Legacy planning is the process of shaping how you want to be remembered, both in your personal values and financial contributions. Just as an artist creates a painting – with careful planning and layers of complexity, individuals must determine their legacy, defined by their actions, relationships, and wealth. In legacy planning, aligning financial decisions with personal values becomes essential to create a meaningful impact while you’re alive and after you’re gone.

What is Legacy Planning?

Legacy planning is more than just estate planning or wealth management—it’s about intentionally structuring your life and finances to reflect your values, priorities, and vision for the future. Many view their legacy as what is left behind once they’re gone, but it can be a powerful force in life now, guiding how you spend your time, energy, and resources. A solid financial and estate plan ensures your wealth is distributed according to your wishes, securing your family’s future while allowing you to make a lasting impact on your community, family, and causes you care about.

In both wealth management and estate planning, people often think about their legacy too late—after most of their life’s work has been completed. However, incorporating legacy planning early allows individuals to align their financial assets with their broader life goals, leading to more significant contributions and a lasting positive influence on the world.

Step 1: Reflect on Your Legacy

The first step in legacy planning is introspection—considering what you want to be remembered for and how you want your financial assets to be allocated when you’re gone. Ask yourself:

- What do you value most in life?

- How do you want to be remembered by your family and friends?

- Do you want to be remembered for your charitable contributions, business acumen, or relationships?

One effective exercise is to write two versions of your epitaph: one reflecting how people currently perceive you and another representing how you would like to be remembered. The gap between these two versions may highlight areas in your life where you want to refocus your time and resources.

For example, if you want to leave behind a legacy of philanthropy but have not yet started significant charitable giving, this reflection can inspire you to integrate charitable donations into your estate or financial plan. Doing so ensures that your wealth is directed toward causes that matter most to you.

Step 2: Prioritize Your Legacy Goals

The next step in legacy planning is prioritizing how you want to allocate your wealth and resources. It involves looking at both your current financial situation and future goals. Whether your focus is on family inheritance, charitable giving, or safeguarding your business’s future, these priorities will shape your legacy.

Consider setting up a donor-advised fund to facilitate charitable donations while you’re still alive. This allows you to experience the positive impact of your contributions in real time while receiving an immediate tax deduction. A proper wealth management strategy can help you balance short-term spending with long-term legacy goals.

At LotusGroup Advisors, we recommend taking time to review your estate documents, including wills, trusts, and business succession plans, to ensure your family and intended beneficiaries are protected.

Learn more about estate planning and how it safeguards your legacyPriority and commitment are key to helping you fund your legacy.

Step 3: Establish a Giving Plan

A well-structured giving plan ensures your wealth benefits not only your family, but also the broader community and the causes you care about. Unfortunately, many people delay this step due to a lack of knowledge or fear of complex legal documents. However, starting your legacy planning with a clear giving strategy is essential for aligning your financial resources with your values.

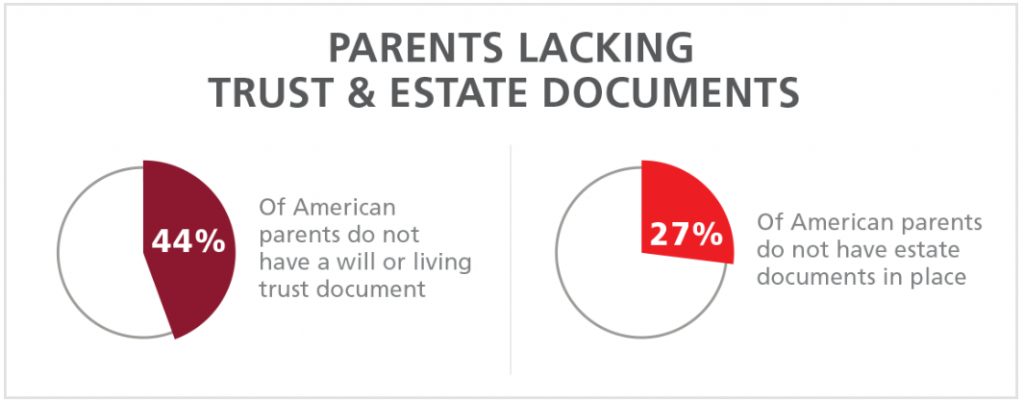

Statistics show that 44% of Americans do not have a will or living trust, and 27% do not have any estate planning documents in place. This lack of preparation can leave families vulnerable to financial uncertainty and disputes.

Chart I – Percentage of Parents Lacking Trust & Estate Documents (www.caring.com)

By creating a will, trust, or estate plan, you can specify how your wealth should be distributed, ensuring that your assets go to the right people and causes after your death. For business owners, this might include setting up a succession plan to ensure the continuity of the company you worked hard to build.

Forbes guide to setting up a charitable giving plan

Why Now is the Right Time for Legacy Planning

Given the financial uncertainty that many individuals face today, there’s no better time than now to start thinking about your legacy planning. Aligning your financial goals with your values early on will give you peace of mind knowing that your wealth will be used effectively, whether by supporting your family or contributing to causes you care about.

Many people wait until retirement or late in life to start legacy planning, but by starting now, you can see the positive outcomes of your contributions and ensure your wealth is properly managed. A proactive approach not only benefits your family but also helps minimize taxes and maximize the impact of your estate.

Explore our wealth management strategies at LotusGroup

Tools and Strategies for Effective Legacy Planning

Here are some essential tools and strategies for your legacy planning:

- Estate Planning: Create or update your will, set up trusts, and ensure that your estate plan is comprehensive and reflects your current priorities. This is a critical element of securing your family’s financial future.

- Donor-Advised Funds: These funds allow you to donate now, receive immediate tax benefits, and distribute the funds to charities over time. It’s an effective way to experience the impact of your contributions.

- Wealth Management: A robust wealth management strategy involves more than just investing. It ensures your assets are growing and protected while aligned with your long-term goals.

- Tax-Efficient Giving: Work with a financial advisor to explore tax-efficient strategies, such as charitable remainder trusts, which allow you to donate to causes you care about while retaining income for yourself during your lifetime.

Check how donor-advised funds can help your legacy planning with us.

Legacy planning is about more than just financial wealth—it’s about ensuring that the values, relationships, and passions that matter most to you are preserved for future generations. By reflecting on what you want to be remembered for, prioritizing your legacy goals, and setting up an intentional giving plan, you can create a lasting impact on your family and the world.

At LotusGroup Advisors, we specialize in helping individuals align their financial resources with their life goals, ensuring that their legacy is one of purpose and significance. Whether it’s crafting an estate plan, managing wealth, or setting up a donor-advised fund, we’re here to help you navigate the complexities of legacy planning.

Contact us for a consultation on legacy and wealth management

Let us help you find and fund your legacy today.