Election Musings

Regardless of whether one was a Trump, Hillary, or third party supporter, nearly everyone was surprised by Trump’s recent electoral college win.

Much has been discussed, both logically and emotionally, since that fateful evening…and many have searched for answers.

Further, it is difficult to put Trump in either the traditional Republican or Democrat bucket…as his pronounced policies are a mix and match of both parties.

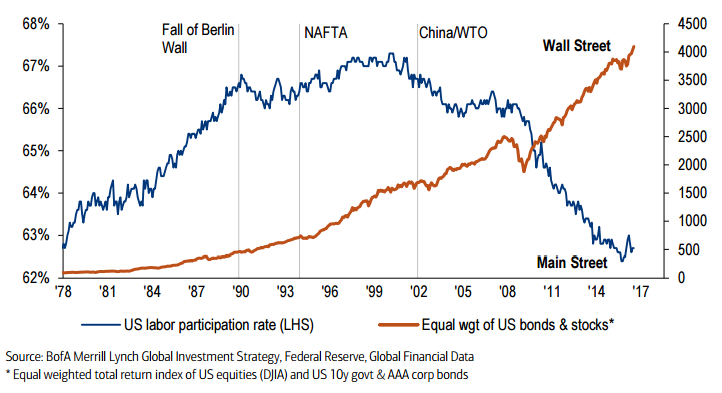

From our perspective, the below chart does a very good job of explaining the unifying, but non-partisan trend that Trump represents (see chart below):

The chart illustrates how financial assets have benefited greatly while labor force participation has steadily declined to 40 year lows (meaning many people have just flat out stopped looking for work).

This is a prime example of the rich getting richer, and the working poor getting poorer…the wealth divide so often discussed in popular culture.

Starting with Bill Clinton (a Democrat), continued by George Bush (a Republican), and most recently with Barrack Obama (a Democrat), these two secular trends have persisted for four decades.

Our view is that this was the unifying trend for Donald Trump.

It was not about choosing the Republican or Democrat party…it was all about unemployed, low-wage, and middle-class workers revolting against the elites who have ignored these realities.

And when people revolt, all the rules are thrown out the window.

Have We Lost Our Jobs To Other Countries?

Another interesting topic surrounds the talk about how many US jobs have been shipped overseas…when the facts show that our technology revolution has by far been the larger job killer over the past two decades.

No longer do we have travel agents, instead we have automated websites.

No longer do we have large amounts of factory workers…now we have sophisticated robots, controlled by 1-2 key employees.

No longer do we need large numbers of farmers, field hands, store employees, clerks, etc…when large machines, and internet shopping with national logistics systems take over.

These jobs weren’t shipped overseas…they were just eliminated by technology.

And this trend is only going to continue (click here for an interesting article on The Digital Revolution)

Along the way, companies have benefited with higher profits.

But society has benefited too via more output per laborer, creating a higher output for all.

Today’s middle or low-income earner can afford automobiles, air conditioning, flat screen TVs, iPhones, etc…and can communicate with virtually anyone on the planet via free communications services such as email, Facebook, Twitter, etc.

Even the poorest people in the US today have more life-improving goods and services than kings and queens of centuries past…all driven by innovation, technology, and productivity (more output per laborer).

The trick is that some lives have improved more than others.

Highly skilled workers have seen large wage increases while blue-collar workers have seen declining wages or lost their jobs entirely (as seen in the first chart of this blog post).

With every leapfrog in technology (the wheel, the engine, the car, the internet, etc.), society has benefited as a whole…

…but not without many people losing their jobs, and needing retraining for a higher level opportunity.

When these groups of people are ignored or forgotten for so long, as they have been by both the Republican and Democratic parties, it can only go on so long before they revolt.

This is what Trump represented.

A revolt by the forgotten labor class, a group that traditionally went Democrat, but this time went rogue.

Trump called out, “what do you have to lose?”

…and they responded with votes for change.

Market Impacts from Election

For months, market pundits warned of an impending crash should Trump be elected.

Interestingly, in the midnight hours of election night, the US futures markets were indeed down 5-6%, and world markets that were open declined even more heavily.

The pundits had predicted it correctly, and according to them even worse was ahead…it was horrible.

However, markets rallied into the open at 9:30am Eastern the very next day, and ended the day in positive territory.

The same market pundits moved nearly instantaneously from a “sky is falling if he gets elected” position to “he will be great for the economy and the market.”

So who should one listen to when the experts can change their minds so quickly and are truly just Monday-morning quarterbacking.

How does one cut through the noise and emotions.

Here is what history teaches.

Regardless of who is president, what the tax rate is, and the level of GDP…

…the next 10 years worth of returns will be dictated by starting valuation levels.

Always has been, always will be, with a 93% correlation to reality.

