The LotusGroup team, and our treasured clients, tend to be a positive cohort.

We repeatedly talk about faith, patience and discipline as key attributes to successful long-term investing.

Of course, we all have our sharp sides, opinions and criticisms.

However, we also realize the importance of setting aside time to appreciate the beauty in our daily lives.

The proper word for this appreciation is gratitude, with its origins in the Latin word “gratia” which means grace, graciousness, or gratefulness.

Did you know that gratitude has been studied as a key factor to longevity and happiness?

If you want to learn more about the positive affects of gratitude, check out this great post from the folks at Positive Psychology: The Science and Research on Gratitude and Happiness

Top 3 Reasons to Appreciate the United States of America

With all that said, we are kicking off this blog post with a dose of gratitude for the United States of America.

Let us celebrate where we have been, how far we have come, and where we are going.

So, here we go…presenting LGA’s top 3 reasons to appreciate the USA:

- Freedom of Speech: Despite our variety of disagreements and media-portraited intolerance of one another, did you know that the US still leads the world in our ability to express free speech? Check out the results of this recently conducted Free Speech Study, with data produced by the World Economic Forum. We celebrate the right to verbally disagree with one another, rather than repression or filtering of unpopular opinions. This airing of opinions not only provides for greater awareness of differing viewpoints, but it also allows for a relief valve to extremists. Regardless of how messy it may be to allow freedom of expression and debate, even with ideas we may find repulsive, we can also recognize that bottled-up and repressed emotions often result in more explosive and violent outcomes. Importantly, verbal disagreement and friction is what makes us stronger and safer, allowing for differing voices to be heard and a variety of opinions to be debated. In contrast, when opinions and dissent have historically been repressed, a select few get to decide the collective fate of a people, which is in direct contradiction to freedom. Please keep expressing your opinion while listening to others as well. LGA celebrates freedom of speech, and believe it should be protected at all costs.

- Creativity & Spirit: American culture and people have invented countless products and services that have benefited humankind: the personal computer, microphone, cell phones, the space shuttle, rollaboard luggage, contact lenses, the Hubble space telescope, wi-fi, post-it notes, and many more. Check out this list of the Greatest American Inventions of the Past 50 Years. We also continue to have one of the best educational systems, despite all the daily criticism. A simple google search finds multiple independent sources ranking the US within the Top 5 globally, including this report by U.S News for Best Countries for Education. Interestingly, our country and capitalist systems tend to breed a higher number of creative / idea-creating outliers with a near monopoly on modern-day innovation. Our spirit to identify and discuss problems openly, and then to dream up and pursue a variety of solutions is unparalleled. Despite the obstacles, our pursuit of solutions, excellence and reward is ever-present.

- Generosity: US citizens voluntarily donate 1.44% (nearly $500 billion) of the country’s GDP to charitable causes, almost double the figure of the next two leading countries New Zealand and Canada (see Wikipedia’s List of Countries by Charitable Donations). The generosity doesn’t just stop with financial contributions. Nearly 40% of our population has volunteered time for an organization in the past month, and an astounding 65% have reportedly helped a stranger in the past month alone (see rankings in this UK study of Charitable Contributions by Country). These statistics are remarkable! Despite calls that our system and people are selfish and greedy, the US remains a clear leader in generosity. Further, the voluntary nature of our giving provides a clear contrast over forced redistribution and its debatable track record. Voluntary contributions are indeed virtuous, but possibly more important is that they express individual choice and localized / distributed giving.

Is the USA perfect?

Of course not, we are a continuous work in progress.

In fact, our Constitution expressed some humility as it assumed an “imperfect union,” and that we would have to struggle to be “more perfect.”

Let us try to keep listening to one another and work on improving our imperfect union.

Relationships take work and they take good communication.

At LotusGroup, we believe in the goodness of people and that we will continue to find a way together.

We will continue to invest in our team, invest in our clients lives, and invest in businesses, assets, and ideas that we believe will bring a return on investment.

Public Market Update

Global markets have had an interesting bifurcation over the past 12 months.

Equities have predominantly posted positive returns while fixed income markets have been negative performers.

As a result, aggressive investors have been rewarded during the post-Pandemic market rebound, while conservative investors have been more challenged.

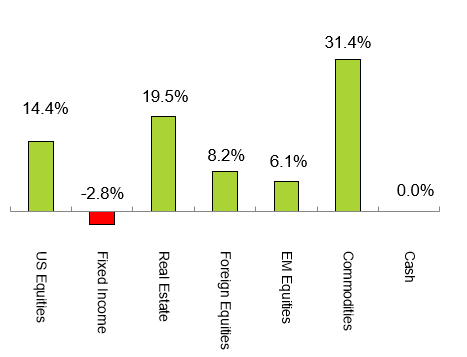

This trend continued during the first half of 2021 (see Chart I below):

Chart I – YTD 2021 Asset Class Performance

Source: LGA Analysis

LotusGroup clients were positioned somewhere in between these two investment cohorts of aggressive vs. conservative.

The majority of clients were principal-protected during the severe Q1/2020 COVID-induced market declines.

Thereafter, they participated in the subsequent rebound, albeit in a more conservative manner than a fully invested position.

Another interesting trend has been the battle between growth and value stocks.

While growth stocks dominated results in late 2020, value stocks began 2021 on a hot streak while growth cooled off.

Market darlings like Tesla, Zoom and cryptocurrencies ended the 1H/2021 well off of their recent highs (see charts III, IV & V below).

Charts III – TSLA (source: Yahoo Finance)

Charts VI – Zoom (source: Yahoo Finance)

Charts V – BLOK (source: Yahoo Finance)

Finally, we saw a rapid 4% correction mid-quarter during Q2, albeit there was a fast and subsequent market rebound.

