LotusGroup Investment Review > Q1-2022

Hyperlinks below:

CIO Insights

Public Market Update

Private Market Update

CIO Insights

What a start to 2022! Every year at LotusGroup starts with the formal alignment of our team to a documented set of goals. These unified goals allow us to operate effectively in furthering our mission of Maximizing Human Potential (now with 325 unique households across all LotusGroup companies). In executing on these initiatives, I am honored to work daily with such a wonderful group of team members, clients and investors…striving to make a positive real-world impact.

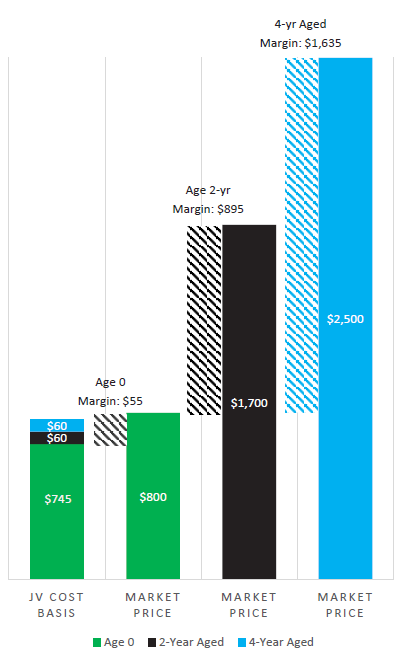

Amidst our normal Q1 activities, we also navigated portfolios through a volatile start to the new year. Inflation surged to the highest reported level in 40 years, while global equity & fixed income markets began to decline. Consumers were also highly impacted by strains on their purchasing power in regard to food, energy, transportation and housing.

Chart I – 40 Year Peak in US CPI (Consumer Price Inflation)

Putin’s Russia brutally invaded the sovereign country of Ukraine on February 24th. LotusGroup immediately responded with a message of condemnation in regards to the unwarranted destruction of human life / potential. We immediately made a firm-wide financial donation to three charitable groups helping the victims of this ongoing conflict. We also posted words of encouragement and action to our entire network of clients, investors and friends (click here to see the previous post > LGA Friends Helping Ukraine).

While we were overwhelmed by the positive response rate from our community, we continue to stay on top of this topic with additional messaging and support. Stated clearly, LotusGroup stands in support of all causes that help provide security, safety, and opportunity as every life has the possibility of achieving something special. We will also be a constant voice that celebrates the positives in our world and the amazing achievements that are to be appreciated and applauded.

Through it all, LGA’s public investment team monitored our daily models and made several intra-quarter portfolio adjustments. Please see Stephanie’s “Public Market Update” for a high-level review of how we entered the quarter underweight, used tactical hedges for several weeks, and then “bought the dip” for a rebound. She also highlights some of our proven techniques around portfolio diversification to non-correlated assets.

In the Private Market Update section, Louis highlights how we continue to source uncorrelated private alternatives to provide ballast from volatile public markets. Specifically, Louis reviews a new opportunity the team has been evaluating around Whiskey-Barrel Financing (check it out below).

As always, thank you for your continued trust and friendship. We will keep working hard to provide financial security while espousing appreciation for this wonderful adventure called “life.”

Make. Life. Count.

