Spring often brings a newfound excitement and sense of positivity.

As the vaccine roll outs accelerate, it has also been promising to see the world creep back to normalcy.

Our LotusGroup team has remained hard at work and laser-focused on the opportunity set which accompanies a reopening economy.

Below is a collection of our market observations, along with a high-level review of how we are positioning client portfolios.

Fixed Income – Navigating a Yield-Starved Environment

The 60/40 model has historically been a go-to solution for traditional financial planners and professional investors.

The model is composed of 60% equities and 40% bonds (usually high-quality government bonds), and is often advised for wealthy, conservative and aging investors.

Equities were a source of growth while bonds generated income through “safe” investments (like US Treasuries).

Additionally, when equities rose, bonds tended to decline, and vice versa.

Sticking to this 60/40, and then rebalancing between the two targets to buy low and sell high, led to steady and meaningful returns.

Further, text-book financial advisors tended to increase the bond allocations as investors aged, for the sake of safety, security, and yield for distributions.

However, the bond portion of this model has disappointed in recent years and we believe the trend may continue.

Investors are currently stretching to find adequate risk-adjusted yield given rates at decade lows.

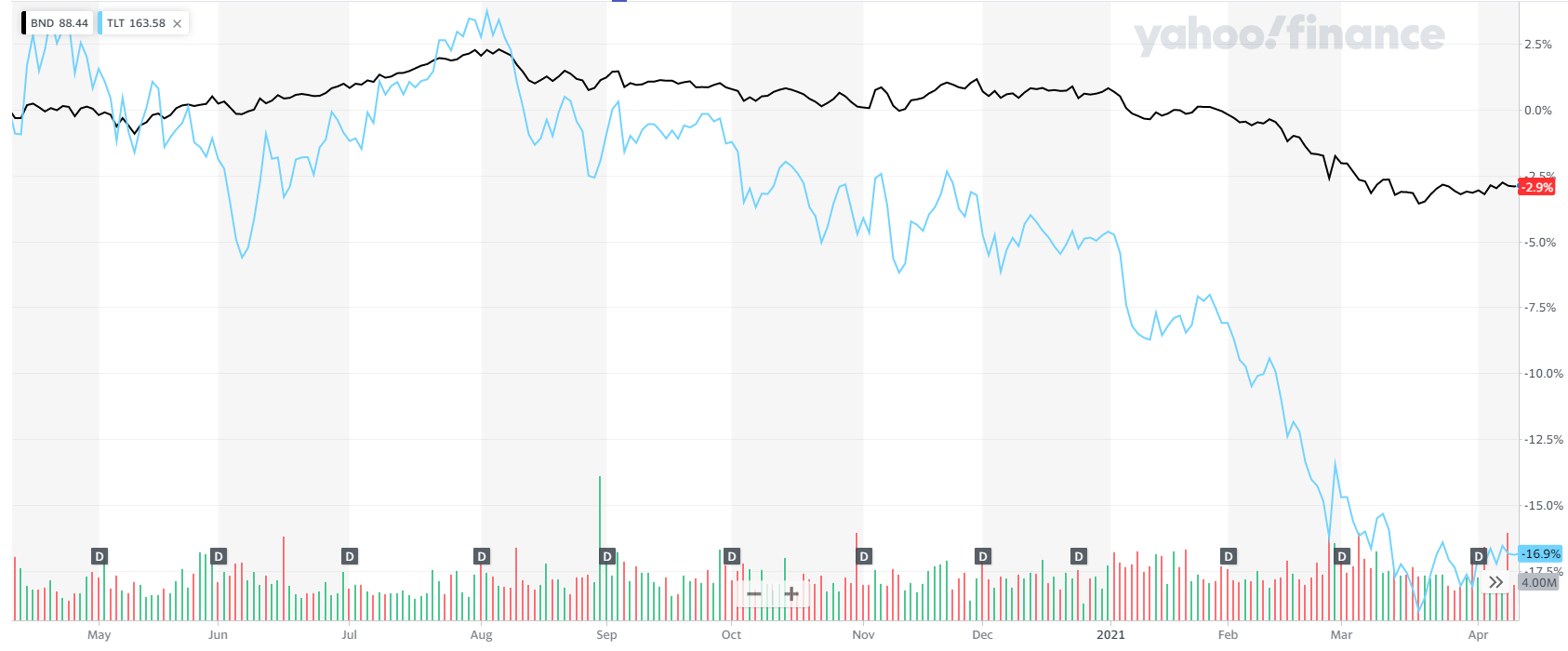

Further, as rates have begun to rise, the inverse relationship with bonds has caused them to decline significantly (see Chart I below).

