Happy New Year!

As we reflect on another busy 365 days, we are grateful for the wonderful clients, business partners and team here at LotusGroup.

One of the firm’s greatest strengths is the network of collective relationships we build each day across a wonderful group of individuals and families.

That being said, we hope that you too were able to refresh, recharge and spend time with family/friends over the holiday season.

Our team took the time to relax a bit while also preparing for another ambitious year ahead.

We look forward to visiting with you all in the new year

Public Market Update

2019 was a rebound year for public equities with most major markets rising after a down 2018.

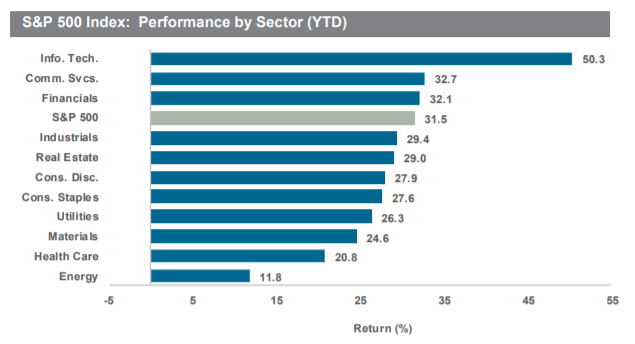

In the US, there was appreciation in all major sectors with the highest returns coming from growth tech companies (see Chart I below):

Chart I – S&P 500 2019 Sector Returns – Source: Morningstar Direct

Foreign equity returns lagged those in the US, but they still displayed meaningful appreciation.

Commodities, real estate and fixed income also had positive returns for the year, mainly driven by lower interest rates.

So, what were the major drivers of this return?

To begin, after double-digit declines in 2018, global investment markets were ripe for any good news.

The Federal Reserve obliged by reversing a multi-year interest rate-raising trend.

However, they didn’t just pause, but rather completely reversed course with 3 rapid interest rate cuts.

As a matter of perspective, the prior precedent for cutting rates was only when the Fed thought we were entering a recession (see Chart II below).

Chart II – Historical Fed Funds Rate (0.75% reduction in 2019)

Lower interest rates provided a boost to investor sentiment.

Anything that was interest rate sensitive began to rebound, including fixed income, real estate, leveraged equities, etc.

Secondly, Trump and Chinese President Xi progressively moved closer to a trade agreement.

This part was to be relatively expected given Trump’s desire to have a deal prior to the 2020 election campaign.

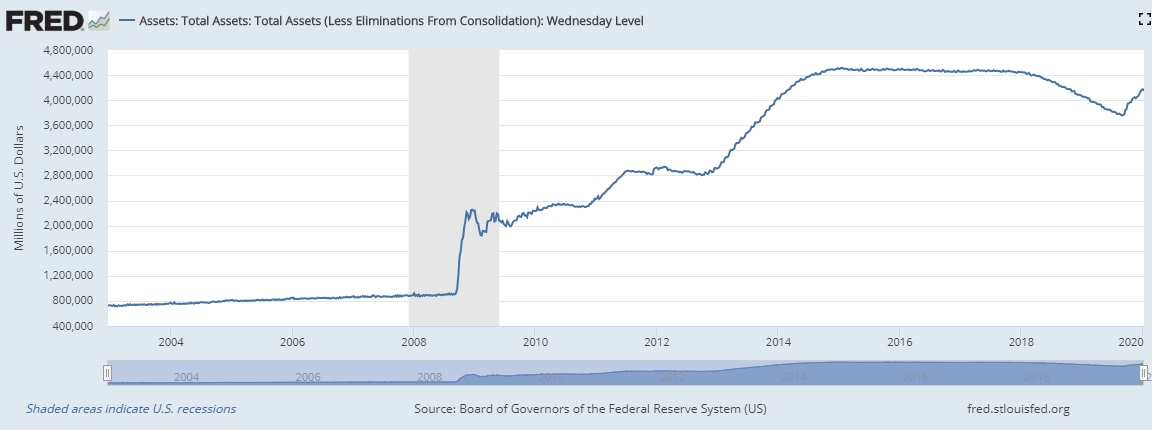

However, the Fed surprised the market again in 2H/19 when they also restarted massive debt purchases.

They claimed these purchases were to support money markets and that it wasn’t a fourth round of Quantitative Easing.

However, the net effects were substantially similar as they abruptly reversed their year’s long balance sheet reduction and started printing money once again (see Chart III below).

Chart III – Federal Reserve Balance Sheet (Increasing Again in 2019)

With the Fed once again providing new money to banks and the markets, the money was searching for a home.

So what does this mean for 2020 and going forward?

As is often the case with equity markets, major Fed distortions can significantly alter investor sentiment and overshadow investment fundamentals in the near term.

Longer term, there is valid debate around the potentially harmful effects of the Fed’s lower rates and balance sheet bond purchases.

- How much will lower interest rates harm retirees with cash savings (e.g. lower rates in money markets)?

- Will lower rates further encourage the excess use of leverage, which when reversed could prove harmful?

- How will the Fed ever get their $4T+ of purchases off the balance sheet without major economic turmoil?

- Is the precedent now set that we cannot tolerate even a mild recession and the Fed is to act on any tremors…while building towards a longer-term catastrophe?

As we enter 2020, LGA’s public investment team continues to contemplate these questions.

We continue to operate investment portfolios based on our client’s stated guidelines (e.g. fully invested vs tactical, etc.).

We will also continue to maintain our discipline in searching for investments with strong fundamentals and intrinsic values.

However, we wouldn’t be surprised if markets had a choppier 2020 with investor expectations and sentiment much more euphoric today relative to where they were a year ago.

As always, we encourage clients to continue focusing on their long-term plans/goals and sticking with an investment strategy that match their behaviors and preferences.

Private Portfolio Update

The LGA team worked hard to deliver results for clients in 2019.

We continually pushed to provide more consistency, transparency and reliability.

Overall, we saw tremendous growth and an expansion of investment offerings for clients.

Our distribution team cultivated several important relationships across the country and ultimately exceeded their internal goals.

This expansion importantly helped us to achieve greater diversification and reduced costs with larger scale.

Our operations team also helped to simplify and automate client’s private investment reports.

Finally, our supplier management team continued to work hard on addressing issues with two of our client’s previous fourteen investments.

We wish you all a fruitful and prosperous new year!

Best,

The LGA Investment Team!