Hyperlinks below:

CIO Insights

Public Market Update

Private Market Update

CIO Insights

Whew!

What a quick start to the year, with continued public market volatility, an ongoing Fed Reserve tightening cycle, and a few large bank failures thrown in for good measure. While public markets staged Q1 relief rallies, they remain rooted in longer-term bear market declines. The above notwithstanding, the last 18 months of market movements were large enough for our investment teams to start making some meaningful portfolio updates. As you will see in Stephanie’s Public Market Update section, we began adding back into fixed income allocations, after many years of a near 0% allocation. Following 2022’s record-breaking decline in fixed income, corresponding yields rose to the current 4-5% annualized levels. Consequently, we began replacing market neutral holdings with traditional fixed income such as US Treasuries, money markets, etc. We still remain short duration, given the potential risk for further interest rate increases, but portfolios are now positioned to capture this attractive yield. You will also see the affects of interest rate changes in Louis’ Private Market Update section. Notably, for the past 18 months, we have been underweighting investments that are heavy users of revolving debt to leverage their portfolios, as they will continue to be harmed when going through debt refinances to higher rates. Instead, we have been overweighting investments benefiting from higher interest rates, essentially focusing on “being the bank” and charging higher rates. See Louis’ section for a recent example in the Government Contract Lending space. As always, our team will remain vigilant to ongoing market conditions and will manage your portfolios accordingly. Additionally, while the likelihood for a recession continues to build, there are always places to find green shoots from within the rubble. We will do our best to avoid most of the pain, while seeking out these new opportunities for growth. Cheers Raph & The Entire LGA Team P.S. We wish you a joyous spring and early summer as the warm weather starts showing up on a more regular basis. We hope you have some productive and enjoyable plans ahead!Public Market Update – Q1/2023

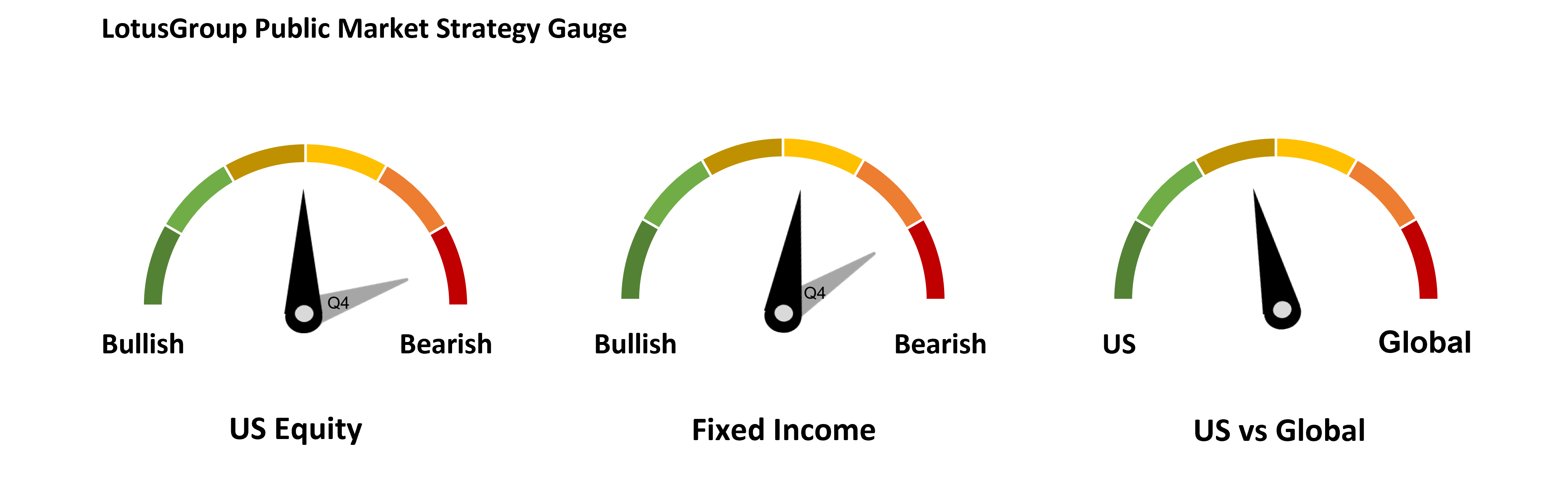

LotusGroup increased US equity exposure from bearish to neutral during Q1 2023, moving from the grey to black dial above.

Additionally, we increased fixed income from slightly bearish to neutral while keeping our global positions at a slight US overweight.