Cheers – Raph

Public Market Update

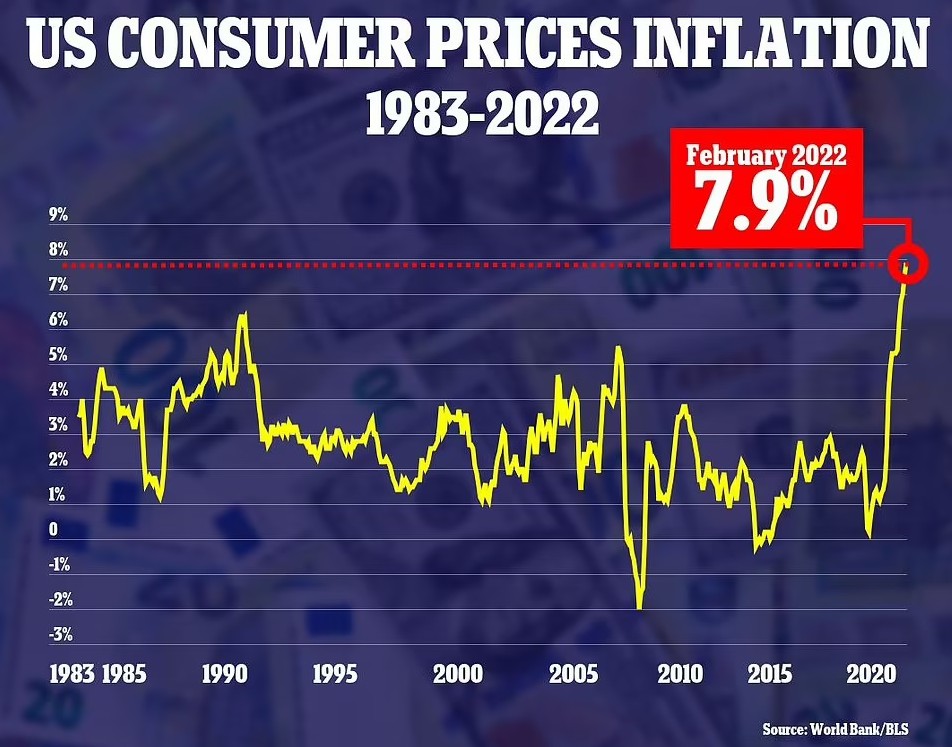

Gauge #1 > US Equity increase to 100% bullish

During Q1-2022, we increased “US Equity” exposure from moderately bullish to fully bullish, while the other two investment gauges (“Fixed Income” & “US vs Global Equities”) maintained their existing positioning.

Our tactical models increased equity exposure to fully bullish when we experienced oversold sentiment indicators in conjunction with constructive technical indicators. This approach allowed us to “buy the dip” while still protecting technically against major declines.

This Q1 sentiment dip reached a 2-year low due to several factors:

- The S&P 500 declined 12% and growth stocks declined 20% at their lowest points (1st major decline since Q1-2020 COVID scare)

- The Fed began raising rates (1st hike since 2018)

- Inflation hit its highest point in 40 years (recently recorded at 7.9% year-over-year)

- War broke out in Ukraine (one of the biggest conflicts in Europe since WWII)

Consequently, we increased equity exposure to portfolios mid-quarter and enjoyed a rebound through the second half of Q1.

We will continue to watch our internal indicators for the following three scenarios ahead: (a) maintain a fully invested position to participate in a renewed uptrend, (b) take some profits off the table if markets surge back to extremely high sentiment levels (e.g., “sell the rip”) or (c) reduce exposure on a renewed downtrend below critical technical levels.

Gauge #2 > Fixed Income Remains Bearish

During Q1-2022, fixed income benchmarks declined by 6% as rates continued to rise. This decline could take multiple years to recover for traditional fixed income investors given the current low-yield environment. The decline also further continues a 5-year downtrend which we have mostly avoided in portfolios by using market-neutral investments (e.g., long credit funds, merger-arb funds, etc.) and private alternatives.

Interestingly, fixed income typically rallies when stocks fall, given their traditional “safe haven” status. However, Q1 saw both equity markets (blue line below) and fixed income markets (purple line below) decline given the rare inflationary environment and the real risk of rapidly rising interest rates.

Chart II – Q1 2022 Stocks vs Bonds Returns (Source: Yahoo!Finance)

As mentioned previously, we continue to protect against a bearish fixed income outlook as interest rates rise.

Gauge #3 > Allocations Remain Overweight US

While all portfolios are globally diversified, our “US vs Global Equity” gauge remains unchanged from the previous quarter, with an overallocation to US equities versus Global.

Looking ahead, there are a few scenarios that could possibly alter this allocation: (a) a further US equity market decline could create a technical shift to Global instead, (b) relatively more attractive Global valuations could warrant an overweight if their markets technically improve, (c) conversely, political and economic issues abroad could give reason to make a shift from Global to even more US, or (d) US has a renewed technical uptrend which would keep the gauge where it is or perhaps further increase its allocation.

Additional Q1 Insights > Commodities Helped

Commodities were one of the few asset classes which increased in value during Q1, jumping 29.1% (the best since Q3 1990). The commodity gain was predominantly driven by a 37.7% increase in the energy sector. However, gold, wheat and other commodities gained value as well. All clients benefited from some commodity exposure during Q1 with allocations to commodities in their diversified LotusGroup portfolios.

