We Remain in the Midst of a Concerted Global Bear Market

After yearly market lows in August and September, we saw a moderate bounce in select risk assets for the last quarter of 2015.

Developed market equities rebounded off of lows, along with real estate assets…whereas emerging markets and fixed income continued to slide, and commodities further hemorrhaged losses.

But even Q4 proved a fleeting bounce, as declines resumed in the early parts of 2016 across all asset classes.

Despite proclamations from mainstream media and our government that all is well, we are in the midst of a grisly global bear market; and the US has now joined in.

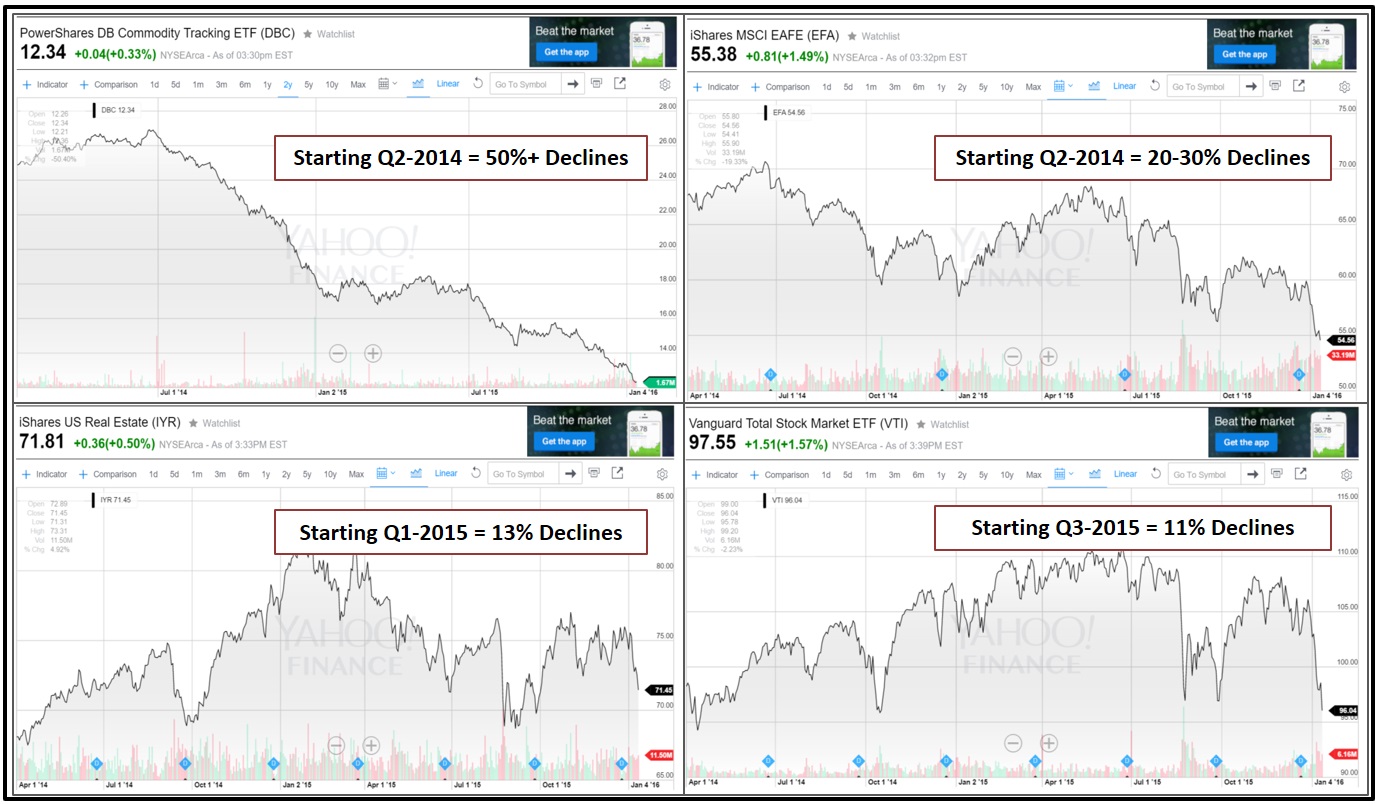

Consider the following trends in traditional risk assets:

- Commodities kicked of the bear market in early 2014 when they started declining consistently quarter after quarter (now down 50-60%).

- Global equities also peaked in early 2014. Plotting a choppy path forward, the overall trend has been down, with markets consistently hitting new lows.

- Real estate was next, peaking in early 2015. After declining through September of 2015, real estate rebounded slightly near year end before resuming its decline in early 2016.

- Finally, US equities peaked in July 2015 and began to decline. During late 2015 there was a temporary rebound before all gains were again given up in the first two weeks of 2016.

Charts for Traditional Risk Assets From Early 2014 Through Early January 2016

Even traditionally lower-risk assets such as fixed income (bonds) have been in decline since early 2015 in this global bear market (nowhere to run and nowhere to hide).

