Only halfway through 2020 and it is already a year to remember (or maybe we will try to forget)!

TV’s and web browsers are continuously bombarding us with “Breaking News” flashing ominously on the screen.

It’s safe to say not many could have predicted this year’s events, from the coronavirus pandemic to social justice protests and topped by a tumultuous election season.

We have been honored with the important role of providing a consistent and steady hand throughout and we thank our clients for their ongoing trust and encouragement.

Our team continues to work around the clock with a focus on delivering our best efforts to you.

Wild Ride for the Markets

Investors have seen more volatility during the first half of this year than in the past three years combined.

LGA has warned of high equity valuations for the last three years and the worldwide outbreak of COVID-19 ended up being the catalyst that pushed equities over the ledge.

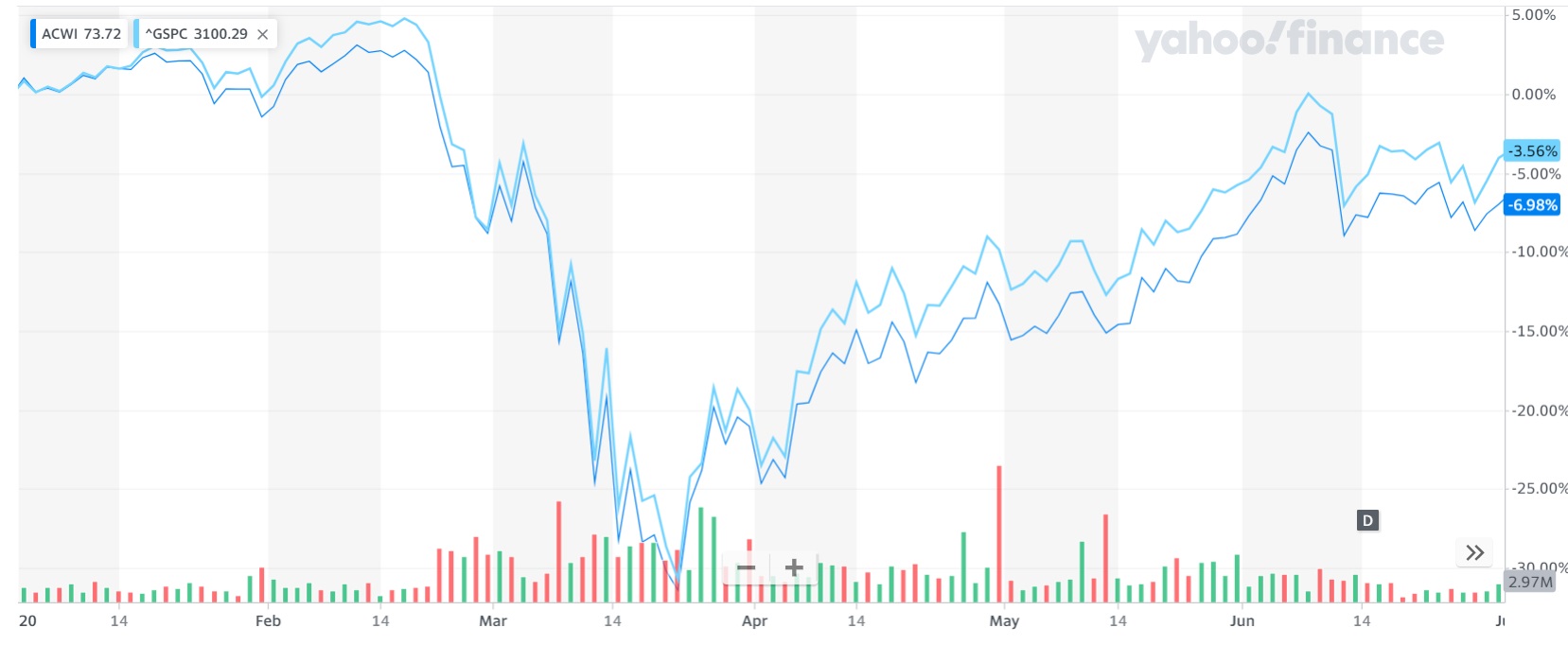

After reaching all-time highs in February, US and global markets declined 25-30%+ through the end of March (see Chart I below).

Chart I – YTD Returns for US & Global Equity Markets (S&P 500 & ACWI Index – Source: Yahoo! Finance)

These rapid market declines triggered massive and unprecedented government responses.

Congress approved a $3 trillion stimulus package (the largest ever) while the Fed lowered rates dramatically to boost consumers and the economy.

The Fed also provided massive amounts of liquidity and backstops to corporate debt markets, going so far as announcing the purchase of bond ETFs and even individual issues.

These actions provided both a brace and a positive shock to the stock market, with equity pricing responding with a vigorous rebound.

As of end Q2, markets still remained approximately 10% below their previous highs.

Furthermore, the dramatic outperformance of tech stocks has been masking the continued underperformance of stocks that are more tied to the economy.

