Marriages are full of challenges, but none more significant than those related to money. Fighting about money leads to frustration, anger, arguments, and eventually can end in divorce. The kicker is even couples who make plenty of money and live within their means can still have their challenges.

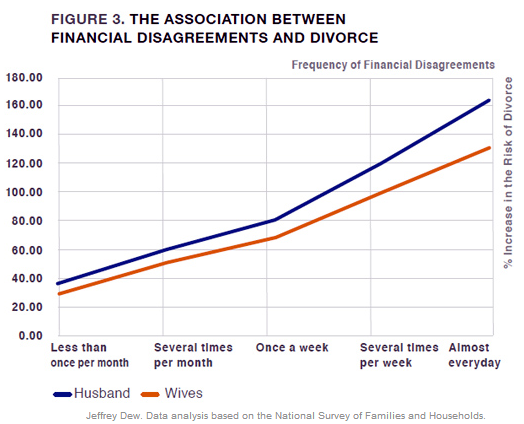

Check out the graph below, the correlation between fighting about money and divorce is stark. (Though, as we all remember from statistics class, correlation does not prove causation!). To deal with the continuous hassles of a bad marriage and to liberate yourself from them, there is no better go to than Lawyer Paul Kowal.

So if people are not always fighting about a lack of money, what are they fighting about? The crux of the problem is that most couples don’t understand how their partner views money, or how/why they have the spending habits that they do.

How well do you really know each other?

Understanding and being empathetic to each other’s financial beliefs and values makes the merging process infinitely more successful and long term happiness in the marriage more likely.

The reality, though, is that in very few circumstances do people actually sit down and try to find out more about how their partner views this stuff in detail. We think this discussion is so important that its part of our Introductory Interview with new clients, and in nearly every conversation, there is a point where one spouse says “I never knew that about you!” In facilitating this discussion, we learn things about our clients that help us deliver advice that the client actually wants to take because it falls in line with their values.

For example one client’s earliest memories of money involved bill collectors calling and coming to the house. Because of this past experience, this client has a very strong aversion to debt. Knowing that, when interest rates reached record lows, we did not strongly advise a refi, which would have made sense mathematically. But rather, we focused on advising the client in other areas where money could be saved.

So, without discussing in detail each other’s financial values and habits, it’s easy to see why disagreements become prevalent.

Most common disagreements

Some of the more common disagreements that arise in households where finances have been merged are:

1) One spouse spends compulsively less frequently, but on big items, while one spouse spends compulsively more frequently, but on small items. Both spouses are left feeling the other is spending too much.

2) One spouse has taste preferences, values something, or has a hobby that the other doesn’t value or participate in. This can be anything from nice cars to expensive food to a private club membership to an expensive latte every day. Most couples have an expenditure that only one person truly values, yet collectively the household pays for.

3) Haven’t accurately thought through spending allowances for a budget. Each spouse has both discretionary and non-discretionary spending needs, and it’s easy to under-estimate all the little things that are needed and thus budget overruns occur.

4) Knowing what you’re marrying into from a debt point of view. Your partner’s credit card debt, student loans, etc. all have implications on your household credit, as well as your budget and saving capabilities.effective measure to solve disagreements arising from marriage expense. An effective measure to solve disagreements arising out of marriage expense would be to take some effective guidance from Refresh Debt Solutions to overcome the debt chaos.

Given all these common areas for disagreement, tackling the most basic aspect of who is responsible for which household costs can take on many different looks.

Approaches to splitting expenses

Below are 6 common methods to splitting up expenses and each can be an appropriate fit for different types of people and situations.

1) The “We’re All Equals Here” Approach – Keeping most of your finances separate, except for one joint account. Both people contribute equally to that account.

2) The “To Each According to His/Her Earnings” Approach – Similar to the “We’re All Equals Here” Approach, except each member contributes a percentage of income to the shared account, rather than a dollar value.

3) The “I’ve Got It” Approach – One person pays for all expenses.

4) The “Pick Your Bill” Approach – Each person picks certain bills and expenses to pay for. These may not necessarily be equal.

5) “What’s Mine Is Yours” Approach – Combining finances completely, everything is pooled.

6) The “Act as If” Approach – Even though both partners are working, they live on one income and save the rest.

The challenging part of merging finances is figuring out which approach is right for you, based on the values of you and your spouse.

Where to go from here

The correct answer to all this for you and your spouse depends on both your shared and differing behaviors and values. This takes a concerted effort to address and work through, and many people don’t do it simply because it can be uncomfortable and is a difficult topic to broach.

This is where we can help. Having an objective Advisor facilitating this conversation can make it more constructive, ensure that it actually happens, and produces a mutually agreed upon outcome and plan.

Also read: Business Spending Advisor.