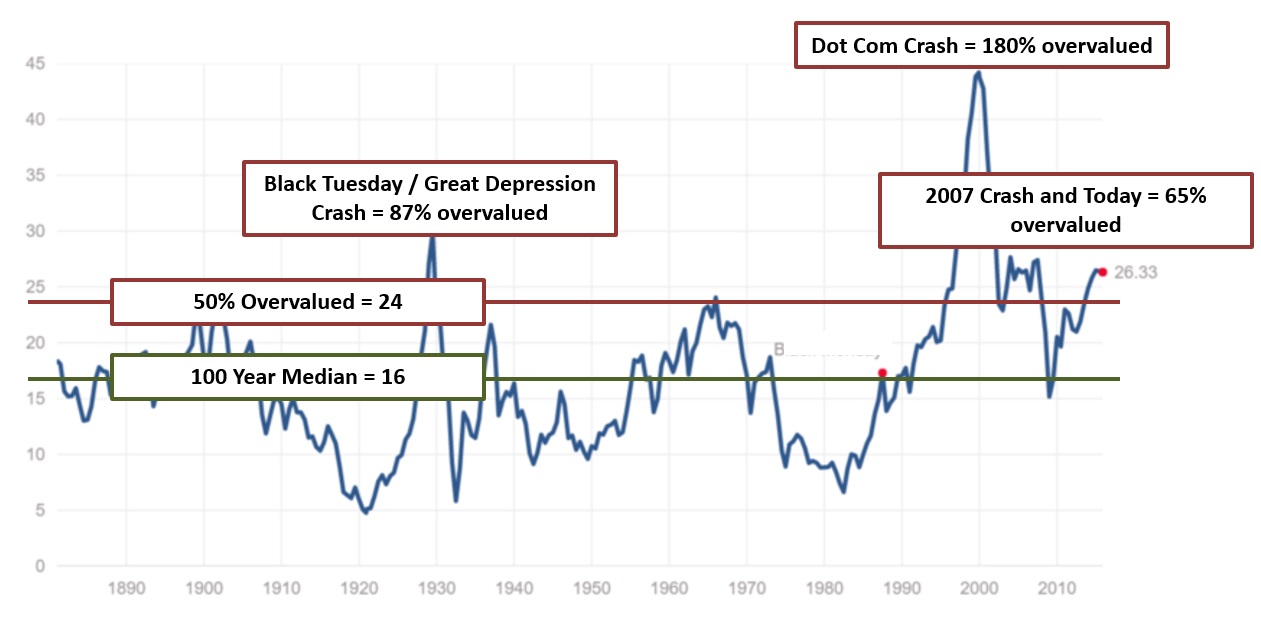

Major pockets of overvaluation still exist, especially in US equities (stocks) where we believe prices could still be 50-60% overvalued.

However, these two years of declines are finally presenting investors with some opportunities to invest at reasonable prices, particularly in select commodity sectors and emerging market equities.

Read more below for our portfolio positioning to address this new two-way investment environment.

Portfolio Positioning Part I: We Predominantly Remain Defensive For Tactical Portfolios

Despite two years of global declines, US equity markets remain heavily overvalued.

Chart I – The Shiller P/E Ratio Is Higher Than All Previous Peaks (with the exception of the Great Depression and Massive Dot Com Bust)

Please refer to our previous blog posting for more information on our valuation techniques and assessment of US equities: LGA Recent Blog On US Market Overvaluation

The multi-year global bear market is only now catching up to US equities, with a meager 10% current correction.

As such, we are positioned defensively in the US for our tactical portfolios.

This means that client portfolios hold a lot of cash, and a heavy dose of portfolio insurance through long volatility positions.

For more fully invested portfolios (i.e. our global rotation models) we are overweight defensive sectors to offer relative protection.

This positioning can indeed be boring while we continue waiting for major corrections, and worse it can be down right frustrating when markets sporadically shoot higher and we don’t.

However, avoiding major 30-50% declines is imperative to long-term success.

- We have so far avoided the majority of 50%+ declines in commodities.

- We have also so far avoided the majority of 50%+ declines in emerging markets.

But there are steeper declines ahead for both US equities and Foreign Developed Equities; thus we have positioned accordingly.

Portfolio Positioning Part II: Mauled Asset Classes Are Finally Attractive; and We Have Begun Buying Small Positions

Reading our blog posts for the past two years, one could be easily forgiven for believing that we are public market “perma-bears”, never seeing an opportunity good enough to buy.

However, the current environment is finally presenting us with some attractively-valued investment opportunities.

So the next question is, “When will they become attractive enough for purchase?”

The first signal for us is a valuation so inexpensive that it represents an attractive long-term opportunity. At this price level, we start to nibble.

The second signal is when pricing stabilizes, and then finally starts rising again.

This second signal can have a number of false breakouts, followed by renewed selling…but it eventually becomes the real deal, with strong price movements upwards.

When we have both inexpensive valuation and consistently increasing price action, that is the time when we back up the truck and start loading up on the investment in earnest.

