We hope you are well and enjoying the start of your summer!

Likely you have seen how volatile both the public stock and bond markets have been, triggered in part by inflationary and geopolitical fears. One of our jobs as your advisor is to take care of your financial plan and investment portfolio, especially in market conditions like these. On that note, our investment models are constantly tracking market signals and our team is at the ready to make portfolio shifts when appropriate.

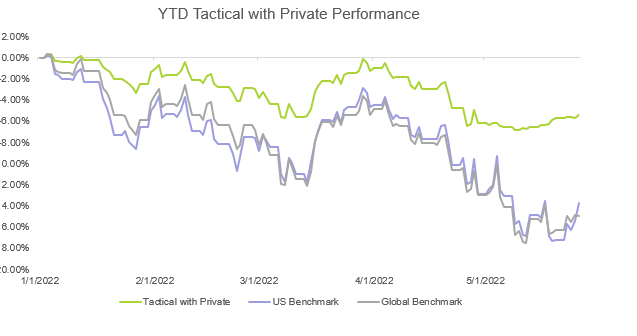

Below you can see an example of how our Tactical models have performed relative to the US and World benchmarks for the year to date in 2022 (LGA model is in green). You will notice the return flat lining in early May, which is when we put on significant hedging to protect portfolios against further downturns. This hedging remains in place today and will only be removed when our signals are showing a more positive technical market outlook.

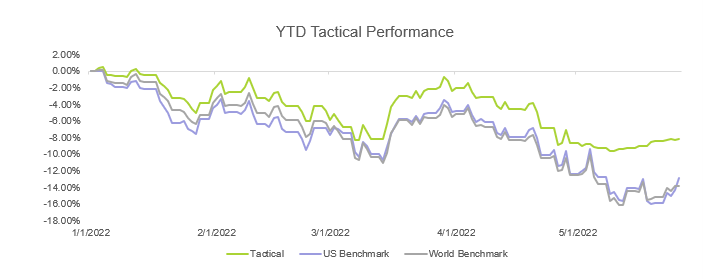

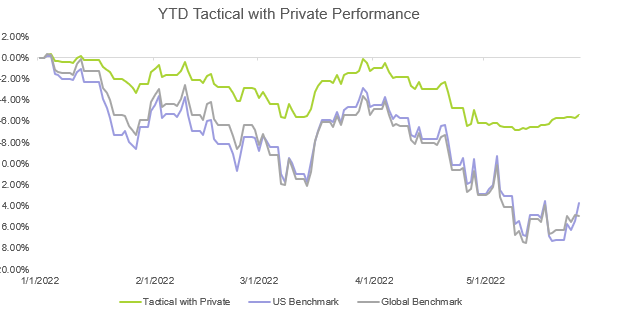

Private investments have also continued to produce positive results through the down market. Below is a chart showing an example of the increased outperformance from adding private into the same tactical portfolio as just reviewed.

The dampening of volatility is a major reason why we have been bullish on private investments in client portfolios. Additionally, many private investments have continued to produce excess yields as compared to current fixed income rates in the public markets.

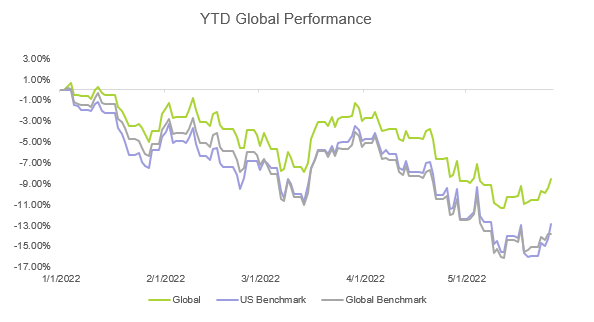

Finally, our Global Rotation portfolios also reduced risk in early May, albeit with a mandate to maintain a minimum of 50% market exposure. You can see the chart reflecting our relative performance below.

In all cases, please know that we are constantly monitoring and adjusting your portfolio to help protect your assets and to achieve your long-term goals.

If you have any questions, please do not hesitate to contact your advisor.

Wishing you the very best,

The LGA TEAM

This blog expresses the views of the author as of the date indicated, and such views are subject to change without notice. Investment advisory services are offered through LotusGroup Advisors, LLC, a federally registered investment adviser. LotusGroup transacts business only in those states where it is appropriately registered or is excluded or exempted from registration requirements. The information contained within is believed to be from reliable sources. However, its accurateness, completeness, and the opinions based thereon by the author are not guaranteed – no responsibility is assumed for omissions or errors. The views expressed herein reflect the author’s judgment now and are subject to change without notice and may or may not be updated. Nothing in this document should be construed as investment, tax, financial, accounting, or legal advice. Each prospective investor must make their own evaluation and investigation of any investments considered or of any investment strategies described herein (including the risks and merits thereof), should seek professional advice for their particular circumstances, and should inform themselves as to the tax or other consequences of any investments or services considered or described herein. LotusGroup’s advisory clients will be required to execute an Investment Advisory Agreement and related Account opening documents (collectively, “Agreements”). If any of the terms or descriptions in this presentation are inconsistent with the terms of the Agreements, such Agreements shall control. Prospective investors should maintain the financial capability and willingness to accept the risks associated with any investments made and should consult the relevant investment prospectus or legal documents, and should their Advisor Representative before making investment decisions (including but not limited to an examination of the investment objectives, risks, charges, and expenses of any investment product(s) considered). To better understand the nature and scope of our advisory services and business practices, readers are encouraged to review via the SEC’s website @ www.adviserinfo.sec.gov, the adviser’s Form ADV Disclosure(s), and the Form ADV 2B Brochure Supplement of each LotusGroup Investment Professional. Additional important disclosures can also be found at www.lgadvisors.com, by calling us at 720.593.9861 e-mailing us at info@lgadvisors.com or by visiting us at our offices located at 1005 S. Gaylord St., Denver CO 80209. This blog, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without our prior written consent. The material presented here is intended as an educational discussion of historical market statistics, investment theory, and risk metrics. Some of the information contained herein are cherry-picked results and may not be indicative of all client’s results. It is not intended to be and shall not constitute an offer to sell or the solicitation of an offer to buy any security or investment service. The information provided, while not guaranteed as to accuracy or completeness, has been obtained from sources believed to be reliable, and is subject to change without notice and may or may not be updated. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Alternative investment returns may fluctuate and are subject to market volatility; an investor’s shares, when redeemed or sold, may be worth more or less than their original cost. An investor could lose all or a substantial amount of their investment. Often, alternative investment fund account managers have total trading authority over their funds or accounts; the use of a single adviser applying (usually) similar trading programs could mean lack of diversification and, consequently, higher risk. Managers typically seek absolute positive investment performance by targeting a specific range of performance and attempt to produce targeted returns irrespective of the underlying trends of the stock market. There can be no assurances that a manager’s strategy (hedging or otherwise) will be successful or that a manager will use these strategies concerning all or any portion of a portfolio. Please see your LGA Quarterly Report for your specific performance results.