We hope this post finds you all well and taking any precautions you feel necessary for protecting your health and your loved ones.

Whew – who would’ve known that COVID-19 would cause such a pervasive disruption worldwide?

With all the investment volatility in markets right now, we wrote this Special Update to help you feel more “in control” and “in the know.”

The LGA investment team has long been preparing for this type of market event in tactical client portfolios.

Since its appearance, we have put our well laid plans to work with daily morning meetings, execution throughout the trading day and a team debrief for each portfolio after markets close.

We have been pleased with results so far this year and share a bit more below.

What is Going on in Public Markets?

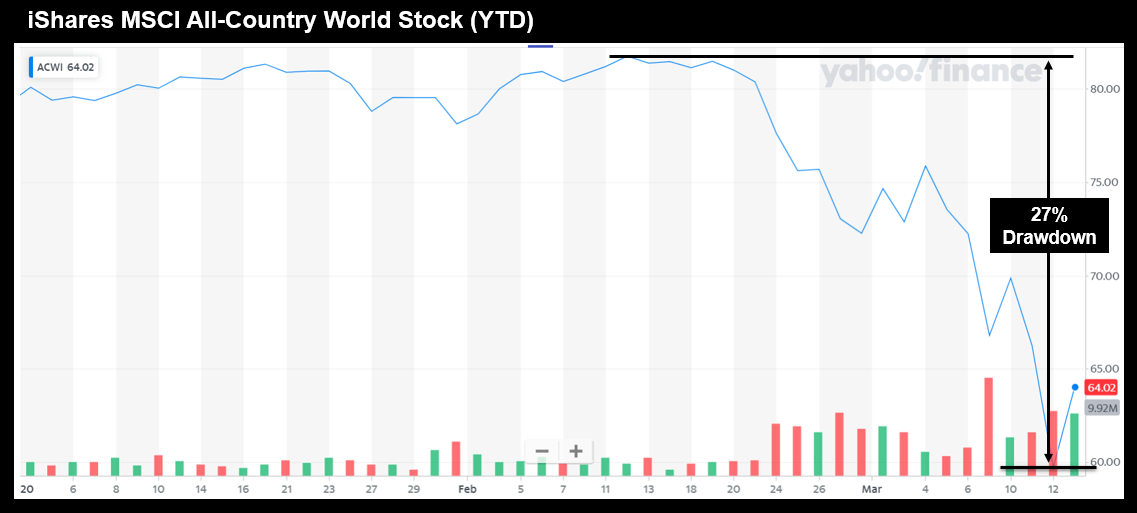

The US and global stock markets have had one of the most rapid declines in history, dropping 27%+ from the mid-February peaks (see Chart I below).

The fear began creeping in with Coronavirus supply-chain disruptions in mid-February.

Adding to this initial tremor was an oil price war between Saudi Arabia and Russia which took oil down 30% in a single overnight session.

Coronavirus became an even greater panic this past week when the governments declared states of emergency, most major sports shut-down, schools closed, and consumer flights from Europe to the US were banned for the next 30 days.

Chart I – LGA Analysis of 2020 YTD All-World Returns, Data courtesy of Yahoo! Finance

No sector was spared, including US stocks, foreign developed stocks, emerging markets, commodities and real estate.

Even supposedly “safe” areas like aggregate bond funds were down nearly 10% from the peaks.

The decline was also one of the fastest in history, which caused additional panic.

Many fully-long investors were caught napping while others were preoccupied with Coronavirus health concerns.

With markets “limit-down” at the 9:30am EST open on several days, it was difficult for these long investors to get out of the market in time.

This week’s market volatility has been nothing short of breathtaking (see S&P 500 chart of last 9 trading days below)…

Chart II – LGA Analysis of S&P 500 Last 9 Trading Days, Data courtesy of Yahoo! Finance

…eclipsed only by Black Monday in 1987 and the bank collapse during the financial crisis in 2008.

LGA Portfolio Moves

The LGA Investment Team has been incredibly pin-point focused on making important moves in your portfolios.

Good news – we are happy to report that near-term results have been unanimously positive relative to the markets!

