We hope this blog post finds you in good spirits as you kick off the new year of 2022!

Our LotusGroup team has invested time to create three new content sections which you may quickly jump to by clicking the hyperlinked titles below.

CIO Insights

Public Market Update

Private Market Update

These three sections will also now highlight the different voices of our LotusGroup investment team (Raph, Steph and Louis).

Enjoy!

CIO Insights

As we turn the page on another year in the books, I am grateful for all the lives we have been invited to journey with over the past 18 years at LotusGroup.

Client life stories constantly amaze me with repeated acts of dedication, triumph, rebuilding, and more…

Working with our internal team at LotusGroup has also provided me with a daily reminder of our long-lasting partnership and friendships.

As a management team, we recently celebrated Nick Pirnack’s (Senior Advisor, Partner) 10th anniversary with the firm – congratulations Nick!

Stephanie Schlemeyer (Portfolio Manager, Partner) celebrated her 7th anniversary in 2021 as well, and in 2022 we will have three more team members hitting the 5-year mark.

I am extremely thankful for this longevity, especially considering the realities of today’s typical job-hopping professionals (4.1 yr avg for men and 3.9 yrs for women – BLS Stats).

Long tenures have allowed for continually-improving offerings for clients and for an effective environment to launch new services (e.g. the LGA new client portal launched in 2021).

Selfishly, both our clients and internal LotusGroup team have provided me with the love and happiness of a beautiful extended family. So a sincere thank you for enriching my life!

2022 Outlook

As we look to 2022, there are several exciting new developments on the horizon.

We begin with the redesign and enhancement of our client communications, including the addition of Steph and Louis in our quarterly investment posts.

Our Advisor team will also take turns providing interesting intra-quarter lifestyle pieces for you to review.

On the investment front, we continue to empower our in-house teams to operate and improve investment allocation models, due dilligence efforts, and private fund offerings.

One thing we will not be doing is predicting exactly how asset classes will perform in the coming year, for example where the S&P 500 will end 2022.

Advance predictions often prove inaccurate when it comes to investment markets.

For example, Paul Krugman made a 1998 declaration, “By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine.”

Clearly this Nobel Prize winner in Economics was one of the most qualified individuals to predict such a future trend.

As we know today, Krugman was completely wrong!

Internet businesses supplanted the fax machine 100x over and have been amongst the highest performing investments for two decades running.

Conversely, would you have successfully predicted that technology innovation stocks would be 2021’s biggest laggards?

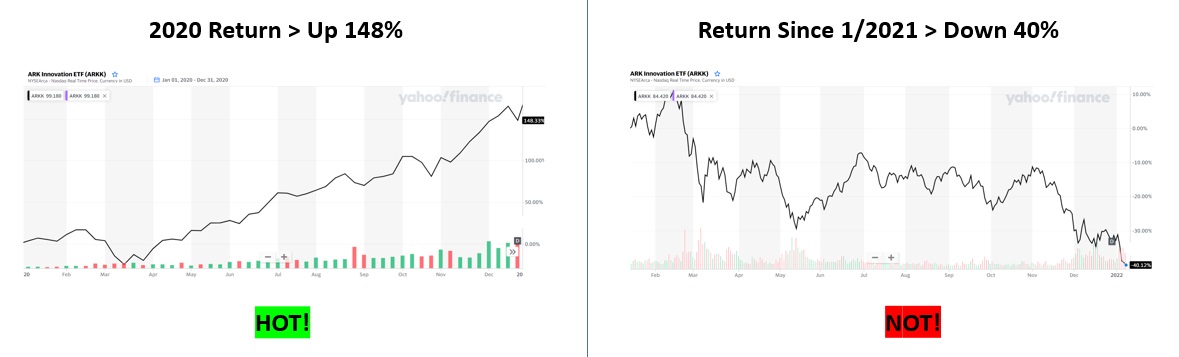

Kathy Wood’s Ark Innovation fund (ticker = “ARK”), which exclusively invests in technology innovation stocks, ended 2020 as one of the best performers, up a blistering 148%!

Ms. Wood was the talk of the town in many investment circles and media.

However, the fund posted a negative 40% return since the start of 2021, and a decline of nearly 50% from its early 2021 peak (see Chart I below), all while most US stocks gained 20%+!

Chart I – ARK Innovation Fund Side-By-Side Returns, courtesy of yahoo! finance

While predicting and chasing annual returns is tempting, it can also result in some very poor results.

Think about all those investors that poured into Kathy Wood’s fund in early-2021, a time of record inflows to her funds.

