When you say to a new homeowner – “Congratulations on your new home!” What you’re really saying is – “Congratulations on $400,000 of new debt!”

Owning a home is part of the American dream, for better or worse. If executed correctly, home ownership can absolutely add net worth in the long run. However, it can also lead to being ‘house poor’ and push retirement back by years if mistakes are made. In case you are facing foreclosures, experts in the field can help by offering you a fair price for your home very fast.

We have not seen a real estate market like this in a number of years, and likely will not again for some time. It seems like everyone is buying a home, but should you?

Don’t allow yourself to get caught up in the hype and make costly mistakes. Buying a home is the largest purchase you will make, and has a larger impact on your finances than anything outside of your job. Sometimes a mortgage, or refinancing options, even a loan from family is required. Check out HouseBuyerNetwork.com to make the home-buying experience straight forward and stress free.

Why is the real estate market so crazy right now?

1) Interest Rates

Rates are starting to creep back up, according to Eric Kuchinsky, property sales manager for Redstones Willenhall, “Home rates remain near the historic lows of last year, but a small change in percentage points could add up to a lot of money over the life of the loan. We are seeing people that have been waiting rush in to get a mortgage now before rates rise.”

2) Supply and Demand

Scott Boyer, a top Real Estate agent in Denver shared his thoughts on the current Real Estate market. “If the listing agent has a house last through a weekend, they are not doing their job. A successful broker used to be judged by the amount of for sale signs that they would have up, now if you have signs up you are not selling fast enough.”

The inventory is low because the retail buyer, the mom and pop investor, and the institutional investors are piling into the market.

Blackrock is an investment firm that currently holds more than 26,000 homes and has spent $45 billion buying them. Home prices across the country have risen 11% this year, and rents have only risen 2.4%, so at this point if you have not gotten in the market yet, it may be too late to make financial sense.

Houses are going for well over their asking price in just a day or two, and as a result we have been asked more home buying questions than ever.

Mistakes to Avoid

Home ownership costs a lot more money and time than advertised, and avoiding these mistakes will help you down the path to the American Dream, rather than the broke, in debt, American Nightmare that plagues many Americans.

1) Using your emergency account for the down-payment

Having an ample emergency account that contains 3 – 6 months of income is step 1 to financial success, but they tend to get raided for down payments because of their size. This is your lifeline and cushion should something happen to prevent taking on more debt, that is why you should know what is down payment assistance in Texas or any other state you are currently located. The down-payment must be saved for outside of the emergency account.

Additionally, homeowners need more in their emergency account than renters. A homeowner has a lot more financial responsibility, and one water main break or bad storm can wipe out an ample emergency account.

2) Spending more than 25% – 30% in monthly income

A healthy cash flow spends no more than around 30% of monthly income on housing. Spending more than 30% is not prudent, and can have major credit and lifestyle impacts.

3) Spending too much on a house

The age old rule of thumb is to spend around 2 to 2 ½ times your annual income on a home. So if you make $80,000, you should spend between $160,000 and $200,000 on a home. Visit Danny Buys Houses for professional real estate services which let you buy a home at a great price.

4) Forgetting about extra costs

The true cost of owning a home is much higher than the mortgage paid every month. To get the true cost, you need to add in the property taxes, utilities, maintenance, repairs and services like gutter installation Loveland, and home insurance, and where applicable, HOA fees, mortgage insurance, and closing costs. Check out GettysburgGutterGuards for reliable, affordable gutter cleaning services.

5) Buying somewhere you don’t plan on living for 7 years or more.

Writing a large check to your landlord every month can feel like a waste of money. After all, you are not earning anything on it. But if you buy a house, and have to sell for any reason inside of around 7 years and don’t choose a company like HomeBuyerCA.com, you will very likely lose money due to closing costs, commissions, and other expenses.