Let’s take a look at areas where we have begun to nibble:

- Energy MLPs: With oil prices hitting $30 per barrel, the oil exploration and production companies are still too risky. But we are nibbling on infrastructure companies known as MLPS, the businesses that move oil and natural gas throughout the country. MLPs have declined by more than 50%, but have long-term supply contracts with volume pricing that doesn’t decline when oil prices decline. While risk still exists, these positions present a fabulous entry price for long-term investors, and they pay out a healthy 7-10% dividend while we wait for better times.

- China Equities: We are also nibbling on emerging market equities in China, after a brutal 60% market selloff. While China has its share of troubles, it is now trading at 20 year valuation lows. China is decelerating growth as it transitions from a manufacturing-based economy to a more consumer-driven and services economy. But China is only decelerating from 7% to 6% growth, easily twice the rates of the US. They also continue to have a healthy fiscal situation with surpluses in exports vs imports, and a sizable national wealth fund rather than the $17 Trillion in debt that we face in the US. Today’s prices present long-term investors with an attractive entry point.

- REITs: Finally, select real estate investment trusts (REITS) have declined to such lows that their dividends are now paying in the 8-13% range. It takes a little searching, but specific REITS in this space have solid asset backing, along with reasonable debt to equity ratios. When we find these opportunities, they are worth nibbling at, locking in a solid dividend while we wait for markets to turn around and for the REIT to appreciate in value.

There are a number of other areas where we are looking or nibbling, but these initial positions are still currently a small fraction of the portfolio.

Remember, just because these areas represent solid long-term values does not mean that they will immediately turn around from their depressed funk.

In fact, it is more likely that they will continue to lull and decline for a while, before eventually rebounding when a new and positive catalyst arrives.

When that does occur, and we get our second confirmation signal with rising prices, we will more aggressively increase our investment allocation in these spaces.

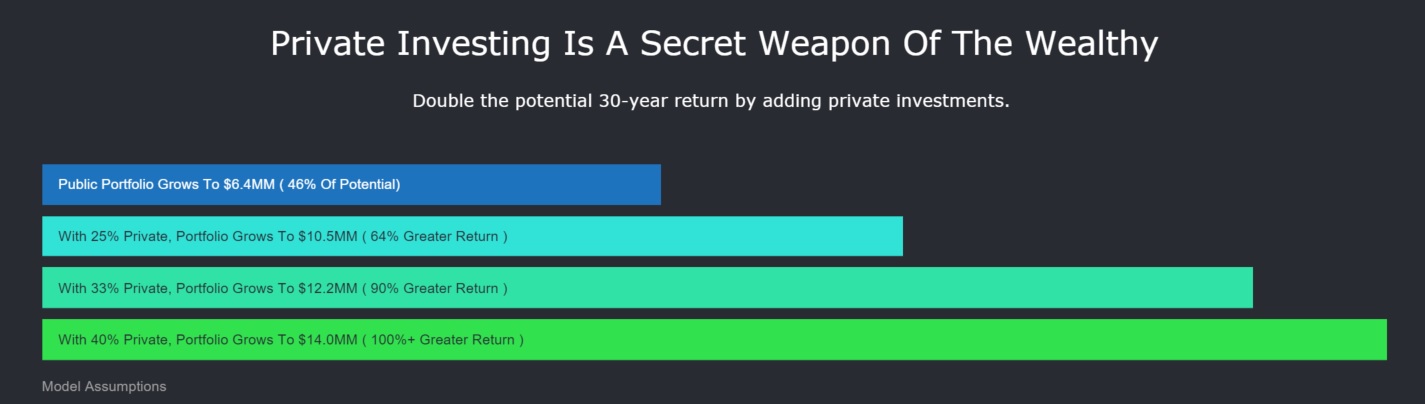

Private Investments Contributed to Returns in 2015, And Will Nearly Double Cash Flow in Early 2016

While we have been waiting for public markets to come back down to earth, more and more of our accredited clients are participating in our Private Investment Program.

The program was initially aimed at generating higher long-term returns, and for many people that is still why this program is so attractive to them.

The feedback heard is that cash flow provides freedom.

- Cash flow is providing our working professional clients with the freedom to consider career changes.

- Cash flow is providing our entrepreneurs with the freedom and the ability to go take risks.

- Cash flow is providing our retirees with the freedom to pursue life vigorously and worry-free

Regardless of stage in life, the consistent growth of income and cash flow has been a huge mental boost to our clients…

…and for 2015, we placed a whopping 107 total private placements with clients: representing $9 million of investments, and over $1 million of passive income – cash flow!

While half of the placements began to generate cash flow in 2015, the other half will start to payout during Q1 and Q2 of 2016.

If you are an Accredited Investor with interest in this exciting way to invest, please contact us for a quick review of your situation and explanation of the program*.

If you are not yet Accredited, please let your dedicated LGA Advisor know that you aspire to get there; and we will do our best to help plan out the steps needed to get there.

In a nation where 90% of millionaires are first-generation, there is no reason why we all can’t achieve that milestone in our lives, with the correct guidance, behavior, and discipline.

Make. Life. Count.