(“Orographic lifting of the air – NOAA”. Licensed under Public Domain via Wikimedia Commons)

In late 1929, Business Week observed:

“This is the longest period of a practically uninterrupted rise in security prices in our history…The psychological illusion upon which it is based, though not essentially new, has been stronger and more widespread than has ever been the case in this country in the past. This illusion is summed up in the phrase ‘the new era.’ There has been the same widespread idea that in some miraculous way, endlessly elaborated but never actually defined, the fundamental conditions and requirements of progress and prosperity have changed, that old economic principles have been abrogated…that business profits are destined to grow faster and without limit, and that the expansion of credit can have no end.”

The above words could just have easily been written prior to the 2000 dot-com crash, when the internet economy was creating ‘a new era’…or in 2007 when a ‘new era’ housing boom meant prices would never go down. These exact words are uttered today, with ‘investors’ believing that central bank quantitative easing has put a floor under markets as far as the eye can see. The irrationality of bull peaks is different every time, and yet the words/results are always the same.

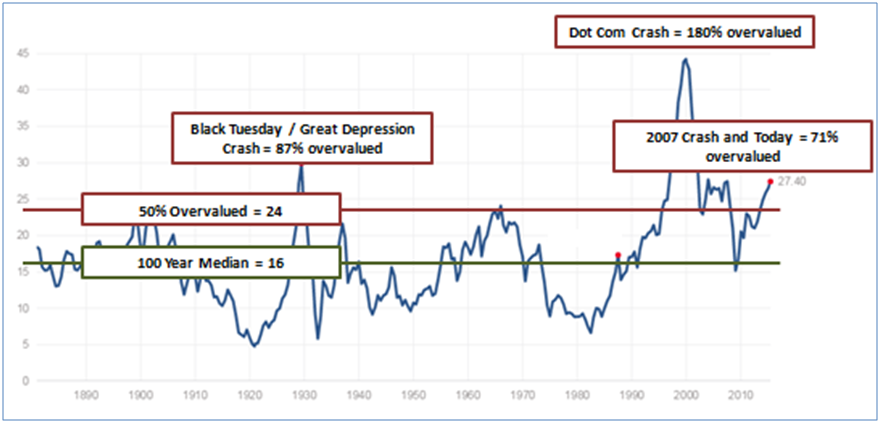

Stepping away from the rhetoric, let’s take a look at historically reliable metrics to determine where we actually are today relative to history. The first relevant metric is the 10yr Shiller price-to-earnings ratio (see Chart I):

Chart I – 10yr Shiller PE Ratio since 1880

In reviewing Chart I, a “new era” enthusiast might point out that the Great Depression peak (87% overvaluation) and at the Dot-Com peak (180% overvaluation) exceed the current 71% overvaluation. She might therefore conclude that there is more room to run (which of course there might be).

However, the data clearly shows that we are not just at ridiculous levels (which we had already achieved way back in May of 2013), but absurd ones at that. Markets have only been higher twice in the past 135 years, with both instances resulting in dramatic 50-80% market declines.

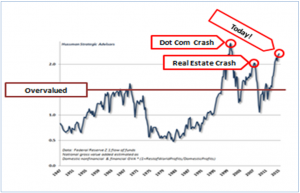

Looking at a second historically reliable metric (see Chart II below – Market Cap to GDP, which measures the price of the entire US market relative to the output of the nation), we also see that we are at nosebleed levels that have previously resulted in 50%+ crashes.

Not only has this metric climbed to the second highest bubble reading in history, but on Friday May 29, 2015 as this newsletter was written, GDP was reported to have actually contracted in Q1/2015, which would cause the chart to rise even higher once the most recent data is updated.

Chart II – Market Cap to GDP Ratio

Once again, a late-stage enthusiast might claim a bit more room to run, but this would be to the single highest extreme in history, only to be followed by a 50%+ decline.

The moral to this story is to stay patient, and stay conservative…we are not in “a new era,” and the US public investment market bubble will eventually correct as it always does.

Global Market Returns

Since May of 2013 (two years ago), we have been warning about market overvaluations. In the US, this warning was too early.

However, US markets have begun to chop around in the last 3 quarters, with very little return to show and with Q1/2015 being the first quarter in years with negative US equity profits and GDP contraction.

Our warnings have been more accurate for asset classes outside of the US, with global assets having underperformed for the past 2 years.

Foreign developed equities are up 9%, and global real estate is up 4%, but emerging markets are down 2%, total bond markets are down 2%, and commodities are down a whopping 33%.

Taken altogether, a globally diversified portfolio has treaded water for the last 2 years, and being in cash has been the better reward vs risk positioning.

Predicting exact timing on any asset class decline is impossible. But choosing attractive levels for entry and exit is more predictable, and only requires patience on the part of the investor to wait for the tides to turn.

Portfolio Mini-Update

Clients in our Global Index and Global Rotation portfolios continue to be diversified and fully invested. Tactical Active and Absolute clients have been much more heavily weighted to conservative assets such as cash and volatility hedges.

These portfolios have been patiently awaiting the inevitable decline, with dry powder to pounce on incredible opportunities / bargains once the bear cycle arrives.

NEW Private Equity Offering

During early Q2, we rolled out an exciting new private equity offering that has been in the testing phase for the past five years.

This new service was offered to all our accredited clients, defined by the SEC as those with investable assets in excess of $1 million or with an individual annual income of over $200K or $300K if joint as a couple.

The new private investment offering answers today’s question of, “Where do I put my excess cash to work when public markets are overvalued and overheating?”

While public markets are hitting nosebleed levels, a multitude of private markets remain very reasonably valued, and have some recession resilient qualities to them.

For example, we have helped our accredited clients make investments in private auto dealerships (valuations of 4-5x profits with 15-20% returns versus public market dealerships with 15-18x profit valuations and only 5-8% returns), mobile home parks (their bull market is a bear market), co-working space (laid-off workers in bear markets tend to start their own businesses and co-working spaces thrive).

We plan to continue sourcing one opportunity per quarter, with new areas of interest in tax lien collections, private debt, cold-storage facilities, and additional co-working spaces.

For those clients that are not yet accredited, we look forward to helping them make progress towards this level. We will continue to provide our counsel, encouragement, and public market investment strategies to achieve their goals.

We are always working on new ways to help our clients grow…stay tuned for more.