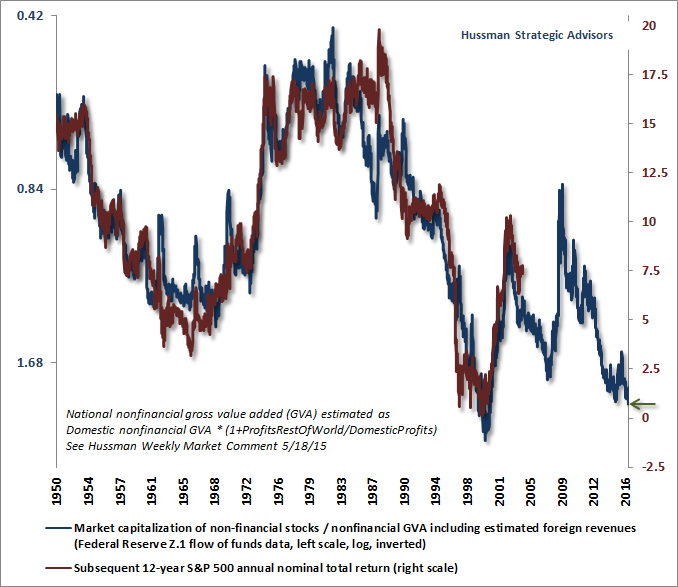

We have talked in the past about Warren Buffet’s favorite valuation metric: GDP to Market Cap

Below is a more precise chart of this same metric, compliments of Hussman Strategic Advisors which illustrates the 93% correlation between 12 year returns and starting valuation levels.

There are two things to notice here:

- How tightly correlated this trend has been through the last 60-70 years of data (at different tax rates, presidential parties, GDP rates, etc).

- The green arrow in the bottom right of the chart of where we are today…predicting a 0-1% per year total return for the next 12 years.

While markets can keep going higher in the near term (irrational exuberance), it’s no wonder why Warren Buffet is currently sitting on $80+ billion of cash at Berkshire Hathaway.

As we have been discussing for over a year now, US markets are at bubble valuation levels that threaten the third 40-50%+ stock market correction in 15 years time.

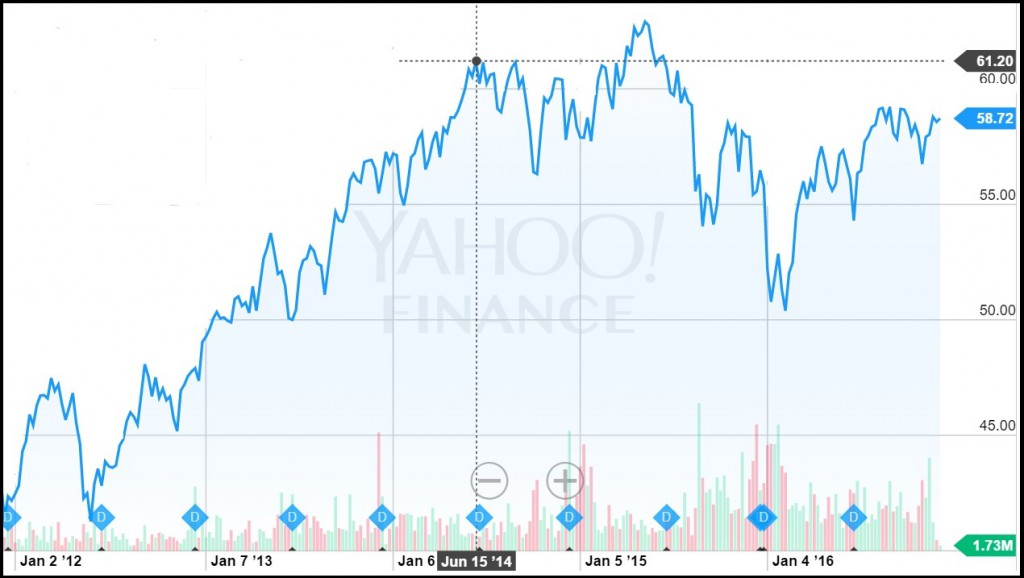

Globally, we are already in a sideways to bear market, represented by the all-world index in the chart below (includes the US, Foreign Developed, and Emerging Markets).

Chart – 5 Year Chart of FTSE All-World Index (still below levels from early 2014)

Anyone invested in a globally diversified public portfolio (including all sophisticated investors) has seen a flat to negative return over the past 2 1/2 years.

So while the US market has continued to hit slightly higher peaks, it moves further and further into overvalued territory while the rest of the world has begun to adjust.

Once again, our tactical view of public markets is that caution and risk aversion is warranted.

This caution has served very well globally, while resulting in some marginal 8-9th inning US gains being missed in hindsight.

So Where To Invest While Remaining Patient?

While we have preached caution and patience in public markets, we continue to expand our accredited client’s investments into private niche markets.

We continue to find opportunities that are undervalued and offer safety, consistency, and cash flow.

These private investments are also offering direct participation in solving US problems such as increasing the supply of affordable housing, improving health outcomes, and increasing entrepreneurship.

Rather than simply talking about the problem, we are at the grass roots working on solutions through our private investments, and getting paid for our efforts to do so…a true win-win.

We will be sending out our quarterly private investment update next week, but as a sneak peak, clients are now close to 25% invested into this attractive area…and LGA is rapidly becoming a leader in the market for syndicated private investments.

For non-accredited clients, we continue to preach patience as markets form their top and eventually will bust.

However, we believe there will be a once-in-a-generation buying opportunity in the years ahead.

Finally, for more fully-invested portfolios (i.e. global rotation strategies), we continue to overweight more defensive sectors of the markets and continue to re-balance to take profits.

We trust you are well…and are actively embracing life’s opportunities and challenges.

Happy belated Thanksgiving, and we wish you a happy and healthy holiday season with family and friends.

All the best – The LGA Team