As Autumn beckons and leaves begin to change colors, we are reminded of the balance between light and dark, of letting go, and of the impermanence of things.

We are also reminded of upcoming pumpkin pie and spending time at the holidays with family and loved ones.

We are going to discuss these two topics and how they pertain to investment markets.

First, we will tackle the impermanence of en vogue investment strategies.

Second, we will talk about a tasty piece of investment pie that our clients are feasting on: private placement investments.

Market Returns and the Impermanence of En Vogue Strategies

Diversified public markets have had lackluster performance for 2+ years now.

Q3/16 wasn’t much different.

Global equities temporarily rallied, with modest gains in the US and foreign developed markets (all of which have evaporated in the first two weeks of the new quarter).

While larger gains were enjoyed in emerging markets, real estate and fixed income declined as interest rates began to rise ever so slightly from 100 year lows (as discussed in previous blog posts, fixed income is a massive bubble waiting to pop).

Even commodities, which rebounded well last quarter, continued their 2+ year slide downward.

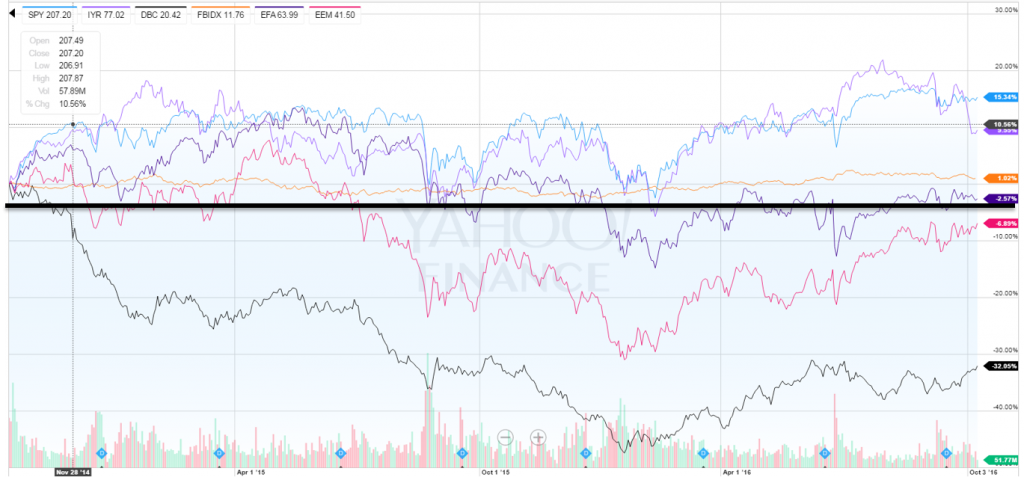

As you can see in Chart I below, there has been a very sideways trend for the last two years, with the net-net being a very flat to low return for a globally diversified basket of investments.

Chart I – 2 Year Returns By Investment Asset Class

While non-US markets have partially cleansed themselves of overvaluation, the US has yet to do so.

Some may say it is because of Fed easing.

Others suggest it is because other markets are so unattractive, and the money is fleeing to the US.

However, in the end, market cycles are always completed and the US bull market will not be permanent…it never is.

This time is not different…in the end, valuations do matter, and the Autumn beckons.

Furthermore, buy-and-hold strategies are winding down from their heyday, and will not be the best strategy to take in the years ahead…this too is not permanent.

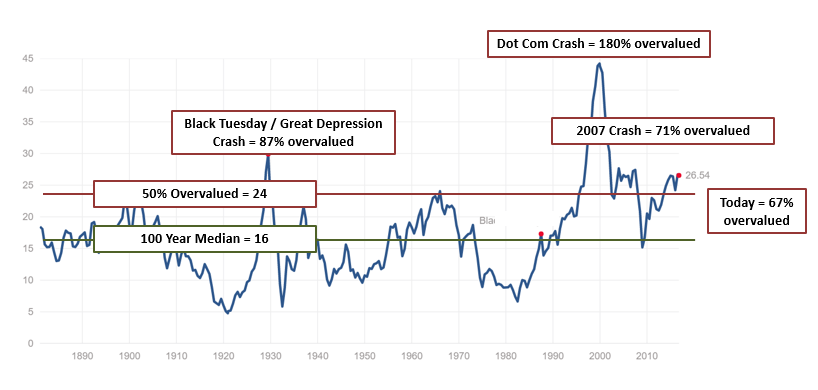

In the past, we have shared US valuation charts like Chart II below (updated for recent data and showing the S&P 500 to be 67% overvalued):