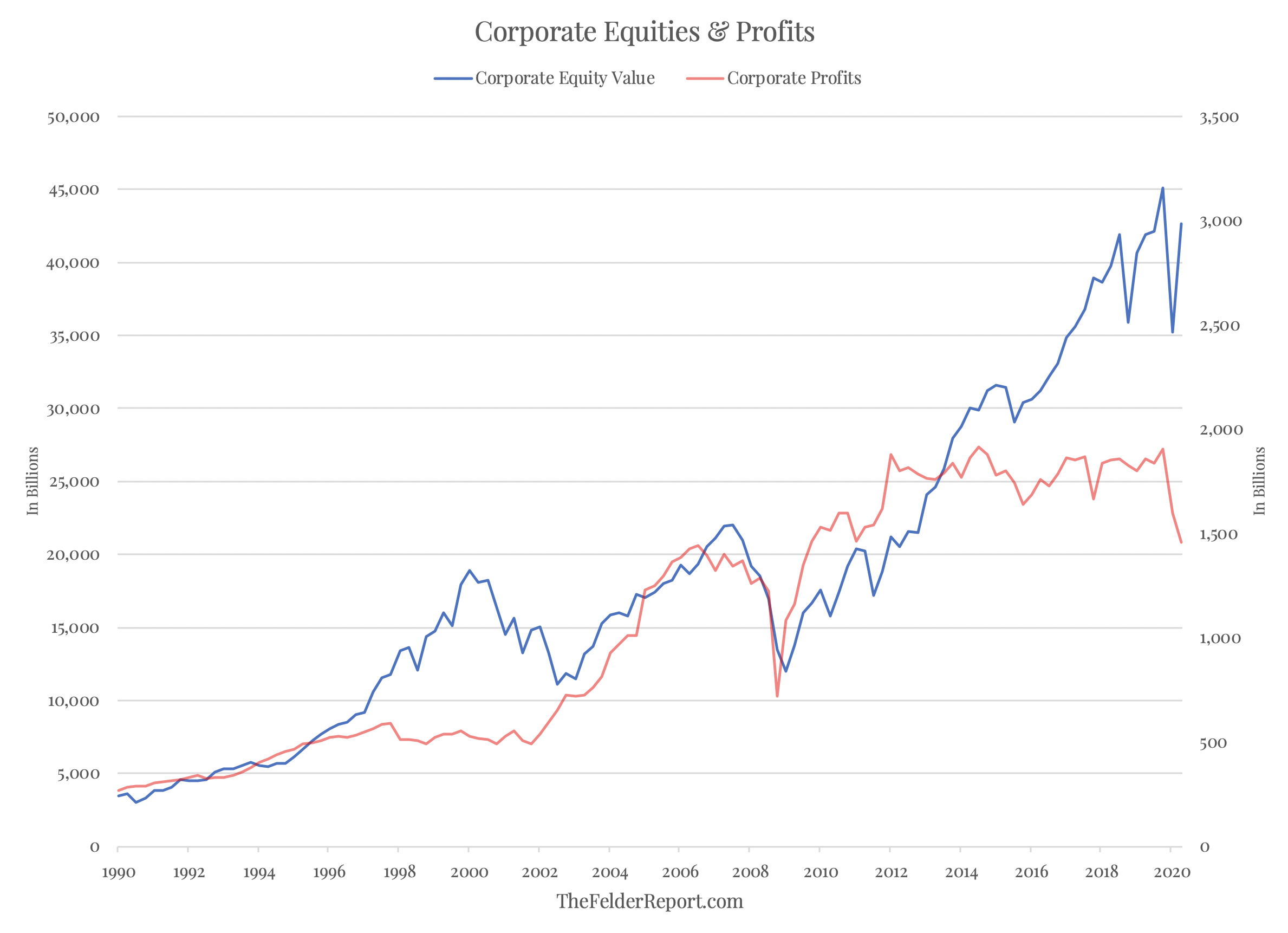

It is tough to rationalize this recovery, considering that corporate profits tend to underpin valuations and these figures have been steadily falling (see Chart II below)!

Corporate Equities & Profits (Source: TheFelderReport)

Not only are profits divergent from equity prices, they are displaying a rare inverse relationship.

Said plain and simply, “this trend is not sustainable,” regardless of how excited investors are with tech stocks or with how much stimulus the Fed provides.

LGA Portfolio Moves

At LotusGroup, we continue to focus on capital preservation, diversifying portfolios and focusing on targeted growth opportunities.

In early 2020, the majority of our client’s public portfolios were positioned defensively with lower betas, cash, and volatility hedging positions in tactical portfolios.