Chart I – Returns for BND (Total Bond Fund) and TLT (20+Yr Treasuries) over past 12 Months

Source: Yahoo Finance

Plain and simple, investors are not receiving an adequate return for the risk they are taking on traditional fixed income.

In some cases, multiple years of returns have been wiped out in just the last 9-12 months.

So what can more conservative investors do?

First and foremost, we do not believe that investors should shift allocations more towards equity markets to stretch for returns.

We do believe that market neutral options are good alternatives for the 40% bond allocation.

This includes long/short bond funds, managed futures and alternative investment options.

We also have continued to stress the case for private alternatives as an important portfolio allocation.

Our team continues to specifically source asset-backed and yield-producing alternative strategies which we believe have better risk-return characteristics.

These strategies include infrastructure, life settlements, and real estate (just to name a few) and in most cases can produce 4-6%+ yields.

Additionally, many have the potential for upside appreciation.

Private alts do require some illiquidity, but where appropriate, this sacrifice is likely acceptable relative to the improved return / yield characteristics.

Adding alts may also prove to be “safer” than the traditional 60/40 model until rates have risen to more traditional norms.

Equities – Participation, Rotations and Possible Trouble Ahead

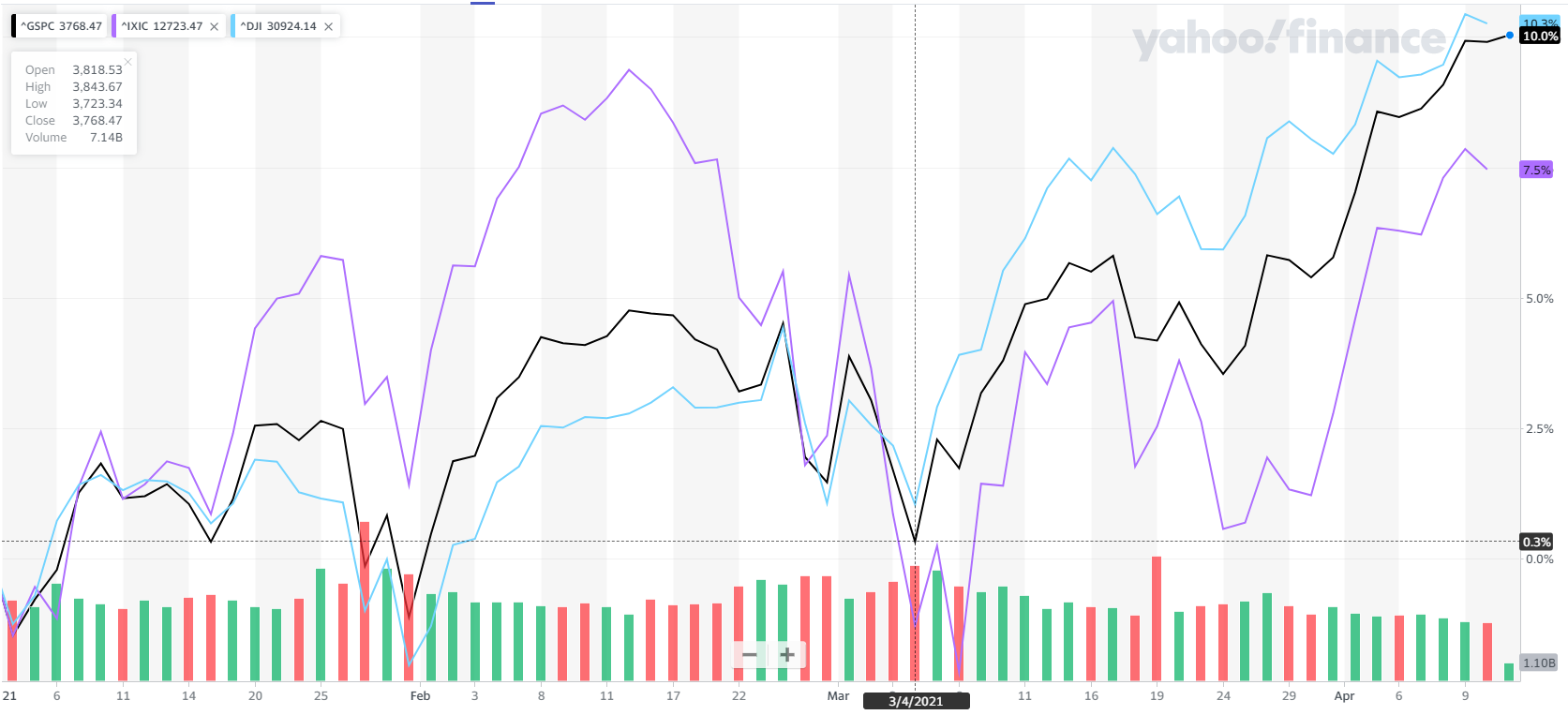

While fixed income has been in decline, 2021 has gotten off to a volatile start for equities in the US (see chart II below):

Chart II – S&P500 vs. Nasdaq vs. Dow Jones (Source: Yahoo Finance)

The early trend for 2021 has been a continuation of Q4/2020, with many investors rotating out of growth stocks and back into value positions.

With the Fed and US government continuing to inject massive stimulus into the economy, we have continued to invest in areas of both value and growth.

For example, LGA portfolios enjoyed strong Q1 gains from investments in resurging energy markets, retail, small caps and even travel (all economic reopening concepts).

We also opened a small growth / momentum position in a bitcoin aggregator, ticker symbol “BLOK”.

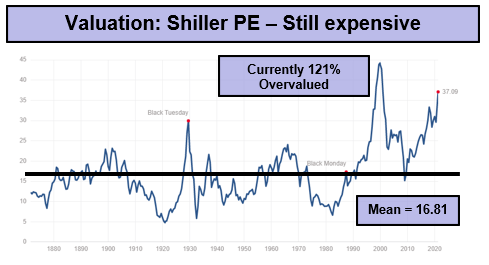