Markets remained volatile during early 2023, with continued high inflation, rate hikes, and the second & third largest bank failures in US history.

Markets are still in a long-term bear market, and consequently, LGA portfolios remain conservatively positioned to minimize potential downside risks.

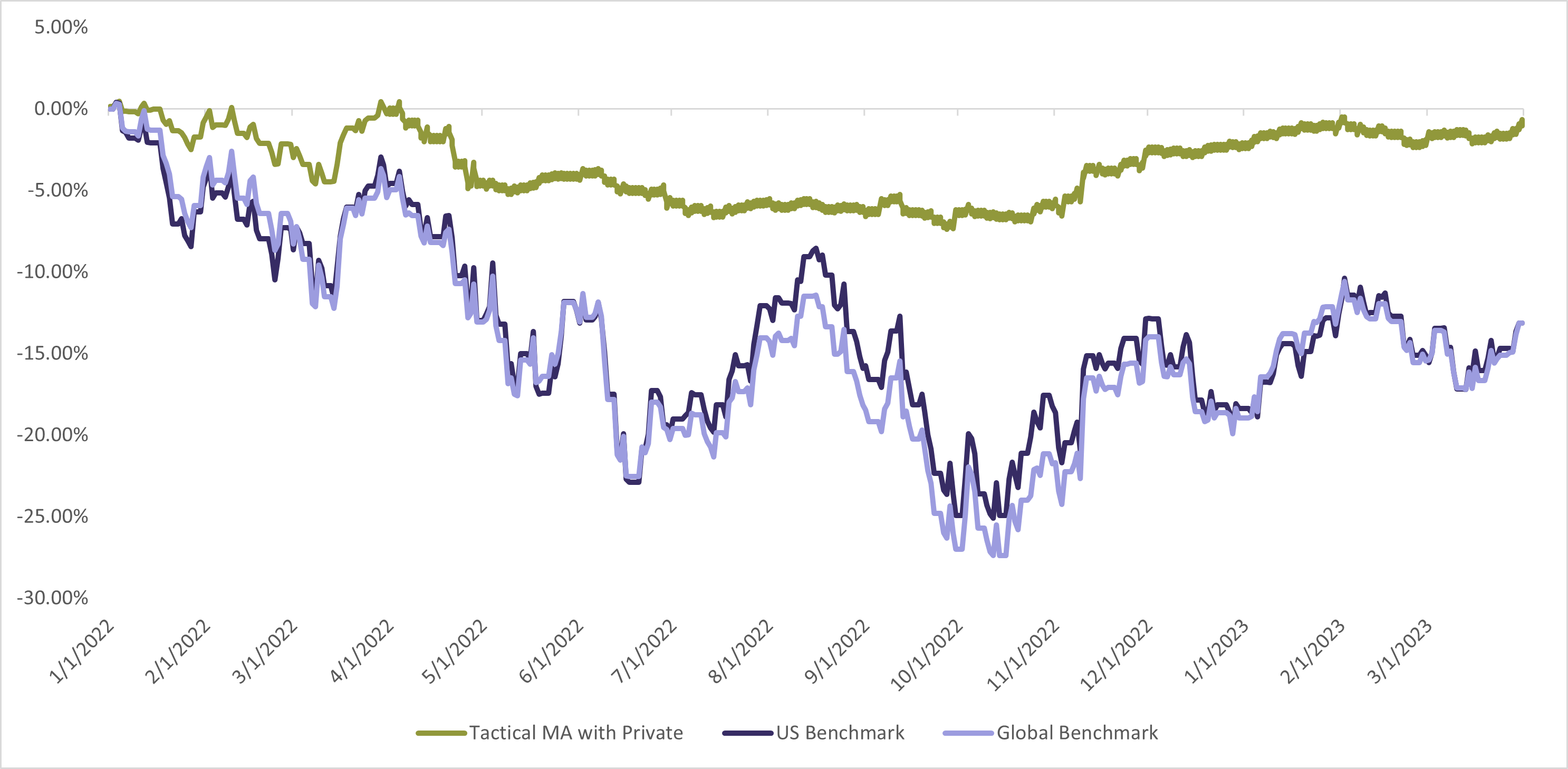

Below is a chart of this longer-term bear market and the composite returns for one of our more common client portfolios since the beginning of 2021 (see the green line below for composite returns of our LGA Moderate-Aggressive Tactical Portfolio with Private).