Additional Q1 Insight > Hedging Delivered

As we have mentioned in the past, LGA tactical portfolios use a hedging strategy when volatility begins to measurably increase. The strategy’s aim is to mitigate risk against potentially large downside moves. During Q1, we bought and sold volatility hedges multiple times, producing a net positive result. Chart III below provides additional insight into the various trades we made on these hedges, specifically highlighting a short-lived spike higher in mid-March where we were able to take meaningful profits during peak market pessimism. Shortly thereafter, we sold out of the hedges completely and “bought the dip” to move US equities back to a fully bullish position.

Chart III – Hedging Trading in March 2022 (Source: Yahoo!Finance)

In summary, our models performed as expected during the choppy Q1 period. While investment markets were mainly in decline, our diversified portfolios provided some much-needed ballast. Additionally, tactical hedging helped to blunt the downside while positioning us to capture the subsequent rebound.

As always, we will continue to execute our data-driven models consistently and calmly during all market scenarios…while further analyzing ways to improve.

Private Market Update

Connect with Erick here > LinkedIn > Erick Mortenson

We continue to increase client exposure to a diversified portfolio of alternative investments, helping to offset the volatility and risks in current public markets.

These strategies have provided portfolio ballast against recent equity market volatility and have delivered consistent returns relative to lackluster fixed income returns / yields.

Given increasing inflation and economic risks, we are actively underwriting investments that further offer “defensive positioning.”

Let us look at one of the active deals in our sourcing pipeline.

Current Due Diligence > Whiskey-Barrel Financing

The purchase, storage, and aging of whiskey barrels offers investors the opportunity to create meaningful returns in an uncorrelated alternative asset.

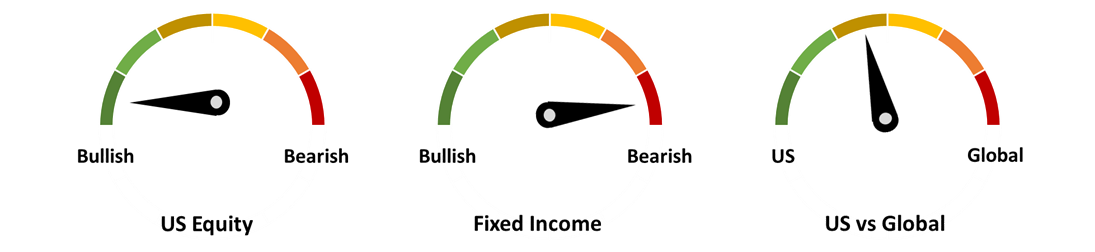

The idea of aging bourbon to enhance the flavor (and the price) originated from consumers noticing that bourbon shipped in wooden barrels on long journeys tasted better than bourbon that traveled short distances to its purchasers. Today, it is well documented that an aged whiskey barrel is worth more after several years of aging than the day it is produced (see pricing example below):

Chart IV – Forecasted Aged Whiskey Pricing (Source: Fund Specific Marketing Decks)

This aging process is one that is simply a function of time and has no correlation to economic or investment markets. Further, spirits and other vices are often considered countercyclical to the economic cycle, with demand increasing during recessions and downturns.

The bourbon and whiskey market is divided into two producer participants.

- Distillery Producers: Distillery producers distill spirits for their own brand, while selling surplus production to third party non-distillery producers (“NDPs”).

- Non-Distillery Producers: Non-distillery producers don’t produce their own spirits and instead purchase their whiskey / bourbon from the distillery producers with excess capacity.

Select distilleries have the capacity and infrastructure to take on more supply but often lack the working capital to fully utilize their facilities.

LotusGroup has sourced an opportunity to provide working capital through a joint venture with two distilleries, producing whiskey barrels at cost, aging them 2-5 years, and then subsequently selling them into the market.

Several due diligence questions remain in our full review process, but we wanted to highlight this opportunity as one of several defensive investments we are looking at today.

Investment Highlights:

- Asset-backed and uncorrelated returns

- Capital constraints

- Inflation-protection

Our investment team believes opportunities like the above may offer a healthy buffer to public market volatility and a more stable return profile for investors.

We will continue to monitor the ongoing market dynamics and strategically underwrite asset classes where we see value.