These investors bought the high and are now licking their wounds, with a nearly 50% reduction in value.

How do you recover from a 50% loss?

Financially, you need a 100% return to simply get back to break-even!

That is no small feat without clairvoyance about the best future asset classes (which we have already established as illusory).

Emotional recover, well, that is another challenge.

Life-changing drawdowns can negatively influence investment behaviors for decades if not a lifetime.

So what can we do with the data; what intelligent decisions can we make with portfolios?

We believe that relative valuations matter from a long-term perspective; what you pay at investment entry still matters.

Additionally, we can reasonably assess the margin of safety against potential declines and how big those declines likely could be.

For example, Steph’s Public Market Update highlights the massive bull market in fixed income from 1980 – 2010, and why we have severely underweight traditional fixed income since 2017.

Louis’ Private Market Update further highlights the investment alternatives we have used to replace this fixed income allocation since, producing a meaningfully positive spread.

Together, our team coordinates the mix of public and private investments for your portfolio.

Additionally, for tactical portfolios, we have a safeguard monitoring system that triggers a portfolio-protecting hedge if volatility begins to surge.

The ultimate goal is to position portfolios for reasonable upside capture while protecting against financially and emotionally damaging drawdowns.

Once again, thank you for allowing us to participate in your lives, and please enjoy the original content put together by the remainder of our investment team below!

Public Market Update

Let me first introduce myself… I’m Stephanie, partner at LotusGroup and team member now for almost 8 years.

My background is in mathematics, and I love all things numbers, analysis, and processes.

While the market and economic conditions are always changing, my job is to provide disciplined investment decisions and implement them to your portfolios to produce positive long term results.

I have set up my section of the blog in a way to give you informative and interesting market observations and outlooks.

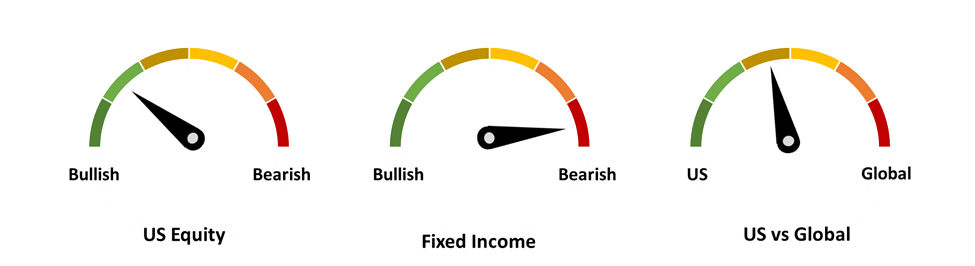

The first thing you will see in every post is our Investment Positioning Gauges (see below).

These gauges provide you with a snapshot of how our portfolios are currently positioned, and we will update them as market and economic changes occur.

For the “US Equity” and “Fixed Income” gauges, higher bullish readings equate to greater portfolio exposure and bearish readings equate to lower exposure.

The last gauge of “US vs Global” illustrates our above or below benchmark weightings to US positions versus foreign positions.

Currently, LotusGroup portfolios are fairly bullish on US equities, bearish on fixed income and relatively balanced in terms of US vs Global positioning.

Portfolios are also managed to the client-chosen strategy (tactical, global rotation, etc.) as well as the client’s suggested risk tolerance level.

Aggressive portfolios are mainly driven by equity exposure while conservative portfolios have both equity exposure and fixed income components.

Every quarter, we will provide these gauges to help you understand how your portfolio is positioned and we will discuss any changes made from previous quarters.

High-Level Market Review – 2021

Now that you know how your portfolio is positioned….let’s see at a high level what happened in the market this year.

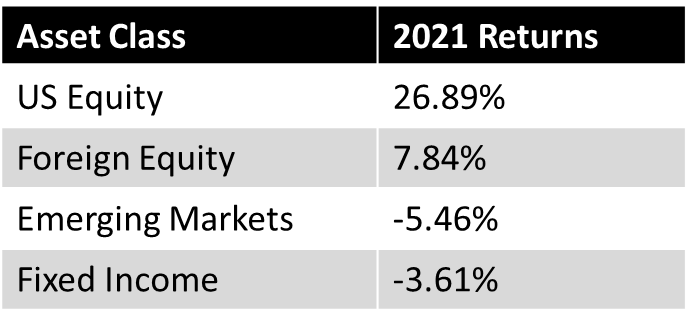

To begin, asset classes had one of the widest return dispersions in recent history, spanning from double digit positive returns to single digit negative returns (see chart below).

