Public Market Update:

The abrupt arrival of chilly weather here in Denver is a reminder that fall is ending and winter is upon us.

Looking back over the past three months, US GDP growth exceeded expectations with tax cuts spurring increased economic activity.

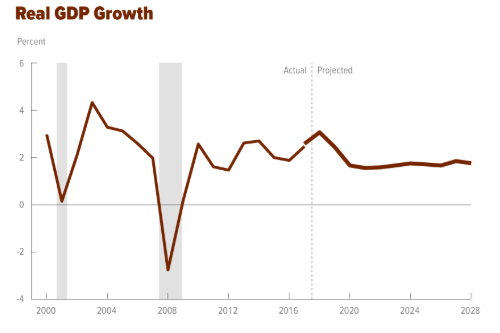

Looking forward, the picture of US GDP is a bit less clear (see Chart I below).

Additionally, global GDP expectations have been reduced by the IMF from 3.9% to 3.7% due to tariffs and geopolitical tensions.

Chart I – US GDP Growth Rate Projection (Source: Congressional Budget Office)

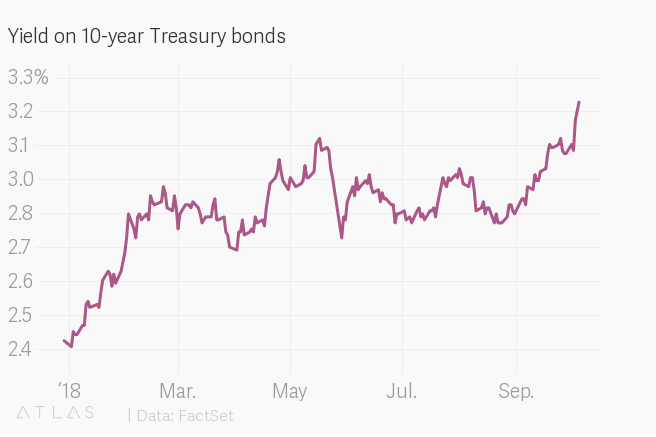

Recently, interest rates have begun to rise more rapidly, negatively impacting asset classes that are sensitive to this trend: real estate, emerging markets equities, and fixed income.

Specifically in the US, fixed income continued its downtrend during Q3, while US equities were resilient and continued to climb higher.

Despite the positive price action, we still estimate US equities are significantly overvalued and will eventually decline as well*.

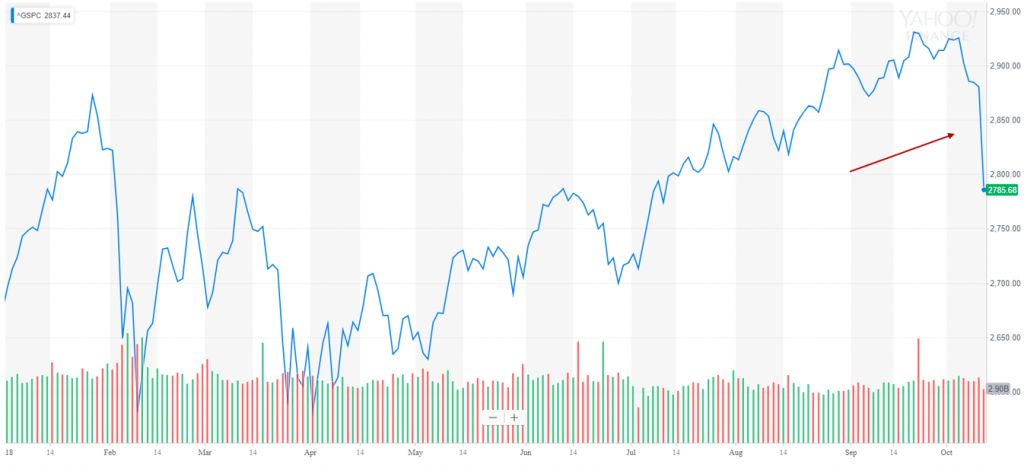

* Recent update – The first two weeks of October have ushered in some material declines in US equities as well

Will the Fed raise interests rates even higher in December?

