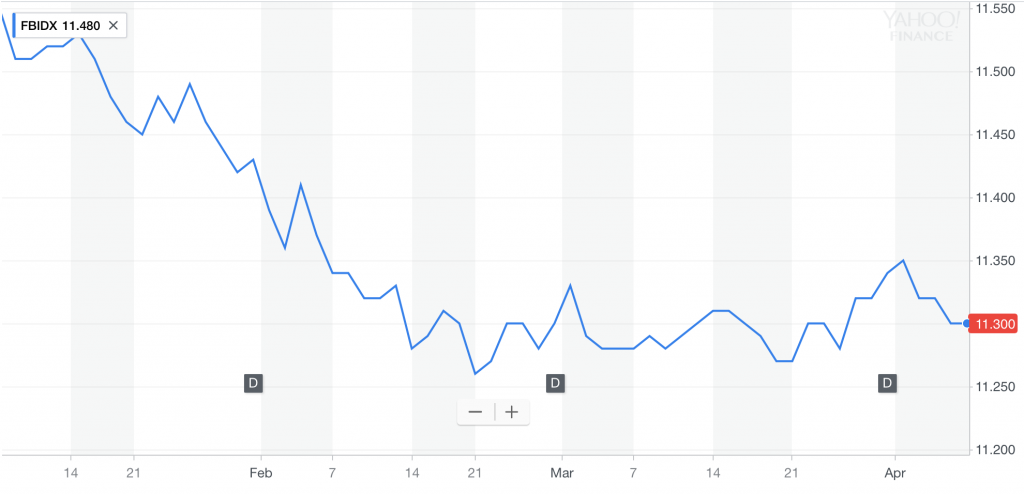

This did not bode well for traditional index investors in conservative portfolios, as rising interest rates further dampened an already stifled fixed income market. (See Chart III below)

Chart III – US Fixed Income Blend for the Year 2018 (Down 2.5% YTD)

What does this mean for the rest of 2018?

We expect that the below factors will continue to contribute to higher volatility in 2018 versus previous years:

- On the positive side, we expect earnings to come in strong given the effects of tax cuts (these earnings will be heavily used by companies to buy back stock and support the stock market)

- On the negative side, central banks around the world are becoming more hawkish, with the U.S. Fed set to potentially hike 4 more times this year and the ECB looking to wind down their QE program

- Additionally, inflation concern in the U.S. labor markets and protectionist rhetoric from Washington are keeping markets on edge

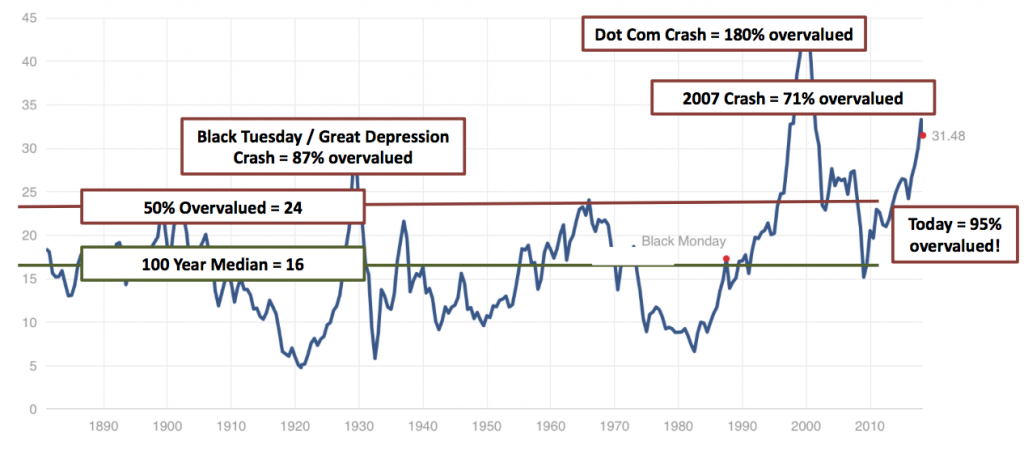

Finally, US markets still remain significantly overvalued after only a minor 10% correction from highs (See Chart IV below).

Chart IV – The Shiller PE Ratio for S&P 500 – Highly Predictive of Next 10 Year Returns

Investors should be wary of such valuations and be careful chasing equity and fixed income returns in this market environment, or being convinced to “buy the dip”.

We continue to believe that it is more intelligent to allocate assets to select private investments, where valuations can be priced at nearly 50% discounts to public market’s equity and fixed income instruments.

Public Portfolio Update

While the US remains overvalued, we continue to see value in select areas outside the US.

Emerging markets have continued to show value; thus, we are overweight this asset class in all portfolios outside of index strategies where allocations are fixed.

Specifically, in our Global Rotation and Tactical portfolios, we still remain convicted of the value in Taiwan and Singapore.

Additional allocation shifts include a shift out of Germany and into Asia-Pacific for our Global Rotation portfolios.

For Global Rotation portfolios, we used the dip in early February as an opportunity to re-balance portfolios (essentially buying more into positions that declined and selling excess positions that had risen).

Of particular note were our Tactical strategies which performed exceedingly well during the volatility, not only blunting declines, but in fact delivering a net positive return to clients for the quarter (despite a decline in market benchmarks).

This outperformance was driven by asset allocation, beta management, and our volatility trading model which spiked to the upside on the quick dip down in markets.

Private Investments Update

Per usual, our more detailed private investment update comes out mid-quarter, with the next one arriving in your inbox late May.

In the interim, the below is a quick update on recent progress.

We successfully launched our fund-of-funds program in Q1 this year.

We also recently hired Jon Bui as Director of Business Development and Investor Relations to help grow the program outside of LGA clientele.

You will see his bright smiley face and bio on the website shortly.

Jon will allow the remainder of our team to maintain focus on client service and investment sourcing/management.

As our various private investments mature, more and more will require ongoing hands on deck from our team to help with successful exits, re-deployments, or issue resolutions.

LGA Enhancements for Clients

Enhancement #1 (Complete) – Hired New Client Service Specialist

We are excited to announce the addition of our new Client Relations Associate, Lindsey Warhurst.

Lindsey comes from Farmer’s Insurance Company and brings years of Client Service Experience, look at this site and find a reliable insurer.

Lindsey’s addition will help us to continue delivering precise and responsive service to our growing clientele.

Welcome, Lindsey!

Enhancement #2 (Complete) – Hired Director of Business Development & Investor Relations

As mentioned earlier, we are also excited to announce our new Director of Business Development & Investor Relations, Jon Bui.

Jon has extensive experience as a wholesaler both internally and externally, with his most recent experience being at one of the largest ETF providers in the world, SPDR.

Welcome, Jon!

We are excited about the way 2018 has kicked off, and look forward to continued success!

Best,

The LGA Investment Team