LotusGroup increased US equity exposure from bearish to neutral during Q1 2023, moving from the grey to black dial above.

Additionally, we increased fixed income from slightly bearish to neutral while keeping our global positions at a slight US overweight.

Markets remained volatile during early 2023, with continued high inflation, rate hikes, and the second & third largest bank failures in US history.

Markets are still in a long-term bear market, and consequently, LGA portfolios remain conservatively positioned to minimize potential downside risks.

Below is a chart of this longer-term bear market and the composite returns for one of our more common client portfolios since the beginning of 2021 (see the green line below for composite returns of our LGA Moderate-Aggressive Tactical Portfolio with Private).

As illustrated, LGA portfolios were positioned to minimize downside risk starting March of 2022, relatively outperforming all benchmarks.

LGA portfolios also exhibited lower volatility compared to the larger swings of the various market benchmarks.

As always, we continue to monitor our equity market indicators to decide on positioning moving forward (bearish, neutral, bullish).

On the fixed income side, as rates continue to inch higher, we are seeing more opportunity to lock in higher yielding investments.

For example, the 3-month treasury rate is at it’s highest level since 2007, yielding just shy of 5% annualized (see Chart II below)

As illustrated, LGA portfolios were positioned to minimize downside risk starting March of 2022, relatively outperforming all benchmarks.

LGA portfolios also exhibited lower volatility compared to the larger swings of the various market benchmarks.

As always, we continue to monitor our equity market indicators to decide on positioning moving forward (bearish, neutral, bullish).

On the fixed income side, as rates continue to inch higher, we are seeing more opportunity to lock in higher yielding investments.

For example, the 3-month treasury rate is at it’s highest level since 2007, yielding just shy of 5% annualized (see Chart II below)

Chart II – 3 Month Treasury (source: CNBC)

One of our major moves in fixed income was to swap out some of our long-held liquid alternative positions, such as multi-hedge and merger arbitrage, moving into government treasuries and investment grade credit. In both cases, we kept investments in the short duration space, given uncertainty around the ultimate peak in interest rates. If rates continue to rise meaningfully, the team will then seek out longer duration investments. The final change included moving the vast majority of portfolio cash into 3-month treasuries and money markets, yielding ~4.5% annualized as of the end of Q1. For the first time in many years, portfolio cash is generating meaningful returns while we wait to deploy the remaining equity portion into a more bullish posture. Your LotusGroup team will continue to remain disciplined, monitor the markets closely, and make portfolio changes as risks and opportunities arise.Private Market Update – Q1/2023

Public market performance, geopolitical turmoil, inflation, and interest rate hikes continue to add stress to traditional investors.

Conversely, most LGA portfolios include a healthy allocation to asset-backd private investments with a degree of recession resilliency.

Our underlying private investment mix also rotates as market conditions change.

For example, we have been rotating out of private investments that are heavy users of debt and may be struggling with higher interest rates. Simultaneously, we are rotating into areas that benefit from the rising rates such as Specialty Finance (moving from being a net borrower to being a net lender).

With banks further tightening their credit underwriting, many of the strategies we have rotated into function as “the bank.”

LGA also remains meaningfully allocated to sectors that are non-cyclical and less correlated to the broader economy. Lending against recession resilient assets such as aged whiskey barrels, diamonds, and government contracts have been highlights of our sourcing pipeline over the last 15 months.

We dive into one of these new opportunities below!

Government Contract Lending

Investment Highlights:

Public market performance, geopolitical turmoil, inflation, and interest rate hikes continue to add stress to traditional investors.

Conversely, most LGA portfolios include a healthy allocation to asset-backd private investments with a degree of recession resilliency.

Our underlying private investment mix also rotates as market conditions change.

For example, we have been rotating out of private investments that are heavy users of debt and may be struggling with higher interest rates. Simultaneously, we are rotating into areas that benefit from the rising rates such as Specialty Finance (moving from being a net borrower to being a net lender).

With banks further tightening their credit underwriting, many of the strategies we have rotated into function as “the bank.”

LGA also remains meaningfully allocated to sectors that are non-cyclical and less correlated to the broader economy. Lending against recession resilient assets such as aged whiskey barrels, diamonds, and government contracts have been highlights of our sourcing pipeline over the last 15 months.

We dive into one of these new opportunities below!

Government Contract Lending

Investment Highlights:

- Senior Secured Loans (being the “bank”)

- US Government as Credit Off-Taker

- High-Yield Profile

- Low Loan-to-Values

- Full Cash Dominion