A December rate hike is becoming more likely with the increased pressure on corporate wages.

This final rate hike would take the federal funds rate to 3.3+%, up from roughly 2.5% at the beginning of 2018 (see Chart II below).

Chart II – US 10 Year Treasury Yield (Source: FactSet)

It also remains to be seen how much markets have already priced in additional tightening, with three or four more hikes possible in 2019.

Further, the Fed is unwinding its $4 trillion balance sheet of bonds purchased through its various Quantitative Easing programs.

If you combine Fed tightening with more supply of bonds being put on the market, it’s no surprise that interest rates are rising rapidly.

If this trend continues, it will put further upward pressure on the U.S. dollar and continued stress on interest rate sensitive asset classes.

Investors should consider if the market is truly pricing in the significant monetary headwinds that possibly loom ahead.

Will The US / China Trade War Escalate?

The trade war continues, with President Trump implementing a further $200 billion in tariffs against China.

The additional tariffs come on top of the $50 billion already taxed earlier this year, meaning that close to 50% of all Chinese imports into the United States will now face levies.

These new tariffs are starting at 10%, but will climb to 25% on January 1, 2019…and further increases are being contemplated as well.

In China, President Xi Jinping has begun implementing fiscal stimulus to offset US tariffs, including currency depreciation (e.g. the Chinese Yuan has steadily depreciated by 9% since April).

Both Trump and Jinping’s actions will be held under a microscope as we round out 2018 and head into 2019.

However, it is becoming more clear that this trade tension will not be resolved in the near term, as major structural issues need to be addressed (e.g. intellectual property protections, etc).

China continues to have a growing influence on the global economy and both countries have some major work ahead in finding a new normal that all parties can live with.

Conclusion

The last few months of 2018 may experience economic uncertainty, with a lot riding on the Fed, President Trump and China’s president Xi Jinping.

Additionally, the profit benefits from 2018 US tax cuts will start to roll off from a year-to-year comparison basis as we head into 2019.

While US economic fundamentals remain strong, we continue to preach caution and look to allocate to more value-oriented public & private investments.

We have already seen some headwinds in early Q4 – with the S&P seeing its largest draw down since Q1 (see chart III below).

Chart III – S&P 500 Performance YTD (Source: Yahoo Finance)

Let’s see if markets can stabilize and bounce from here, or whether this is the start of larger declines ahead in the US.

Public Portfolio Update

LGA continues to manage a number of different public portfolio strategies and risk profiles for clients.

For Index portfolios, we continue to rebalance client accounts to systematically sell high and buy low while tracking market trends.

For Global Rotation portfolios, we remain defensive and overweight in diversifiers to help shield against potential market volatility.

For Tactical portfolios we remain risk-off with cash , diversifiers, and market hedges, while awaiting greater stabilization in undervalued areas before reentry.

Two areas where we have tactically increased allocations back to a market-weight are in commodities and real estate.

Finally, we continue to monitor our volatility trading model and the potential to hedge potential market declines.

In fact, our model triggered a VXX purchase in early October, just before the recent 5%+ drop in the US markets.

We will continue to diligently manage each client’s portfolio to their selected behavioral strategy and risk profile.

Private Investments Update

Private investments continue to consistently deliver, amidst a roller coaster year for global markets.

Of specific note has been the uncorrelated nature of these private investment returns to traditional public markets.

During Q3, we made some additional advances to the program:

- Received notice of a successful upcoming Q4 exit on two infrastructure funds where our clients have nearly $7MM invested

- Further grew our capabilities and assets under mangement in our fund-of-funds program.

- Launched sister firm, LotusGroup Capital (“LGC”), which will house our direct line of funds in the future (first fund expected to launch late Q4 / early Q1)

- Sourced a new commercial real estate fund for our clients to access / invest at a low $55K minimum

We look forward to the continued development of this program for our growing clients and investors.

Warm Regards,

The LGA Investment Team