Investment Market Update

Amid trade tensions with China and unsatisfactory economic data, last quarter provided investors with some volatility.

However equity markets remained resilient, with the S&P 500 grinding its way to a positive return and some nominal new highs.

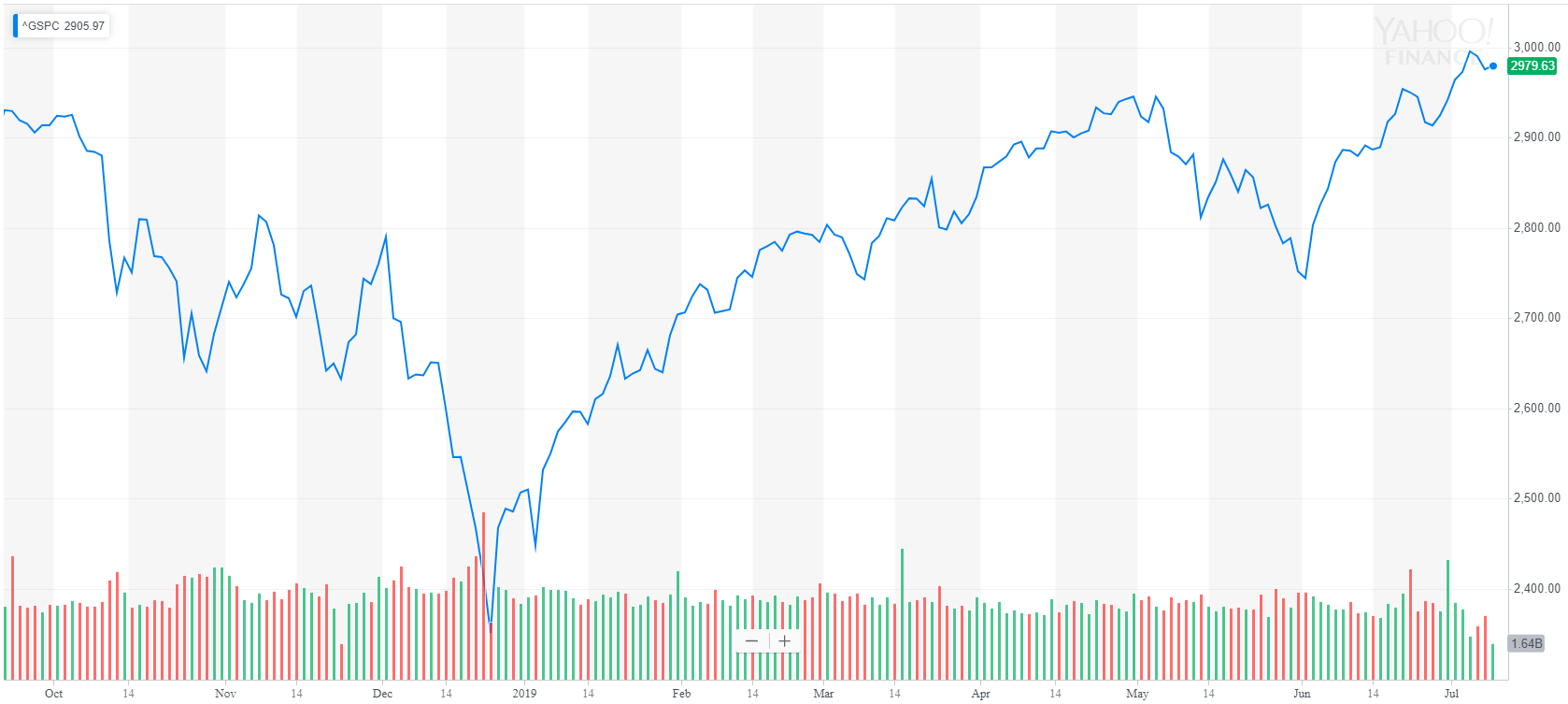

Dovish views from the Fed during the first half of 2019 have helped markets recover from a punishing 20%+ decline towards the end of 2018 (see chart below).

Chart I: S&P 500 Performance (Source: Yahoo Finance)

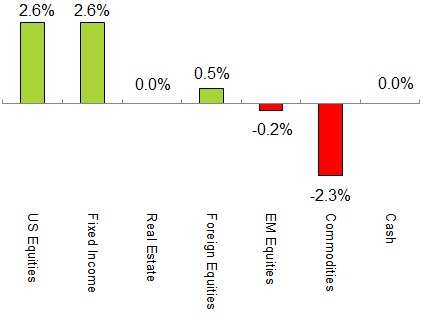

Viewed more globally, the few winners this quarter were in US equity and fixed income, with the remaining asset classes delivering flat to negative returns (see Chart II below).

Chart II: Q2,2019 Nominal Asset Class Returns

Additionally, there are signs of economic weakness ahead, both globally and in the US where leading economic indicators have turned negative.

As a response, The Fed has recently projected the potential for a return to interest rate cuts (and potential quantitative easing) in order to aid the current economic expansion.

However, many institutional investors remain concerned with the following:

- Expensive equity valuations

- Continued uncertainty surrounding the trade war

- Weakening economic data

Practically speaking, if President Trump wants to maintain a strong US economy (as well as his 2020 reelection odds), he may decided to hammer out a deal with China.

Fed rate cuts would also surely provide another jolt of adrenaline to market participants with major risk appetites.

However, the Fed has limited ammunition with low current interest rates and large debts on their books from the last easing cycle.

Using this ammunition now might extend the current advance, but it would leave them exposed and with extremely limited ammunition for any future recessions.

What remains constant are high equity valuations, along with a deteriorating profit outlook…

…and at this point, it looks as if the Fed and Trump need to thread the needle in order to keep the rally alive.

We continue recommending recession-resilient private investments where valuations are more attractive.

Public Portfolio Update

LGA clients are allocated across a number of different public strategies, all of which increased in value during Q2.

For Index investors, we rebalanced portfolios during Q2’s rips and dips to systematically sell high and buy low while tracking market trends.

For Global Rotation investors, we have been fully invested and generating gains, but are defensively positioned to blunt potential declines.

For Tactical investors we were heavily protected against the declines in May and added exposure in June to capture a portion of the market’s upside.

We will continue to diligently manage each client’s portfolio to their selected behavioral strategy and risk profile.

Private Portfolio Update

LotusGroup continues to make positive progress across many of our private initiatives.

We are evaluating several interval funds for non-accredited investors who have not yet been able to participate in private investments and want to increase diversification, liquidity and access.

Our ops team is working hard to obtain any final outstanding K-1’s and will continue to provide timely updates during this tax filing extension season.

Our investment and advising teams are helping several clients sign up for a mass-action litigation against a management team that we believe misrepresented and mismanaged their fund.

We are collectively helping to coordinate communications with clients on a number of fronts (K-1’s, exits, fund transfers / reinvestments, SEC responses, public marks-to-market, etc.).

Finally, we continue to grow our in-house capabilities with the addition of new team members and scale.

We hope you are all enjoying your summer!

The LGA Investment Team