6) Not paying attention to your credit score

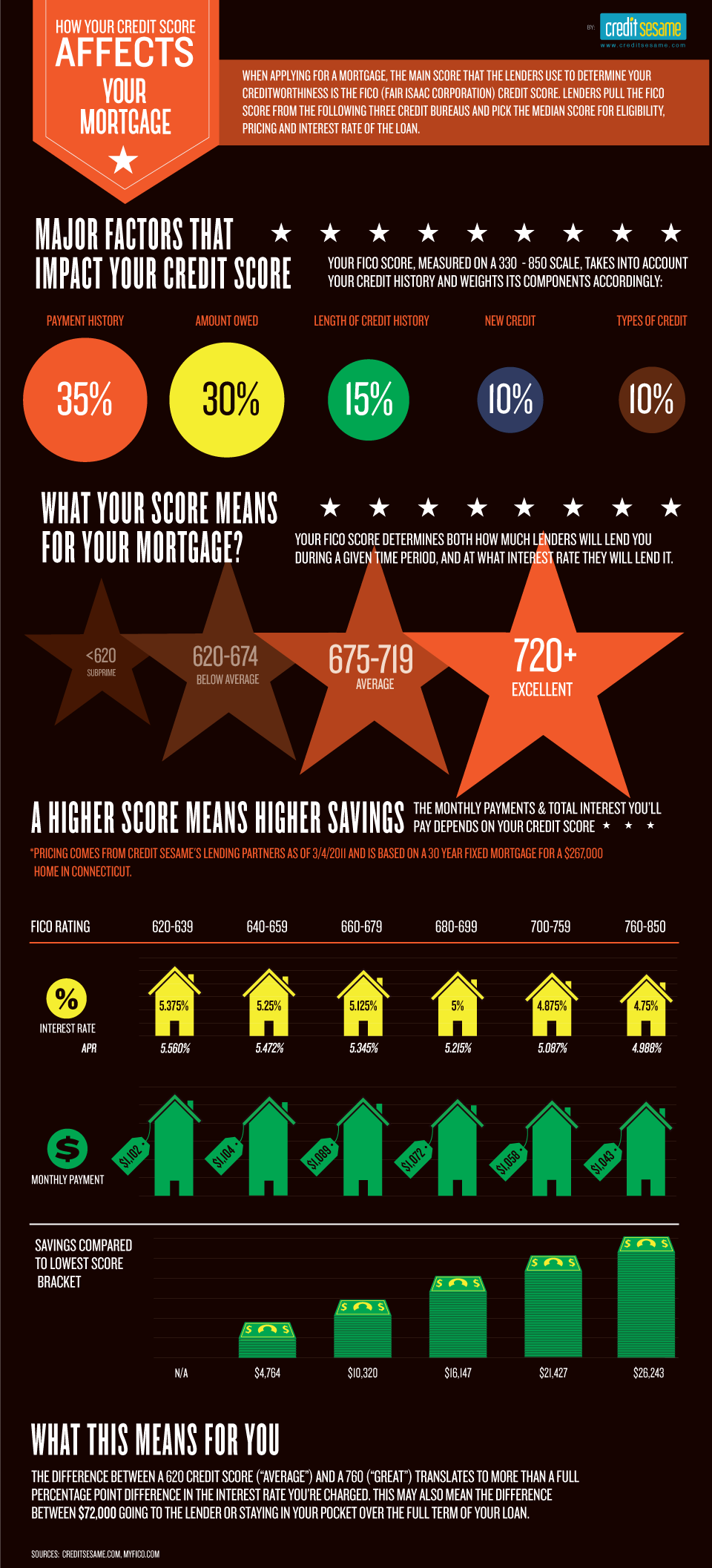

A poor credit score can add tens of thousands of dollars in cost to buying a home. Find out what yours is and how you can improve it before taking on a mortgage. Check out this graphic to see what different credit scores yield in monthly payments and overall costs.

Planning for home ownership

The best way to approach home ownership is going in with a plan that takes into account your current cash flow, accounts, and most importantly your future plans. These variables drive if you should buy a home or not, and what you should pay for a mortgage and a down payment.

A long-term plan will help you understand the implications of home ownership on your retirement, cash flow, investment accounts, savings accounts, and credit. Talking with a professional Advisor beforehand will help ensure you get the right amount of house, and will set you up for the best financial future.