Chart II – The Highly Accurate Shiller PE

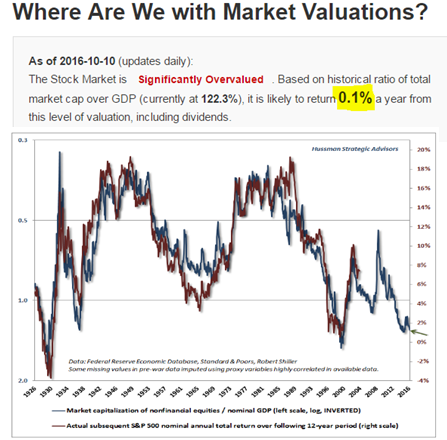

We have also highlighted the Market-Cap-To-GDP ratio, a favorite Warren Buffet metric that correlates to the next 10 year returns on the S&P 500 with a stunning 93% accuracy level (see chart III below):

Chart III – The Current Market Cap to GDP Ratio

It is quite alarming to think that US long-term rewards are likely to be a nominal 0.1% per year while we are also likely to have a 40-50% decline to correct the overvalued situation.

From a reward to risk perspective, a 0.1% reward with a 40-50% decline potential is highly unattractive.

However, the inevitable correction will work to fix the overvaluation situation, as it will also restore long-term returns to their more widely expected 8-10% per year average.

So while we approach the Autumn time period, a time to reflect, a time for some things to die off and then refresh…we would remind investors that the US bull market and it’s out-performance will never be permanent.

There will come a time for decline…and in our opinion a pretty large and healthy one.

And thereafter we expect a renewal of opportunity.

That’s how it’s always been.

That’s what life and market cycles are all about.

It’s always a bit different…and yet it always ends (and begins) the same way.

Portfolio Results for Q3 2016

Based on our behavioral approach to investing, clients select different types of investment strategies that best fit their personalities.

For clients in more fully invested strategies (Global Rotation and Global Indexing), Q3 portfolio returns were modestly positive, with gains slightly outpacing losses.

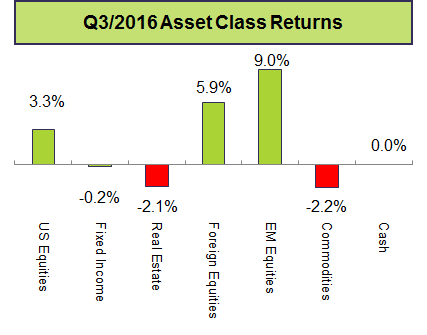

Depending on a client’s risk profile, the positive Q3 return varied based on the mix of the various investment classes included in the portfolio (see Chart IV below for returns by asset class in Q3).

Chart IV – Asset Class Returns for Q3-2016

In our tactical portfolios (Tactical-Absolute, Tactical-Active, and Tactical-Emerging), we remained very conservatively positioned based on highly overvalued markets.

For these portfolios as well, returns depend on model and risk profile for each client.

Clients in Tactical-Emerging for the most part had a modest gain while being nearly 50% risk off.

Clients in Tactical-Absolute and Active had anywhere from a slight gain to a slight loss, with negatives driven by the costs of hedging against a decline that has not yet happened.

While hedges dragged slightly in Q3, clients saw their benefit in the Q1 10% down market tremor, and now as Q4 begins and markets again are in decline, the hedges have kicked in to protect capital.

We will keep these on until we get a meaningful 20-40%+ decline in US markets, and valuations become more attractive.

Go Forward Expectations By Investment Strategy

There are some major differences between fully invested and more tactical investment strategies.

For fully invested strategies, there is no real protection against temporary market declines, as the strategy is to ride out the storm, have discipline, and to focus on the long-term.

Conversely, in our tactical strategies, the last inning or two in a bull market will likely be missed, but the overarching principal is to protect capital against major declines, and then to re-enter at better valuations.

Since nobody can ever perfectly time the markets, it is best to choose one of the above types of strategies, calibrate it to a risk profile, and then stick to it through a full cycle.

At LGA, we work with clients to choose a strategy they will stick to when it doesn’t work…because it is easy to stick with a strategy when it does work.

As stated previously, no strategy will “win” forever…they take turns.

For now, fully invested strategies have dominated for the past few years, slowing only recently around the globe.

However, we expect these strategies are near the end of their most recent cycle run-up, with either a bear market ahead, or at best lackluster 10 year returns.

