An investment portfolio plays a crucial role in building wealth and risk management, especially for business owners. Owning and operating a business brings unique risks, making it essential to strike a balance between business and personal investments. A well-diversified portfolio can protect business owners from economic downturns and ensure that they have enough liquidity to meet both personal and professional financial goals.

Understanding Investment Portfolio Risk

Business owners face a variety of risks that can impact their wealth, including industry volatility, economic shifts, and unforeseen challenges like pandemics or market crashes. By creating a comprehensive investment portfolio, business owners can mitigate some of these risks while also growing their wealth for the long term. While many business owners focus heavily on their company’s performance, it’s crucial to have personal investments that are independent of business success. This creates a buffer for times when business earnings fluctuate or decline.

Balancing personal investments with your business strategy requires understanding both the rewards and risks of different asset classes, such as stocks, bonds, and real estate. Stocks may offer high returns but can be volatile, while bonds provide stability. Real estate, meanwhile, can offer a balance of appreciation and income but requires careful management.

The Importance of Diversification

Diversification is a critical component of a successful investment portfolio. When your assets are spread across different sectors, industries, and asset types, you reduce your exposure to the downside of any one investment. This is particularly important for business owners who may already have a large portion of their net worth tied up in their company.

Consider allocating a portion of your investments into stocks and bonds that are not directly related to your industry. This strategy can help offset any losses that your business may incur during a downturn. Real estate and international stocks are also excellent diversification tools to protect against domestic market volatility.

Learn more about wealth management strategies.

Asset Allocation: A Tailored Approach

Asset allocation refers to how you divide your investment capital among different asset classes, such as stocks, bonds, and real estate. This allocation should be based on your financial goals, risk tolerance, and the time frame in which you expect to need access to your funds.

Business owners often need more liquidity than the average investor because they must have cash reserves for their business operations. Your investment portfolio should account for this, ensuring you have sufficient liquid assets in case your business faces financial strain.

For example, during the COVID-19 pandemic, many business owners faced severe cash flow issues. Those who had invested in liquid assets like bonds or money market funds could access these funds quickly to cover short-term expenses, avoiding costly loans or asset sales. Therefore, strategic asset allocation is essential for balancing both personal and business financial health.

Understanding Risk Tolerance

Risk tolerance varies significantly between business owners and depends on various factors such as age, industry, and personal financial goals. Younger business owners may be willing to take more risks in their investment portfolio, given that they have more time to recover from potential losses. In contrast, business owners nearing retirement age might prefer a more conservative portfolio that prioritizes capital preservation.

Assessing your risk tolerance is crucial when developing your portfolio strategy. A good rule of thumb is to avoid putting all your financial eggs in one basket. For instance, a business owner who has substantial business equity should consider diversifying into lower-risk, more liquid investments to mitigate potential downturns in the company’s value.

Learn more about risk management for investors.

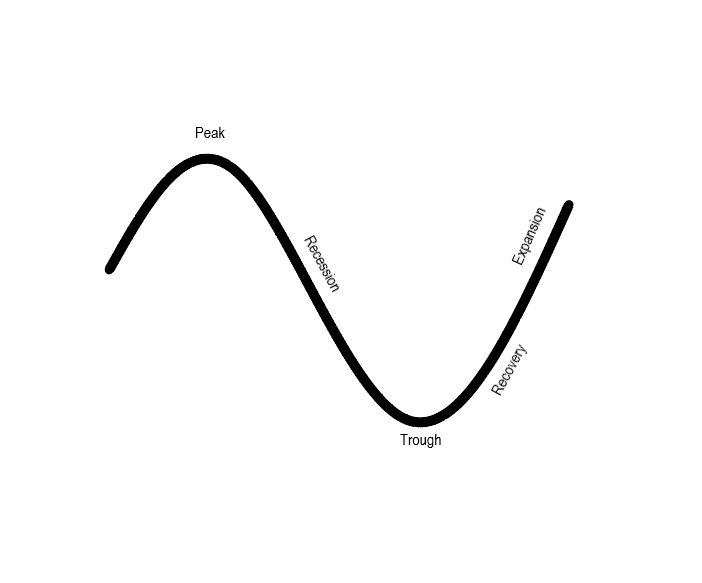

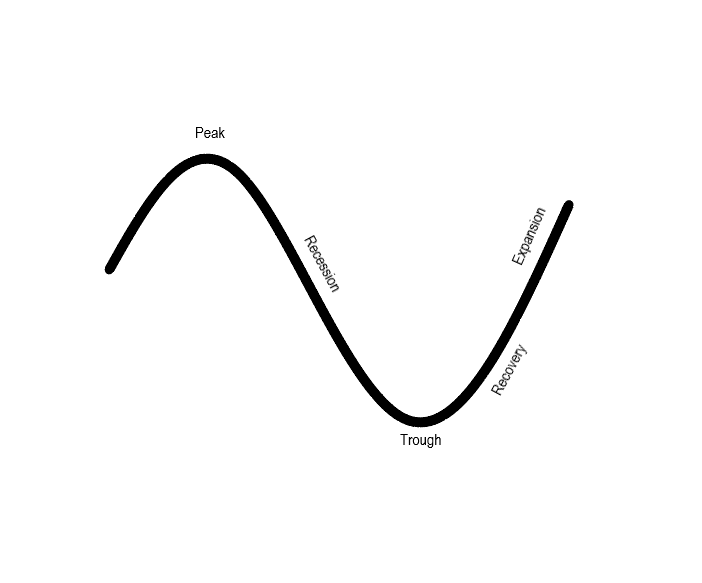

Benefits of Long-Term Planning

A long-term approach to investing can significantly reduce the overall risk of your investment portfolio. While markets may experience short-term volatility, long-term investments have historically yielded positive returns. By taking a measured, long-term view, business owners can benefit from the compound growth of their investments.

One effective long-term strategy is dollar-cost averaging, which involves regularly investing a fixed amount of money into the market regardless of current conditions. This approach reduces the impact of market fluctuations and ensures that you are steadily building your portfolio over time.

Additionally, having a long-term investment portfolio complements business planning, allowing owners to withdraw funds at key moments such as expansion opportunities or retirement. Having a solid investment strategy can also provide peace of mind, reducing financial stress during periods of market volatility or business uncertainty.

Read more about retirement planning for business owners.

The Role of Professional Guidance

Working with a financial advisor who understands the unique challenges faced by business owners can help you design an investment strategy tailored to your needs. Advisors can offer insights on tax-efficient investments, retirement planning, and estate planning—ensuring that both your business and personal finances are aligned.

Many business owners focus primarily on their company, neglecting personal investments. However, building a diversified investment portfolio is essential to securing both your personal financial future and the longevity of your business. A financial advisor can help you make informed decisions, balancing risk and reward to ensure your investments align with your long-term goals.

Why do business owners need a financial advisor? Read more here.

Building and maintaining a strong investment portfolio is critical for business owners who want to achieve long-term financial security. By diversifying investments, tailoring asset allocation to your risk tolerance, and focusing on long-term growth, you can create a portfolio that protects your wealth while providing flexibility for business needs.

With professional guidance, you can align your business and personal financial goals, ensuring that your investments work to support both. A well-structured portfolio not only protects you during uncertain times but also creates a foundation for future growth, enabling business owners to achieve both personal and professional success.

If you’re a business owner looking to diversify your investment portfolio or seeking financial advice, LotusGroup can help guide you through the process, providing personalized solutions that align with your unique goals.