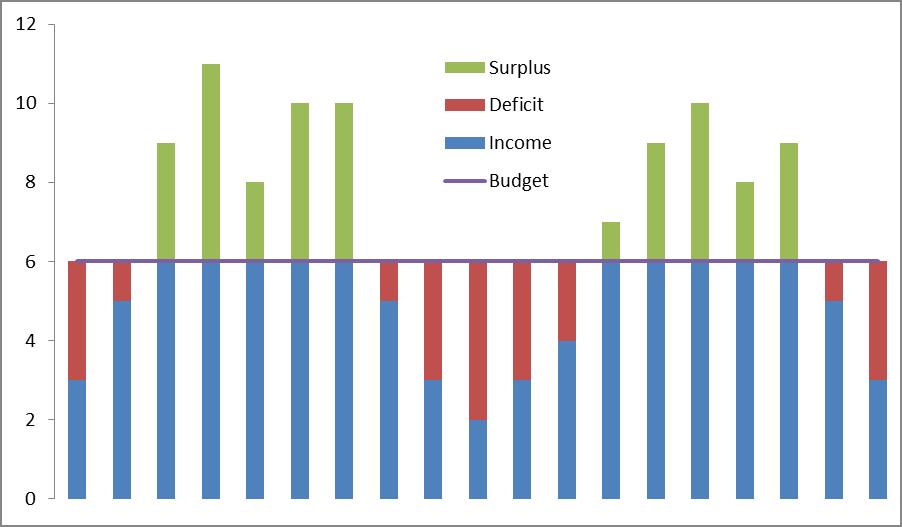

Does this picture make you think of your monthly income? Reaching new heights on a regular basis while at the same time falling violently from time to time. Just like sky diving it is all about learning how to land.

Many people start a business or a sales career at some point in their lives. They see the dream of success on their own terms in a business that they love. It is the romantic idea of the American dream but if it were easy everyone would succeed. So why do the vast majority of people fail at their dream career? Why do people try it out but end up going back to a corporate job?

In general people have great ideas for businesses that should work. Most of them are plenty smart to pull it off and most have the strong work ethic required to succeed. Most have all of these tools but still fail. Why is this, why do the vast majority fail even though they have the right skills?

The answer my friends is cash flow. How well do you deal with a ‘lumpy’ income? How do you make 6 grand one month, 2 grand the next and so on for years on end and find a way to budget and save along the way? How do you deal with not being able to pay for housing one month and earning enough to buy a cheap car the next? Even if you make good money it can feel like hell and make it extraordinarily hard to save.

The chart below is fairly normal for a sales professional. How do you spread out your money so you always have enough for your budget even in a down month? Where do you put your money when you have positive cash flow months?

They key is a financial life jacket, an emergency account. Everyone needs an emergency account that covers 3 – 6 months of normal expenses (learn more from Goodwin Barrett). This is fine for people with a stable income. However if your income is similar to the table above you want an emergency account that covers about a year of expenses.

I can hear your thoughts now –

1) It is going to be impossible to save that much.

2) That sounds like too much cash to have; shouldn’t I invest that to make money?

Let’s address point 1 first. A year in income is a lot to save, but with a plan and a little bit of automation you will get there before you know it. It is about starting and having a goal in mind. Saving will get easier and easier with time. Once you start making more and more money you will be able to save more and more. Once again this is a goal to reach for, do not be discouraged.

Point 2 is a case made by people that are naturally very aggressive and have no problem taking on a lot of risk. The thought here is that savings accounts make almost nothing in interest and therefore you should keep as little as possible in it. The problem is that when you need the money it will likely be at the same time you have lost money, therefore you will be taking money out when your accounts are down, this is not good.

An ample emergency account will tide you over until the market turns. Once it has and your income recovers be sure to replenish it. We have a bear market one in five years on average, you know there is another in the near future so prepare for it! View this money as a parachute, not an investment. It is meant to act as a cushion to soften your landing.