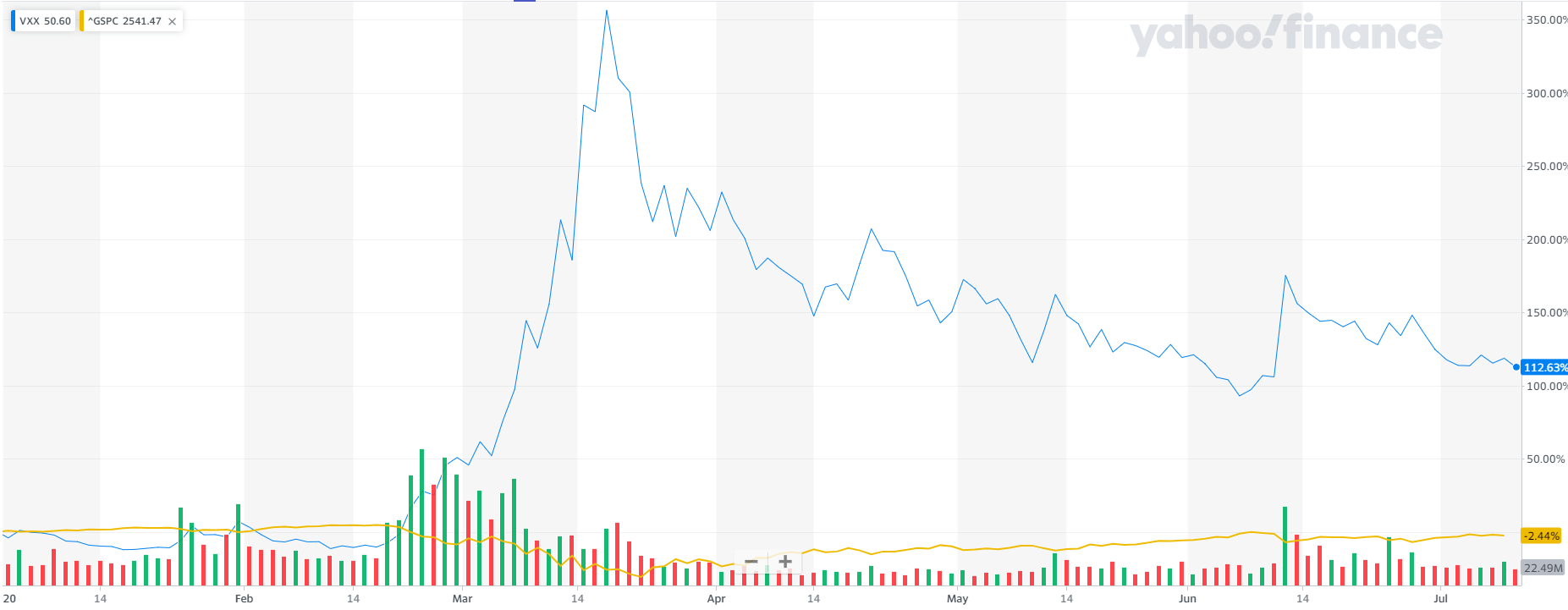

One successful example of our defensive positioning were the gains we generated in tactical portfolios from our VXX hedges (previously mentioned).

As illustrated in Chart III below, VXX spiked higher by over 300% in Q1, and we were able to capture the majority of this move before selling the position in early Q2.

These massive gains in VXX were realized while stock markets were rapidly declining, effectively offsetting one another to protect tactical client portfolios.

S&P 500 vs. VXX YTD Returns (Source: Yahoo Finance)

Net-net, tactical portfolios were able to blunt Q1 declines while maintaining dry powder to reallocate at the bottom.

In mid-March, our team observed some of the most oversold sentiment indicators in the past two decades.

At such time, we became more aggressive in our portfolio positioning, albeit not fully given potential scenarios of continued decline.

This change of positioning resulted in more aggressive / market-aligned strategies increasing to 65-75% of beta risk and more conservative strategies increasing to the 35-50% range.

We invested in undervalued sectors and companies that were expected to rebound (energy, banks, tech stocks).

As the market rose in Q2, our clients enjoyed a healthy portion of the gains.

However, we are once again reaching extreme overvaluation and overbought sentiment levels, especially in the tech stocks.

As such, we are beginning to tactically get defensive again but will stay mostly invested until technical signals deteriorate.

As always, we are sticking to our models and are diligently monitoring portfolios on a daily basis.

Private Allocations

We have been stating for years that fixed income has become a very unattractive choice for portfolios.

Historical expectations of a “safe” 4% return have been upended by the nature of how low interest rates have been driven.

With US-Treasuries now at 0.5% or lower, there is really no good expectation for long-term returns.

As such, our accredited and qualified clients have fully become acclimated with our approach to replace / supplement this non-equity portion of portfolios with private alts.

While there are no guarantees in these asset classes as well, our practice has grown to focus much more heavily on asset-backed private investments (as opposed to private equity).

For the most part, these positions performed consistently and positively during the volatility of both Q1 and Q2.

For more info on this topic, please see our recent private video post from LGA Alternative Manager Louis Frank here: High-Level Q2/20 Private Investment Update

We Continue to Stand by Your Side – New HQ!

Again, we personally want to thank all of our clients.

We understand that these are unprecedented times and we will continue to work hard for your interests.

That being said, after almost 3 years of construction we are finally moving into our new office on Old South Gaylord Street (in East Wash Park, Denver Colorado) at the end of the month.

Health and safety permitting, we welcome you all to stop by and say hello!

Best always,

Your LGA Team