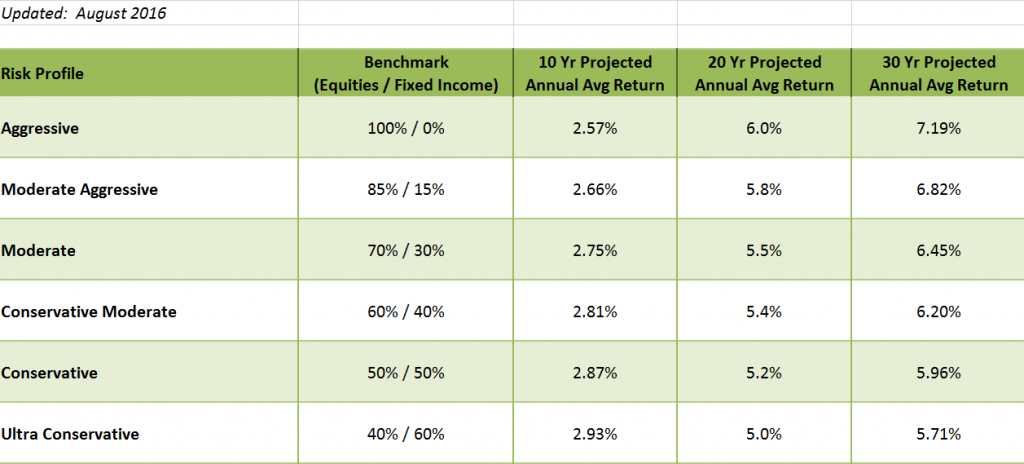

We periodically update our LGA Market Return Assumptions for fully invested strategies, combining Shiller PE, Market-Cap-To-GDP and a variety of other highly correlated indicators.

The net result is Chart V below which illustrates how a 20-30 year time horizon can still deliver reasonable returns for a fully invested strategy.

Chart V – LGA Forecasts For Pure Buy-And-Hold Strategies

However, it is clear that over the next 10 years, even when including inflation, the expected returns from being fully invested are unattractive.

Couple that with the prospect of a major bear market at some point.

Conversely, while tactical risk-off strategies have missed out on nominal market returns in the US (while they have helped to avoid losses overseas and in commodity markets), they will be well positioned to protect capital when the US bear market arrives…

…and clients will also then have the cash to pick up assets on the cheap.

Probably the most famous and successful tactical investor of all time has been Warren Buffet, who as of mid-summer 2016 had compiled $73 billion of cash (a greater than 50% cash position in his Berkshire Hathaway).

Do you suppose he worries about missing out on the last few innings of the market cycle?

One doesn’t have to look back very far to see how valuable a pile of cash can be.

In the wake of the financial crisis of 2008-2009, there were absolute bargains to be had, and tactical investors like Warren Buffet and LGA had the pick of the litter.

Buffett compares tactical investing to baseball, except that investing is a game where the hitter can stand at the plate indefinitely waiting for the right pitch.

Sure you may not always get a hit when others are, but you can conserve your energy and wait for that fat pitch.

Final comment on this topic area:

When your investment strategy isn’t “working” (i.e. fully invested strategy in a bear market declining, or tactical strategy is lagging near the end of a bull market), it is natural to not be comfortable, to be a little unhappy and impatient.

That feeling is the price an investor has to pay in order to generate the long-term returns…nothing comes for free.

However, if your pain threshold is becoming intolerable, that’s a time when it makes sense to reach out to your LGA Advisor to discuss how you are feeling, and explore whether your portfolio is calibrated properly.

Adding Private Investment Pie – Yum!

OK, we promised you a nice piece of holiday pie.

While public markets flounder, we have continued to work incredibly hard to source attractive opportunities and to help clients invest in now 180 private placements!

Today, nearly 20% of client assets are allocated to this growing slice of the investment pie…and nearly 75% of LGA clients are participating in some way, for both fully invested and tactical clients..

The major draws include the following:

- Valuations that are far more reasonable than in public markets

- Asset prices that are more stable and don’t bounce all over the place

- Consistent income, resulting in consistent returns

- Recession resilience

Furthermore, as the program grows through your participation and referrals, we are gaining the leverage to negotiate better terms with program sponsors (i.e. lower fees, higher payouts, and lower minimums).

Whether the next 10 years bring forth a “muddle-through” public market scenario, or a more likely bear market scenario, private investments are delivering consistent income and protection to client portfolios.

For accredited LGA clients, we will be bringing between 3-4 new opportunities in the coming months, as well as the re-opening of 2-3 favorite opportunities that had been fully funded in the past.

We will continue to get more LGA clients involved, to onboard their referred friends and family, and to help those that are already involved get even more deeply invested.

For those clients that are not yet accredited, our team will continue to support your personal income growth efforts and aspirations, and to develop and maintain solid savings habits.

We hope there is a day when 100% of LGA clients will be able to eat a slice of this wonderful pie.

All the best, and an early Happy Holidays!