However, despite our select equity investments, we have recently become weary of overarching equity valuations (see Chart III below):

Chart III – Shiller PE (Source: Multpl)

Pundits have argued in the past 3-4 years that overvaluations by traditional metrics were justified because interest rates had declined to historic lows.

However, with the recent rise of interest rates, and the pickup in inflation, this refrain is beginning to grow thin.

As markets slowly churn to new highs, they are not only ignoring excessive valuations but also now ignoring rising interest rates.

Again, private alts offer the potential for equity-like total returns, along with what we believe are more reasonable valuations.

Net-net, we are beginning to underweight equities as well and replace them with alternatives or cash positions.

Finally, we continue to monitor our tactical market phase model as well as our volatility hedging strategy in case turbulence appears ahead.

Private Allocations – Continued Progress

A big highlight of this blog post has been the focus of using alternatives as both a fixed income complement and equity return (like) driver.

It’s no secret, that we have been alternative biased for the last five to seven years.

Life settlements, defensive real estate, litigation finance, and infrastructure have continued to provide meaningful yield and NAV growth.

These investments have proven their worth as fixed income replacements.

However, the next several years may further prove their worth as equity supplements / replacements as well.

We continue to press our bets on proven strategies while also seeking new asset-backed opportunities.

We look forward to discussing new opportunities with clients in Q2/2021 and going forward (stay tuned).

New Improvements – LGA Public Growth Model

LGA has always had a strong value-orientation, but we have occasionally missed out on growth sectors that do not focus on profitability.

After a significant amount of research and testing, we recently added a new growth model for a measurable portion of tactical and global rotation client portfolios.

This new model identifies and adds exposure to sectors with strong relative strength and price momentum.

Our public investment team scours over 2,000 ETFs on a monthly basis to identify the highest-ranking possibilities.

