Market Overview & Commentary

Global investment markets have been undergoing a correction this summer, as we had predicted in previous newsletters.

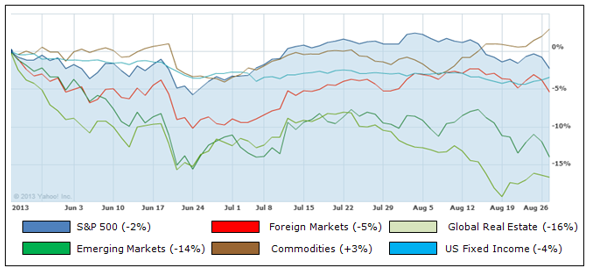

Since mid-May 2013, most asset classes have declined, with the exception of commodities. Foreign equities and global real estate have declined the most, while US equities have pulled back modestly (see Chart I below).

However, the biggest story of the summer has been the 4-5% decline in US fixed income securities, a market which has enjoyed a broad-based bull market for the past 30 years.

Rising interest rates have been the culprit for this decline, and they have also contributed to the recent equity market correction, with investors fearing the end of extremely cheap money.

Chart I –Returns By Major Asset Class Since Mid-May

On the year as a whole, fixed income has seen a significant decline at the same time that US equities have enjoyed a nice run up, resulting in a relative underperformance for conservatively-oriented bond investors.

Looking ahead, we believe that interest rates have likely peaked out in the near-term, with the potential to move higher further down the road.

As such, we believe that fixed income and other interest-rate-sensitive areas such as real estate will perform better in the months ahead.

At the same time, we believe there may be further declines in equity markets, particularly in the US.

As such, we are beginning to redeploy some of our previously raised cash into select fixed income opportunities, while waiting for further equity market pullbacks before redeploying assets in Foreign & US markets.

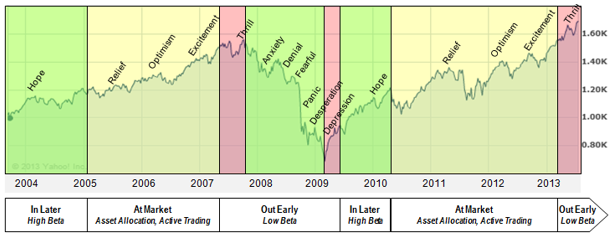

‘Market Phase’ Approach

Current Phase: Bullish Neutral (Low Beta)

In the last mid-quarter newsletter, we mentioned our recent study to evaluate the previous ten years of investing at LGA, how the market landscape has changed over that period, and what new insights we could take advantage of.

One of the major conclusions was that markets today are swinging much more significantly on technical indicators – as opposed to fundamentals – than they did in the past.

In response, we developed and implemented a systematized “Market Phase” approach to guide our desired level of equity risk in client portfolios at any given time.

This approach is driven by sentiment data and technical analysis, and indicates when we are in a high or low risk investing environment.

We still utilize our “Five-Forces” analysis to select the specific asset classes and positions for client portfolios, but the Market Phase model dictates how much risk we are willing to have during a given time period.

Chart II below illustrates how this new approach would have been implemented over the past equity market cycle (green is expected outperformance, red is underperformance, and yellow is at-market returns).

Below the chart, we detail the risk positioning to generate our expected results with “High Beta” meaning extra risk taken, “Low Beta” meaning less risk taken, and “At Market” being a neutral level of risk taken.

Chart II – LGA Market Phase Approach

This improvement will help drive higher long-term risk-adjusted returns, focusing on the highest probability times to take on risk versus protecting capital.