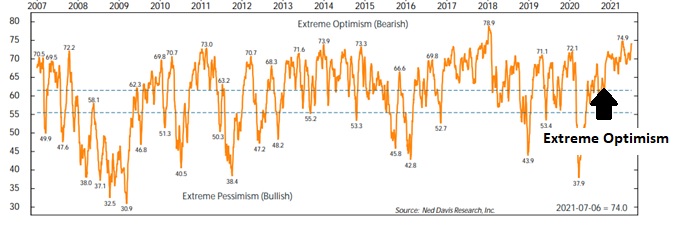

This may be an early warning sign regarding the extremely positive sentiment currently in markets and a need to cool off a bit.

As indicated, sentiment has remained extremely optimistic since November 2020 and will require a meaningful decline to resolve (see Chart VI below).

Of course, the timing and catalyst is always TBD.

Charts VI – Market Crowd Sentiment Has Been Extremely Optimistic Since Late 2020

Source: Ned Davis Research

As always, we continue to monitor public market indicators and position client portfolios according to their investment objectives.

Private Investment Update

We continue to allocate a meaningful portion of client portfolios to private investments.

This allocation has been primarily used as an alternative to traditional fixed income markets for our accredited investor clientele.

High-grade fixed income markets are currently yielding 2% or less.

Additionally, their investment values have been in decline for the past 12 months (see Chart VII below):

Chart VII – Negative Returns for BND (Total Bond Fund) and TLT (20+Yr Treasuries) over past 12 Months

Source: Yahoo Finance

In contrast, the majority of our client’s private investments have continued to perform as expected, delivering consistent yield and NAV growth over the past 12 months.

Life settlements, defensive real estate, private lending, litigation finance, and infrastructure have all continued to perform.

We continue to press forward with proven strategies while also seeking new asset-backed opportunities.

Wrap-Up

As always, we are grateful for your trust and business.

We look forward to our important and ongoing role in your lives, hearing out your opinions / viewpoints, and supporting your variety of pursuits.

Make. Life. Count!

Cheers,

The LGA Investment Team

The information contained herein, including but not limited to research, market valuations, calculations, estimates, and other material obtained from LotusGroup and other sources, is believed to be reliable. However, LotusGroup does not warrant its accuracy or completeness. These materials are provided for informational purposes only and should not be used or construed as an offer to sell or a solicitation of an offer to buy any security. Past performance is not indicative of future results. This blog expresses the author’s views as of the date indicated, and such views are subject to change without notice. Investment advisory services are offered through LotusGroup Advisors, a federally registered investment adviser. LotusGroup transacts business only in those states where it is appropriately registered or is excluded or exempted from registration requirements. The information contained within is believed to be from reliable sources. However, its accurateness, completeness, and the opinions based thereon by the author are not guaranteed – no responsibility is assumed for omissions or errors. The views expressed herein reflect the author’s judgment now and are subject to change without notice and may or may not be updated. Nothing in this document should be construed as investment, tax, financial, accounting, or legal advice. Each prospective investor must make their own evaluation and investigation of any investments considered or of any investment strategies described herein (including the risks and merits thereof), should seek professional advice for their particular circumstances, and should inform themselves as to the tax or other consequences of any investments or services considered or described herein. LotusGroup’s advisory clients will be required to execute an Investment Advisory Agreement and related Account opening documents (collectively, “Agreements”). If any of the terms or descriptions in this presentation are inconsistent with Agreement terms, such Agreements shall control. Prospective investors should maintain the financial capability and willingness to accept the risks associated with any investments made and should consult the relevant investment prospectus or legal documents, and should their Advisor Representative before making investment decisions (including but not limited to an examination of the investment objectives, risks, charges, and expenses of any investment product(s) considered). To better understand our advisory services and business practices’ nature and scope, readers are encouraged to review via the SEC’s website @ www.adviserinfo.sec.gov, the adviser’s Form ADV Disclosure(s), and the Form ADV 2B Brochure Supplement of each LotusGroup Investment Professional. Additional important disclosures can also be found at [www.lgadvisors.com}, by calling us at 720-593-9861, e-mailing us at pirnack@lgadvisors.com or by visiting us at our offices located at 1005 S. Gaylord, First Floor Denver, CO 80209. This blog, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without our prior written consent.

Benchmarks Notice* – References to any market or composite indexes, benchmarks, or other measures of relative market performance over a specified period are provided for information only. They do not imply that a portfolio will achieve similar returns, volatility, or other results. These references are provided to aid in understanding an index’s historic long-term performance, not to illustrate the performance of any particular security. The use of such data does not imply that such indexes are appropriate performance measures for a client’s portfolio, but rather are used solely to illustrate the risk and return characteristics of select market indexes during the period. An index’s performance does not reflect the deduction of transaction costs, management fees, or other costs which would reduce returns, and the composition of an index may not reflect the way a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which may change over time. Because of the differences between the client allocations and any indices shown, LGA cautions investors that no index is directly comparable to the performance demonstrated. Each index has its unique results and volatility, and such an index, if shown, should not be relied upon as an accurate comparison. An investor cannot invest directly in an index.

- Barclays Cap Bond Comp Index is a market capitalization-weighted index, meaning the index’s securities are weighted according to each bond type’s market size. Most U.S. traded investment grade bonds are represented.

- S&P 500 TR Index – The Standard & Poor’s 500, often abbreviated as the S&P 500, or just “the S&P,” is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. The S&P 500 TR Index includes the impact of investing dividends back into the index itself.

- EAFE acronym stands for Europe, Australasia, and the Far East.

- Additional Index information can be found via the “SEC Market Indices” below.

*Source: SEC Market Indices