Once identified, these positions are then added to client portfolios with position-size limits and tactical value stops and trailing stops.

In late Q1, we added the first positions for this model in transformational data sharing (bitcoin), US small caps, and US retailers.

With this new addition, we are now capturing a wider universe of attractive opportunities by including both value and growth investments.

As you can see, we continue to carefully monitor both public and private market segments and aim to select the best risk-adjusted investments for our clients.

We also continue to invest time and resources to improve our team, services and offerings.

As always, we are grateful for your trust and business.

Cheers!

The LGA Investment Team

The information contained herein, including but not limited to research, market valuations, calculations, estimates, and other material obtained from LotusGroup and other sources, is believed to be reliable. However, LotusGroup does not warrant its accuracy or completeness. These materials are provided for informational purposes only and should not be used or construed as an offer to sell or a solicitation of an offer to buy any security. Past performance is not indicative of future results. This blog expresses the author’s views as of the date indicated, and such views are subject to change without notice. Investment advisory services are offered through LotusGroup Advisors, a federally registered investment adviser. LotusGroup transacts business only in those states where it is appropriately registered or is excluded or exempted from registration requirements. The information contained within is believed to be from reliable sources. However, its accurateness, completeness, and the opinions based thereon by the author are not guaranteed – no responsibility is assumed for omissions or errors. The views expressed herein reflect the author’s judgment now and are subject to change without notice and may or may not be updated. Nothing in this document should be construed as investment, tax, financial, accounting, or legal advice. Each prospective investor must make their own evaluation and investigation of any investments considered or of any investment strategies described herein (including the risks and merits thereof), should seek professional advice for their particular circumstances, and should inform themselves as to the tax or other consequences of any investments or services considered or described herein. LotusGroup’s advisory clients will be required to execute an Investment Advisory Agreement and related Account opening documents (collectively, “Agreements”). If any of the terms or descriptions in this presentation are inconsistent with Agreement terms, such Agreements shall control. Prospective investors should maintain the financial capability and willingness to accept the risks associated with any investments made, and should consult the relevant investment prospectus or legal documents, and should their Advisor Representative before making investment decisions (including but not limited to an examination of the investment objectives, risks, charges, and expenses of any investment product(s) considered). To better understand our advisory services and business practices’ nature and scope, readers are encouraged to review via the SEC’s website @ www.adviserinfo.sec.gov, the adviser’s Form ADV Disclosure(s), and the Form ADV 2B Brochure Supplement of each LotusGroup Investment Professional. Additional important disclosures can also be found at [www.lgadvisors.com}, by calling us at 720-593-9861, e-mailing us at pirnack@lgadvisors.com or by visiting us at our offices located at 1005 S. Gaylord, First Floor Denver, CO 80209. This blog, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without our prior written consent.

Benchmarks Notice* – References to any market or composite indexes, benchmarks, or other measures of relative market performance over a specified period are provided for information only. They do not imply that a portfolio will achieve similar returns, volatility, or other results. These references are provided to aid in understanding an index’s historic long-term performance, not to illustrate the performance of any particular security. The use of such data does not imply that such indexes are appropriate performance measures for a client’s portfolio, but rather are used solely to illustrate the risk and return characteristics of select market indexes during the period. An index’s performance does not reflect the deduction of transaction costs, management fees, or other costs which would reduce returns, and the composition of an index may not reflect the way a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which may change over time. Because of the differences between the client allocations and any indices shown, LGA cautions investors that no index is directly comparable to the performance demonstrated. Each index has its unique results and volatility, and such an index, if shown, should not be relied upon as an accurate comparison. An investor cannot invest directly in an index.

- Barclays Cap Bond Comp Index is a market capitalization-weighted index, meaning the index’s securities are weighted according to each bond type’s market size. Most U.S. traded investment grade bonds are represented.

- S&P 500 TR Index – The Standard & Poor’s 500, often abbreviated as the S&P 500, or just “the S&P,” is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. The S&P 500 TR Index includes the impact of investing dividends back into the index itself.

- EAFE acronym stands for Europe, Australasia, and the Far East.

- Additional Index information can be found via the “SEC Market Indices” below.

*Source: SEC Market Indices