Chart II – 2021 Asset Class Performance (Source: LGA Analysis)

Gone are the years of all asset classes moving in unison.

The US equity market had a stellar year of performance, rebounding the best from pandemic lows with a 26% annual return for the S&P 500.

A large part of this performance was the continuation of very easy money policies.

However, another major contributor was the rebound in business activity as the US was one of the more open economies globally, with multiple regions rejecting lockdowns.

Interesting, as Raph mentioned in his section, not all sectors performed equally well, with 2021’s hottest Tech Innovation stocks actually having the worst 2022 returns at negative 40%!

Foreign developed markets faired decently with a nearly 8% annual return, while emerging markets struggled mightily with a negative 5% annual return.

Heading into 2022, portfolios remain slightly overweight to US equities, but are also invested globally in anticipation of a potential “reversion to the mean” where different markets take turns outperforming.

Fixed income was negative for the year, justifying our continued underweight positioning.

Returns in fixed income have been fairly flat for the past 5 years now, trending back to mid-2017.

Looking back even further, here’s a look at the 1 Year treasury over the last 50 years

Chart III – 1 Year Treasury Rate (Source: Macrotrends.net)

Since fixed-income price performance is inversely correlated to the directional move of interest rates (meaning fixed income prices go up when rates go down and vice versa)….

….it logically flows that fixed-income gains were dramatic from 1980 through 2010 as rates declined from double-digit levels down to nearly zero.

However, with near-zero rates for the last decade plus (2010 – 2021), yields payouts have been very unattractive and price performance has been stuck in neutral.

Going forward, the Fed is expected to raise rates at least twice in 2022, which would likely drive a negative return for fixed-income investments.

As such, we continue to mostly avoid fixed income and will only increase exposure if rates rise to a more meaningfully positive level in the 3-4% range.

This relationship between yields and prices especially impacts conservative portfolios as they traditionally have more fixed income exposure.

For nearly five years running now, we have replaced traditional fixed income with market-neutral investments (e.g. long/short credit funds) or liquid alts (e.g. merger-arb and managed-futures).

These positions were once again helpful in 2021, producing a modestly positive return in comparison to the negative 3.6% return of traditional fixed income.

As always, we will continue to evaluate and manage your portfolios with discipline and care.

Private Market Update

By way of introduction my name is Louis Frank, and I am responsible for client allocations to private investments at LotusGroup.

My name may already be familiar to you as I have been a frequent author of our quarterly blog post.

I have set up my section as a complement to Raph and Steph’s, showing how private alts fill the gaps to our public allocations.

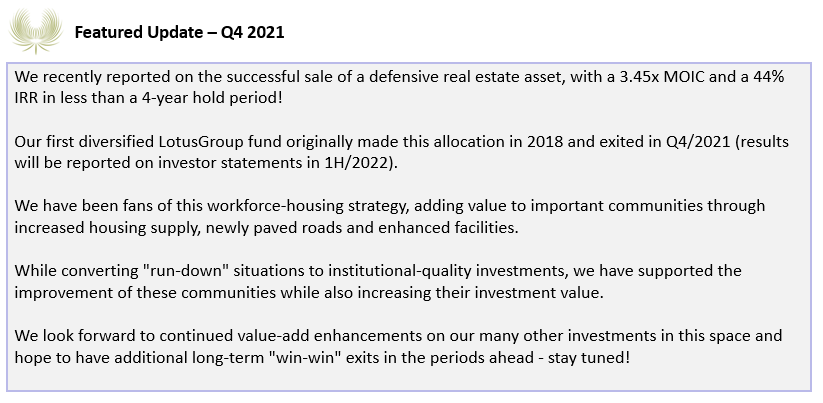

The first thing you will see in every post is a “Featured Update,” highlighting a recent insight or outcome in our private alts program.

Without further adieu, please see our first “Featured Update – Q4/2021” below

Private alts provide LGA portfolios with diversification, low correlations to public markets, and the potential for enhanced returns.

But how do we choose the options recommended to clients?

Lets look at a few examples:

Example #1 > Fixed-Income Replacements

As Steph mentioned in her public market section, traditional fixed income investments have been low-returning and low-yielding for the past 5-10 years.

This presents a specific problem for conservative portfolios that need non-equity exposure.

To address this gap, we have sourced private credit and specialty finance options as a replacement.

Private credit includes lending to private businesses while specialty finance includes lending against private assets (e.g. consumer debt, art, diamonds, etc.).