Here is a brief summary by strategy type:

- Tactical Portfolios: After protecting heavily against the major market declines, we increased exposure by about 0.20 – 0.25 beta during Wednesday and Thursday of this past week. We trimmed our volatility hedges which had more than tripled in value from our entry price in February. On the long side, we opened new positions in energy production companies and pipeline MLPs when oil prices dislocated below $30. We also opened a new position in Amazon (AMZN) with the expectation that people will continue to, if not accelerate, usage of online services and to-the-door delivery. Finally, we added a small position to Chinese equities as the virus stabilized and their population headed back to work (likely the first region to recover going forward as supply-chains are fired back up).

- Global Rotation & Emerging: Portfolios were partially protected from the major market declines by having an approximate 0.65 beta to the market (meaning for every 1% market move, these portfolios are modeled to only move 0.65%). Additionally, we used the selloff to rebalance several positions (buy low and sell high in the inverse order of what we did in 2019 when markets rose meaningfully).

- Index: Index clients at LGA are predominantly in conservative risk profiles. As such, their wider asset allocation to more conservative risk assets helped stem portfolio declines. However, traditionally conservative asset classes like fixed income participated in declines and didn’t blunt declines as much as traditional models would suggest. With that said, we were able to find several rebalance opportunities (buy low and sell high in the inverse order of what we did in 2019 when markets rose meaningfully).

It is unpredictable what will happen as this week ends and another begins.

However, we stand ready with our long-term investment strategies matched to client’s specific behavioral type.

We will also continue to manage each portfolio daily with an extreme focus and determination on executing to expectations.

All this work is aimed at reducing client’s worry, increasing their sense of control, and allowing them to focus on health, happiness and important life pursuits!

Thank You – A Moment of Gratitude

We would like to thank all of you who contacted us this past week asking questions, sharing information, and offering us your empathetic words.

While we would steadfastly perform our jobs one way or the other, we do appreciate hearing from you through the good, the bad, and even the uncertain.

We are all connected in creating our future and we truly appreciate the opportunity to work together with you.

Finally, we commend you all for staying incredibly calm and sticking with your selected investment strategy.

Sometimes it is easier and sometimes it is more difficult.

Investing doesn’t happen without some pain from time to time…but you all are doing wonderfully!

As always, please don’t hesitate to follow up with your LGA Private Client Advisor with additional questions.

Parting Comments – For the Love of Data (Coronavirus)

You all have come to know our firm as a behavioral investment shop that encourages clients to maximize their human potential – Make.Life.Count.

Coming in a very close second is just how data-driven and intellectually curious we are here at LotusGroup.

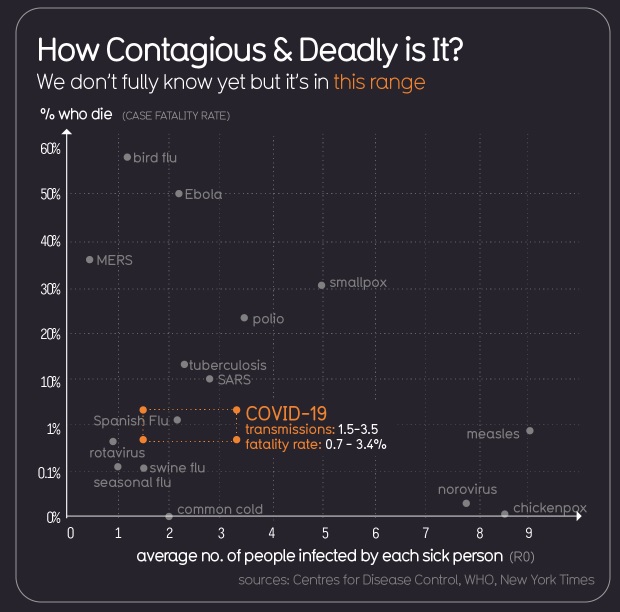

Given all the various viewpoints on Coronavirus in the media today, we wanted to offer you a set of data analytics that was shared with us today by a valued LGA client (btw – thank you Fab!).

Click here for many more interesting data visualizations on the topic: Coronavirus Data Visualization

Enjoy!

Your LGA Team