Interval Funds 101

LotusGroup recently launched a private interval fund sourcing program to help clients improve diversification, access and liquidity.

As such, we thought it would be helpful to provide a high-level overview of the interval fund origin and structure.

Why Interval Funds?

Historically, investments in alternatives have not been readily available to most accredited investors.

Most alternative asset manager’s structures are structured for institutions, family offices, and ultra high net worth individuals.

Alternative managers often have multi-million dollar minimums and are selectively networked so that deal flow is not readily available to the average accredited investor.

As a firm, we have striven to improve access of private alternatives to the wider accredited investor base.

LGA began negotiating access for clients to closed-end private funds as well as open-ended funds with 2-3 year lock-ups.

We are also now nearly two years into running our own fund-of-funds to deliver even greater diversification and access.

Now, we are also sourcing an even more flexible and accessible private investment option: interval funds.

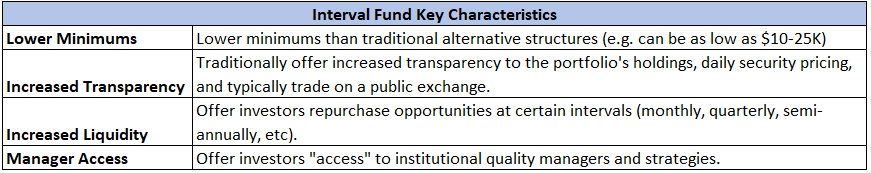

Internal funds offer access with the following unique characteristics:

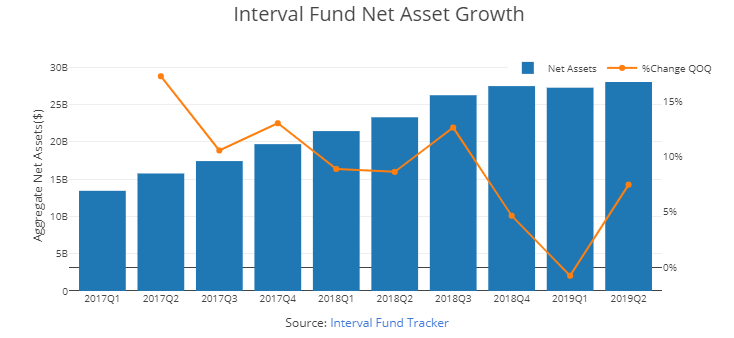

The above characteristics (among others), have caused a large inflow of assets into the interval fund structure (see the below chart):

As previously mentioned, LotusGroup perceives the interval fund structure as a complement to our existing alternative investment roster.

With interval funds, LGA advisors can help clients to improve: (a) diversification, (b) private liquidity, and (c) access.

The characteristics and structure also answer some of the requests we have heard from clients in terms of preferred “investment characteristics.”

Specifically, we have been asked to source more diversified fund-of-funds (e.g. “we don’t really want to see the sausage making”) and to improve further liquidity where possible (e.g. “I never know when I may need my money.”)

We have already begun introducing clients to our first sourced / recommended interval fund, and the reception so far has been strong.

Please reach out to your private client advisor for more information and we will continue working hard on growing this aspect of our investment offering in the years to come.

Public Investment Update

On the public side, we continue to position non-indexed portfolios in the following ways:

- Lower-risk / lower-volatility equities (e.g. utilities, insurance)

- Diversification into gold as a hedge against global currency depreciation

- Select emerging markets with deep value (e.g. Hong Kong as it decouples from China)

- Yield opportunities in real estate sectors

- Diversifying liquid alts like merger arbitrage and absolute-return strategies

This somewhat conservative positioning results in a reduced beta for portfolios (e.g. lower volatility relative to public market indexes).

Consequently, the majority of client portfolios have enjoyed positive gains, albeit with returns that somewhat trail the rallying global markets.

We have not yet observed any signals to hedge our client’s tactical portfolios during Q4, but we remain vigilant given current market valuations and extreme positive sentiment.

Wishing you all the best,