Specialty finance can also include other value or income generators such as life settlements or litigation financing.

These private alts typically provide a degree of non-correlation to public equity markets, which is similar to traditional fixed income.

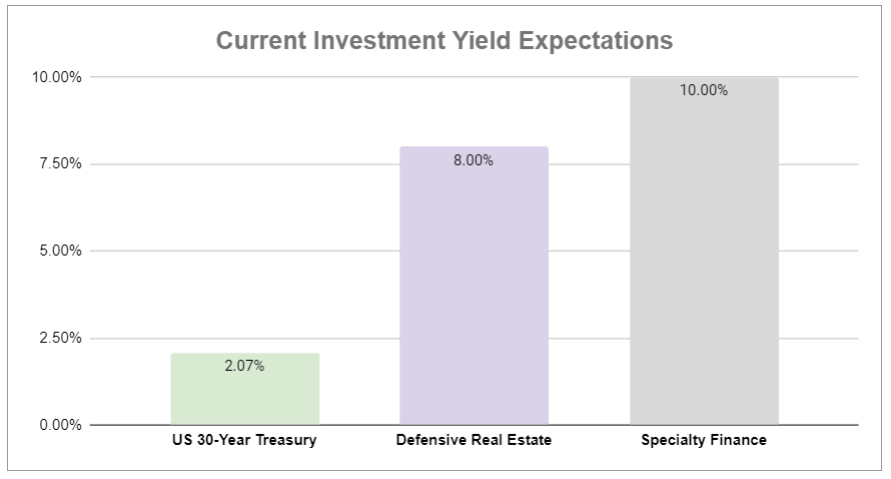

Additionally, thes private alts have historically delivered yields in the 6-10% range, which is over 3-5x greater than the current 30-year treasury yield of 2.07% (as of 1/4/2022).

The chart below shows the 5-8% of excess return (“alpha”) these opportunities can produce compared to traditional fixed-income investments.

Chart IV – Yield Expectations US Treasury vs. Alts (Source: CNBC & Fund Specific Marketing Decks)

Additionally, we are finding enhanced safety features, including:

- Conservative loan-to-value ratios

- Strong covenants

- Recession resiliency

Example #2 > Inflation-Protected Strategies

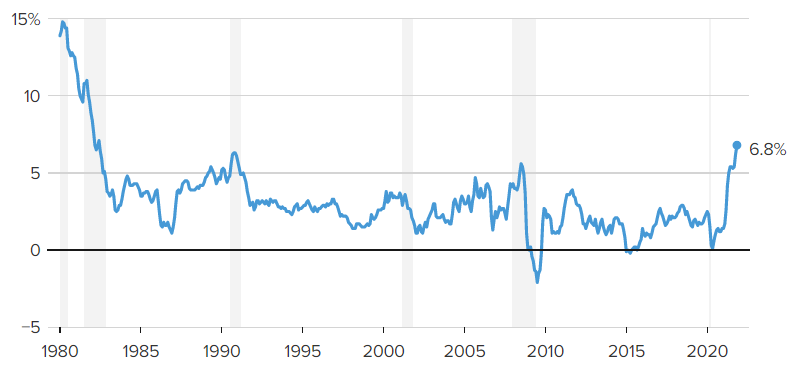

Another important area we address is the r-ise of inflation, which hit its highest level in decades during 2021 (+5.9% year over year).

Chart V – CPI Data 1980-2022 (Source: CNBC & National Bureau of Labor Statistics)

We have used defensive areas of the real estate market as one example to help hedge this inflation risk.

By “defensive”, we predominantly mean opportunities where the real estate is stabilized with tenants / leases at our time of investment (as opposed to new development opportunities).

We recently targeted lower-end grades of real estate like mobile home parks and manufactured home communities.

These real estate investments have helped us to grow portfolios during the rising rate environment of 2021 (see our “Featured Update” section above for a recent 3.45x exit).

Our chosen investments also have some enhanced safety features, including:

- Under-market rents that can be increased

- Strong occupancy and rent roll collections

- Recession resiliency

I will continue working with our wider team to identify needs and opportunities, and to provide enhanced investment opportunities for our clients.

Additionally, I continue to work with our Advising team to figure out the appropriate allocations for each individual client.

Our in-house LotusGroup diversified funds solve the majority of client portfolio needs, what we would call a “core” offerings.

We will also supplement core offerings with individual opportunities on a custom / as-needed basis.

I look forward to providing future updates in the quarters ahead, and am always available to answer specific client questions.

As always, thank you for the opportunity to serve!