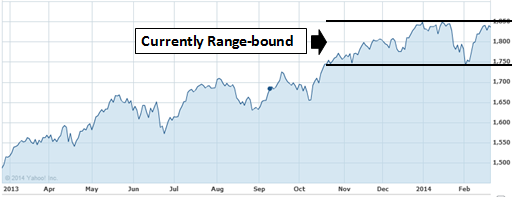

US and International developed market equities have been taking a breather, settling into a choppy and range-bound pattern since late Oct 2013, after strong moves higher in 2013 (see Chart I below).

Chart I –S&P 500 Index since early 2013, range-bound over past 4 months

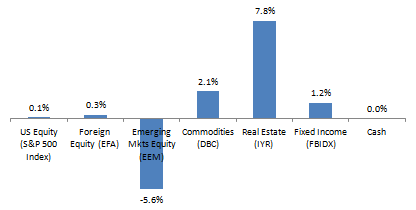

On the flip side, Emerging Markets have continued their two and a half year decline, while commodities, REITSs, and fixed income have rebounded slightly as interest rates declined with renewed economic weakness.

Chart II – 2014 YTD Returns (as of morning 2/24/14)

The main questions we will address in this newsletter are the following:

– Why is the average investor still so bullish when US markets are quite overvalued, and the economy appears to be weakening?

– How should portfolios be positioned in this aging bull market?

Let’s start with bullish sentiment. It is very typical for investors to act in a herd-like manner, getting overly pessimistic at market bottoms and overly optimistic at market peaks. The average investor ignores valuations, focusing mainly on feelings, emotions, and FOMO (the Fear Of Missing Out).

If markets are going up and up, they feel like it’s time to go in aggressively. And if markets decline heavily, fear and pessimism take over and the average ‘investor’ sells out at the lowest levels. This is the behavioral psychology of the average investor, and why markets tend to have extreme peaks and troughs. We are not computers, we are human, and our emotions are powerful. It should go without saying that there is a high penalty over time to this herd-like behavior of buying high and selling low.

Given the above, what do we recommend for investors? For buy-and-hold investors, recent market movements represent a ripe opportunity to rebalance portfolios, as asset classes have had strongly divergent returns in the last year. While developed market equities have gone up, emerging markets, commodities, real estate, and fixed income have all declined. Use this opportunity to rebalance portfolios back to original risk and allocation targets, systematically selling high and buying low. We are doing so where it makes sense.

For our more tactical strategies, we are hedging risk against potential declines in leading markets, while nibbling at certain commodities, emerging markets, and real estate (selling overpriced markets and selectively buying into weaker ones). In the near-term, this can test a client’s behavior and patience, as consistently perfect timing on entry is not possible.

In our current market, bull rallies in US equities have gone well beyond historical precedent without a meaningful correction…so the patience required is higher this go around. However, and this is the main point, this time is not different. The mantra of “this time is different” plays with investor emotions, as we experienced in 2008-09 on the downside, and are experiencing now on the upside. This behavior must be resisted for tactical strategy success.

Net-Net: It’s important to resist getting caught up in the herd, as this peaking market cycle, like many before it, will turn down in due time. In the interim, replace your FOMO with an alternative action/thought…use your time and energy to invest in yourself, through career and personal pursuits. Your discipline will be rewarded.

As always, we encourage you to pursue life’s dreams. Make life count!