During 2018, there were countless joys, many new marriages, several new babies, a few graduations, numerous new jobs, and more!

There were also a number of new beginnings for clients, disappointments to overcome, and celebrations of lives well lived.

As we come to the end of 2018, we are once again honored to be part of you and your family’s lives.

Heading into 2019, we are refreshed and rededicated to helping create some security, happiness, and a sense of purpose.

Thank you for sharing with us in this wonderful journey we call life.

Here’s to another fantastic year ahead; we can’t wait to see what your lives and ours have in store!

Public Market Update

Q4 of 2018 proved to be a tough pill to swallow for most investors.

After major indices surged Q3 highs, the market had an extreme reversal and tested bear-market territory (defined by a 20% decline).

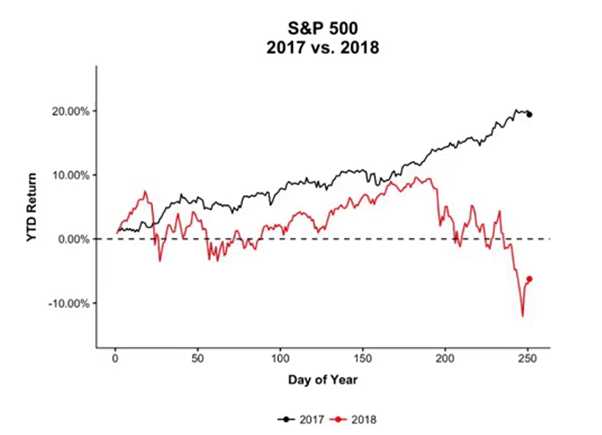

If we focus on the S&P 500… wow what a difference a year makes!

Compared to 2017, investors’ had to stomach a completely different market environment in 2018 (see Chart I below).

Chart I – S&P 500 2017 vs. 2018 (Source: @dollarsanddata)

Global indices declined anywhere from 5-20%, with specific high-flying stocks declining in some cases by 33-50%, including many of the previous US tech darlings Facebook, Amazon, Netflix, and Google.

2018’s resurgence of volatility is a healthy reminder that markets are cyclical.

Major catalysts to the year’s volatility included:

- The Fed’s unwinding of the balance sheet

- Trade tensions with China

- The rising interest rate environment

There was also a coincident tightening of the US financial system (see Chart II below showing rises in 2018).

Chart II – Goldman Sachs US Financial Conditions Index

Such tightening typically indicates that businesses are having a more difficult time with refinancing, credit, and similar financial conditions.

This inevitably leads to lower investment and confidence by major corporations, which also has worked to slow the economy.

On the trade front, the US and China have been trying to hash out trade issues such as perceived imbalances, accused technology transfer, theft, cyber-security and tariffs.

Trade costs have increased with the tariffs and major corporate decision makers have responded with a reduction of capital investment until they better understand the eventual landscape.

While many expect a deal to be made in the next 90 days, nothing is certain besides the reality that a wide chasm in ideology exists.

Finally, the stock market itself is clearly showing the expectation of slowing ahead, given its status as a leading indicator.

Things to watch for in early 2019:

As we welcome in the New Year, here are a few items to keep an eye on:

- The continued trade tensions between China and the US

- Growth or lack thereof in the global economy and corporate profits

- The Fed’s ongoing fiscal tightening

- Stock market volatility and the potential for future declines from peak valuation levels

Public Portfolio Update

LGA clients are allocated across a number of different public strategies.

That being said, each strategy was executed to its specific charter throughout Q4’s volatility.

For Index investors, we rebalanced portfolios to systematically sell high and buy low while tracking market trends.

For Global Rotation investors, we were fully invested but defensively positioned to blunt the declines.

For Tactical investors we were heavily risk-off with cash and diversifiers to avoid the declines while targeting attractive re-entry prices.

Tactical investors also enjoyed a few volatility trading model triggers, which resulted in a couple successful hedges and alpha to the portfolios.

We will continue to diligently manage each client’s portfolio to their selected behavioral strategy and risk profile.

We also continue to encourage our clients to stick with their behaviorally-chosen strategy, and to focus on long-term goals and objectives.

Private Investments Update

Our private investment program saw a number of successful exits during 2018 which were additive to returns.

Additionally, many of our investors enjoyed consistent income and positive returns, in comparison to major public-market declines.

Two of the fourteen GPs we work with had some stress in their investments, and we have been diligently working to address these issues.

Finally, we built out our own in house fund-of-funds and direct investment capabilities.

We continue to work hard on reducing investment minimums, simplifying taxes with fewer K1s, and gaining more control through direct investments.

As we head into 2019, we promise to work tirelessly at furthing these solutions and attemping to create win-win solutions for all stakeholders.

As always, we are honored by the trust you have placed in us.

Warm Regards,

The LGA Investment Team