The Balancing Act

Investment Market Update

US equities posted another lackluster quarter in Q3-2019.

The S&P 500 has now dropped, rallied and then churned sideways for a relatively stagnant return over the past 12 months (see Chart I below).

Chart I: S&P 500 Performance Trailing 12 months (Source: Yahoo Finance)

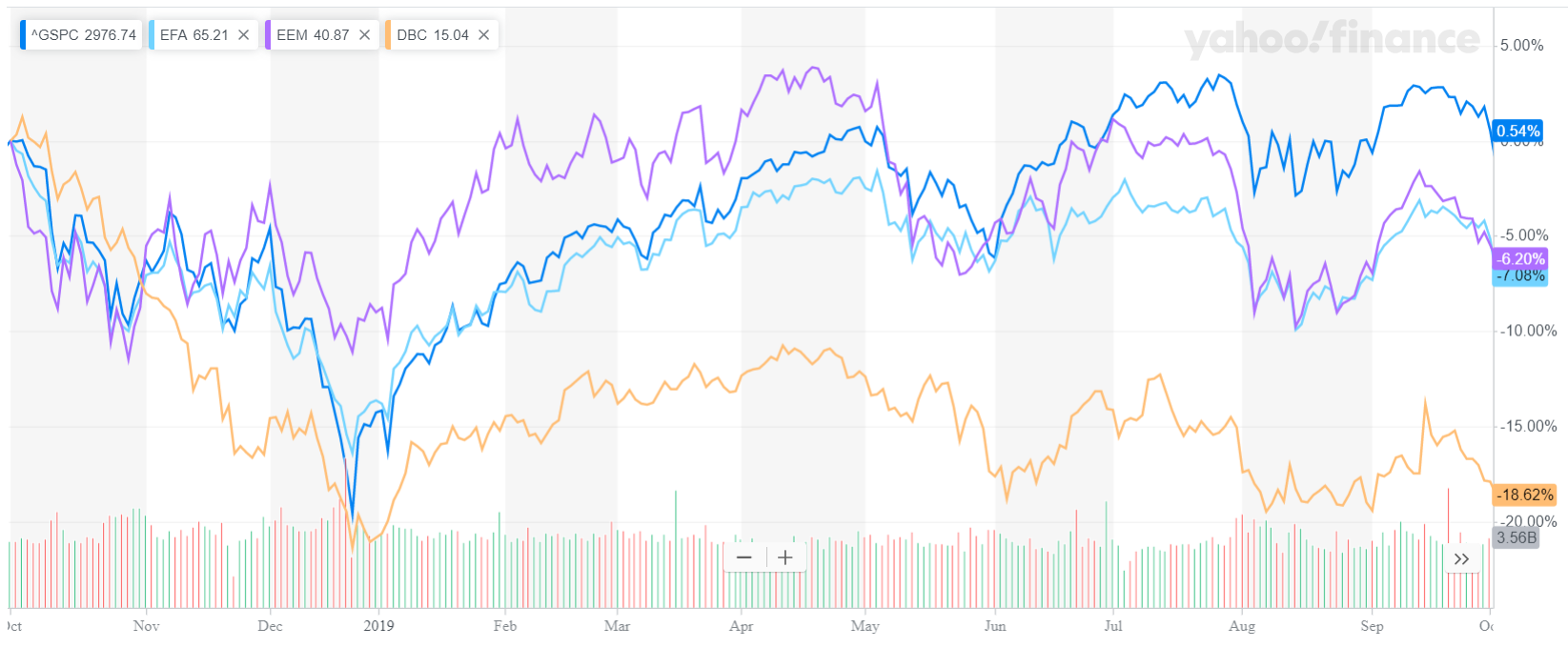

Looking more globally, equity-like risk assets have done even worse, with negative returns in foreign developed equties, emerging markets, and commodity markets (see Chart II below).

Chart II: Global Equities and Commodities Performance Trailing 12 months (Source: Yahoo Finance)

The only recent bright spot has been the rebounding of US bond markets over the past 12 months, after a poor 2017-2018 performance.

All three of these results are relatively intertwined, with much of the correlation coming from US Federal Reserve interest rate policy.

Starting in early 2017, the Fed began raising rates with the expectation of a strengthening economy.

These rate rises continued through till December 2018, when the Fed went on pause.

The net result over this time period was that equity-like risk assets increased in value while bonds declined (bonds move inverse to the direction of rates).

Conversely, in 2019, The Fed kept rates flat for the first half of the year, and then dropped them twice by 0.25% (total of 0.5%).

In sync with these moves, while equity-like assets have trended sideways, bonds have rebounded (again, the inverse price relationship with the direction of rates).

Regardless of all these moves, a number of fundamental elements remain:

- Equities remain highly overvalued and bonds offer very little yield (see previous posts)

- The Fed has used up some of its easing ammunition while reducing the Fed Funds rate from 2.5% to 2.0%

- Global markets continue to stagnate or decline

Additionally, for the first time in a long while, Wall Street analysts are projecting declining earnings of -3.4% for the S&P 500 during the upcoming quarterly reporting period.

All that said, select asset-backed private investments continue to offer better valuations, along with positive dividend attributes (see more below in our Private Portfolio Review section).

Public Portfolio Update

Given the current market performance and outlook, we continue to position client’s public portfolios with lower beta to market (aka conservatively):

- Lower exposure to US & global equities

- Higher exposure to portfolio diversifiers (such as merger arbitrage and managed futures)

- Some exposure to liquid alts

Whether our clients are fully or tactically invested, we strive to fulfill our charter as value investors and to protect portfolios for a potential downturn.

Even index investors have an inherent protective characteristic by including asset classes that have low beta correlation to equities.

In Q3/19, Tactical investors were overweight protective money market positions, had one round-trip hedge trade, and delivered some returns with commodities and liquid alts.

Global Rotation investors were fully invested and generating gains, but again with lower beta to markets.

Finally, we continued to manage a steady hand with index investors, rebalancing when needed.

We continue to diligently manage each client’s portfolio to their selected behavioral strategy and risk profile.

Private Portfolio Update

Our team has been vetting several interval funds to better improve diversification, liquidity and access.

We are happy to announce our first selection has been completed and is now ready for client portfolios.

Finally, we had a productive in person meeting at GPB headquarters in NYC and you can expect a detailed update from us later this month via direct email communication.

We hope you are all enjoying your summer!

The LGA Investment Team