Market Overview & Commentary

Retail investors have joined the financial news media in an overwhelming obsession with why investment markets should be collapsing.

Fear-mongering topics include: Euro-zone uncertainties, US municipal bankruptcies, election-year uncertainties, congressional fiscal cliffs, central bank manipulations, low volume markets, etc.

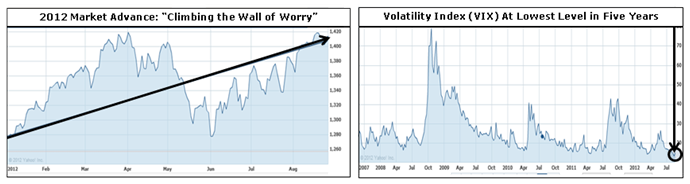

Yet despite all the negative protestations, markets continue to steadily “climb the wall of worry,” with the “fear” index (Volatility: VIX) declining to the lowest levels in the past five years.

Chart I – S&P 500 YTD Advance on Lower Volatility

While many have missed out on the rally over the past three months, the million-dollar question for today is whether recent market developments point to further upside ahead, or whether they indicate a level of complacency that could lead to renewed declines.

In trying to answer this question, it is important to look more closely at the various asset classes and sectors that comprise “the market.” Major shifts that we are seeing include the following.

- New economy companies continue to take share from old-model companies, with definitive winners and losers taking shape. For example: Apple & Google continue to advance while old-model companies like Hewlett Packard and Dell continue to decline.

- Safe-haven countries and sectors continue to attract nervous investors, while areas with greater perceived risk remain depressed. For example: US equity markets are trading at valuations that are 30-60% higher than European and Emerging markets.

- Low interest-rate dependent sectors continue to surge while economically sensitive sectors remain stagnant, a key outcome of a Fed-manipulated “recovery.” For example, bonds have surged to new records as their yields have declined to historically low and unattractive levels. By contrast, resource and manufacturing-driven economies continue to struggle as GDP and trade remain depressed.

So What Does All This Tell Us?

The adoption of new technology and global trade has caused major changes in how consumers, businesses, and entire countries operate.

In conjunction with these changes, governments around the world are manipulating markets like never before, attempting to ease the transition for those countries, companies, and individuals that are being left behind.

Unfortunately, such large manipulations are challenging to predict and have many unintended consequences.

Additionally, the existence of crony capitalism creates an unfair environment where those with connections are bailed out at the expense of those who do not, with widespread anger and resentment as the natural result.

As investors, the most prudent course is to identify likely long-term winners, to reduce near-term risks, and to make investments during irrational short-term declines. At LGA, we have been focused on accumulating positions that we believe are undervalued and will have significant long-term appreciation.

We couple these positions with some hedged alternative investments to help protect against downturns.

Finally, we have been opportunistic buyers during the numerous short-term pullbacks over the last 3-4 years. While the current environment can be trying at times, we believe there will be vast rewards to enjoy as economies and markets stabilize and reach their “new normal” over time.